- United States

- /

- Food

- /

- NasdaqGM:FRPT

Freshpet (FRPT): Valuation in Focus After Solid Earnings and Ongoing Sector Headwinds

Reviewed by Simply Wall St

Freshpet (FRPT) just posted its latest quarterly results, where the company managed to beat EPS and EBITDA estimates even though revenue came in a bit below forecasts. Revenue climbed 12.5% from a year ago, highlighting continued category sales growth as management pointed to ongoing operational improvements.

See our latest analysis for Freshpet.

Freshpet’s 1-day share price dipped a modest 0.13% after the latest quarterly results, but over the past seven days the stock rebounded with a 4.6% gain. However, the 90-day share price return of -23.7% and a year-to-date drop of 62.5% reflect fading momentum as investors weigh solid operational progress against recent market concerns and legal headlines. In the bigger picture, Freshpet’s 1-year total shareholder return is down nearly 60%, underscoring the challenging climate despite category growth and business improvements.

If you’re keen to broaden your search after seeing how sector dynamics can move stocks, now is the perfect time to explore fast growing stocks with high insider ownership.

With shares still trading well below analysts’ price targets and Freshpet showing ongoing growth despite mixed headlines, the key question is whether the current weakness signals an undervalued entry point or if the market already anticipates any future upside.

Most Popular Narrative: 28.8% Undervalued

Freshpet's most popular narrative points to a fair value well above its latest close. This sets the scene for a closer look at the assumptions fueling this price target.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput, leading to a significant reduction in CapEx ($100 million less over 2025-26) and enhanced gross/EBITDA margins. This positions the business for improving net earnings and cash generation.

Want to see what really pushes Freshpet’s valuation skyward? The real story here involves dramatic earnings growth projections and a profit margin expansion few expect. Curious which ambitious targets, if hit, could re-rate the whole stock? Dive into the full narrative to uncover the financial assumptions Wall Street is betting on.

Result: Fair Value of $76.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressure and slower category growth could quickly undermine the optimistic case for Freshpet's long-term earnings trajectory.

Find out about the key risks to this Freshpet narrative.

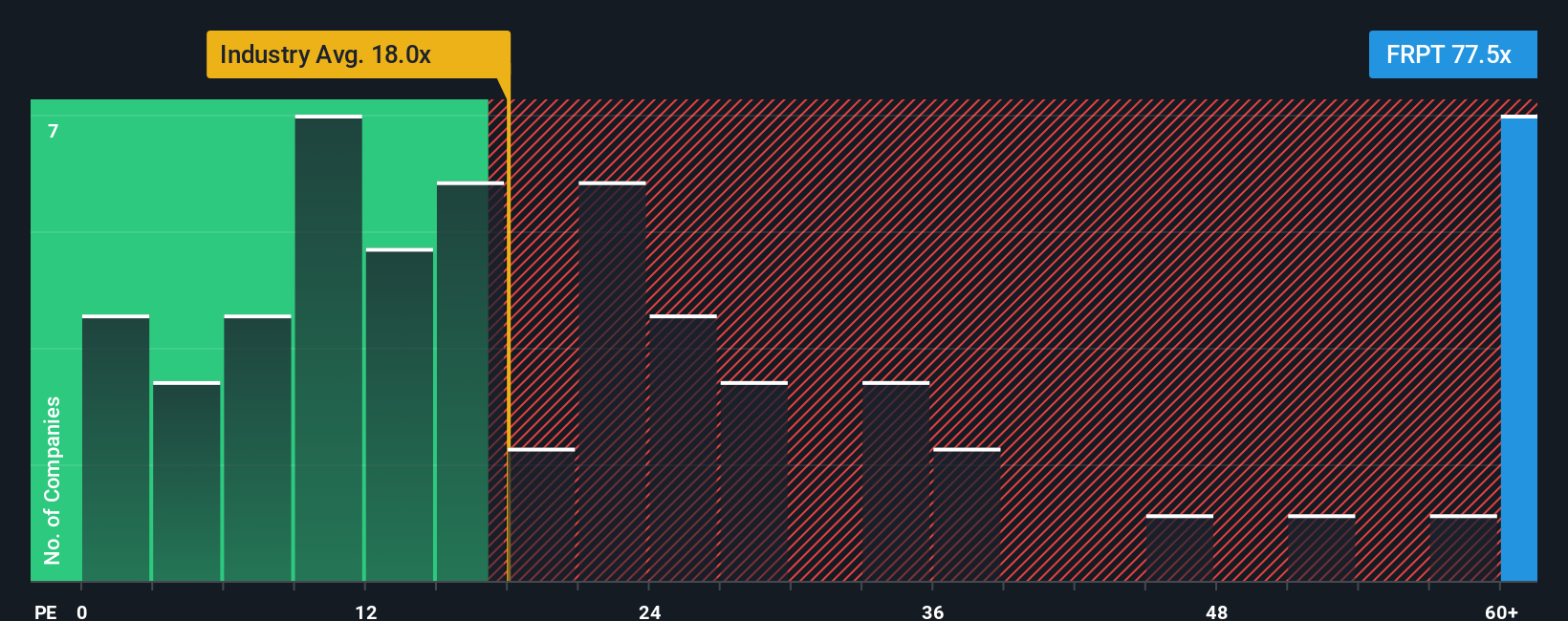

Another View: Market Multiples Raise Red Flags

While the fair value narrative paints Freshpet as undervalued, a look at valuation ratios reveals a different story. The company's price-to-earnings ratio currently stands at 78.4x, which is much higher than the industry average of 18.4x and its peer average of 17.1x. Even the estimated fair ratio for Freshpet, based on regression analysis, is just 32.1x. This considerable gap suggests the market is pricing in a high level of future success and increases valuation risk for investors if growth falters. Is the optimism built into these multiples really justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

If you prefer a hands-on approach and want to test your own perspective, try building your own thesis using our tools in just minutes. Do it your way

A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss the chance to spot your next winning move. Take advantage of these hand-picked opportunities curated by Simply Wall Street’s Screener for investors like you.

- Jump on the momentum of emerging tech by checking out these 27 AI penny stocks that harness artificial intelligence for rapid growth and innovation.

- Secure high-yield potential by reviewing these 17 dividend stocks with yields > 3% which consistently reward shareholders with attractive payouts above 3%.

- Uncover bold value plays among these 3560 penny stocks with strong financials that are poised for breakout performance thanks to robust financials and market tailwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives