- United States

- /

- Food

- /

- NasdaqGM:FRPT

Is Freshpet’s (FRPT) Operational Discipline the Key to Defending Its Lead in Fresh Pet Food?

Reviewed by Sasha Jovanovic

- Earlier this week, Freshpet reported quarterly results that beat analyst expectations for earnings per share and EBITDA, despite revenue missing forecasts slightly.

- CEO Billy Cyr emphasized Freshpet's category-leading sales growth and operational improvements, underscoring the company's focus on improving efficiency and its position within the fresh pet food market.

- We will explore how Freshpet’s earnings and operational improvements may influence the company’s long-term investment narrative.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Freshpet Investment Narrative Recap

To be a Freshpet shareholder, you have to believe in the long-term strength of the fresh pet food category and the company’s capacity to drive profitable growth through operational efficiency and consumer loyalty. While the recent earnings report highlighted outperformance in EPS and EBITDA despite a slight revenue miss, this did not materially affect the most pressing growth catalysts: driving margin expansion through efficiency gains, while the biggest near-term risk remains a potential slowdown in overall category growth and premium product adoption among budget-conscious pet owners.

Of Freshpet’s recent announcements, the August move to lower both near-term and long-term sales growth targets stands out in the context of the most recent results. Although the company continues to report operational improvements and impressive sales growth rates relative to peers, the reduction of its ambitious 2027 net sales goal and acknowledgment of slower category growth reinforces why investor attention is focused on execution and sustainable buy-rate trends.

Yet, against this backdrop, investors should be aware of how prolonged softness in new dog adoption and shifting consumer habits could challenge Freshpet’s ability to meet longer-term...

Read the full narrative on Freshpet (it's free!)

Freshpet's outlook anticipates $1.5 billion in revenue and $137.7 million in earnings by 2028. This assumes a 13.7% annual revenue growth rate and an $104 million increase in earnings from the current $33.7 million.

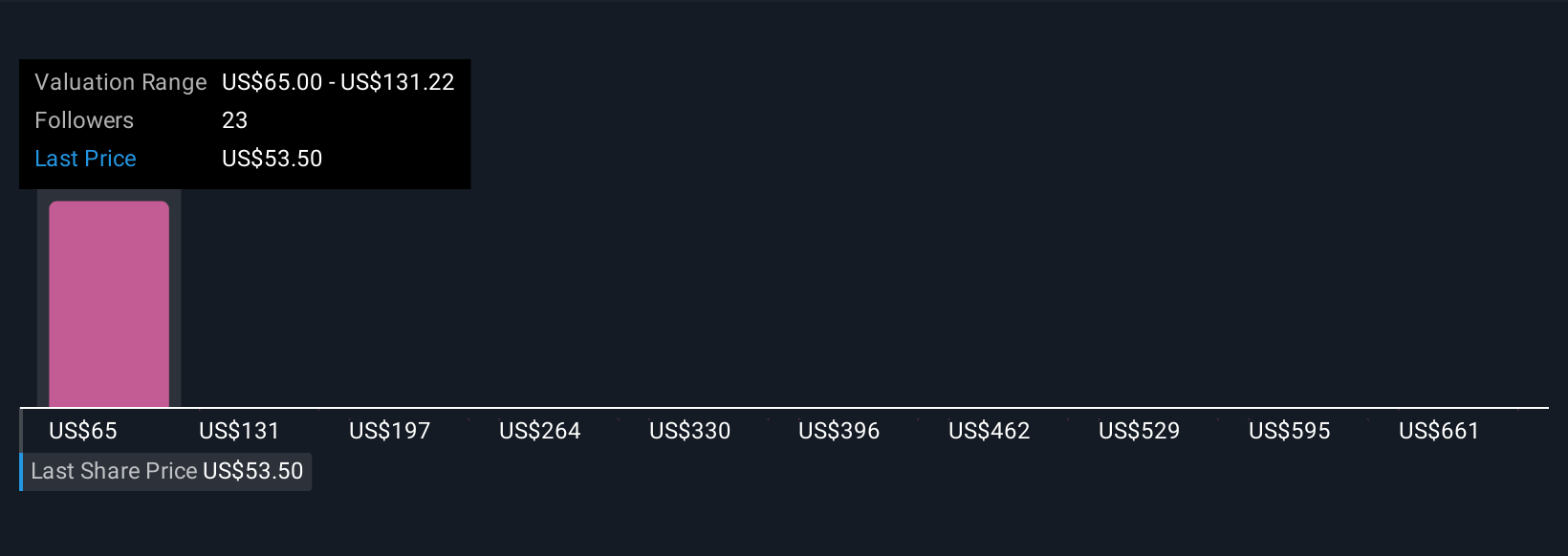

Uncover how Freshpet's forecasts yield a $79.31 fair value, a 47% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members estimate Freshpet’s fair value between US$79,313 and US$727,180 per share. While many believe in operational improvements and strong brand loyalty, beware that slowing pet adoption trends raise questions about future revenue potential.

Explore 5 other fair value estimates on Freshpet - why the stock might be a potential multi-bagger!

Build Your Own Freshpet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Freshpet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freshpet's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives