- United States

- /

- Beverage

- /

- NasdaqGS:FIZZ

National Beverage Shareholders Have Enjoyed An Impressive 217% Share Price Gain

It hasn't been the best quarter for National Beverage Corp. (NASDAQ:FIZZ) shareholders, since the share price has fallen 22% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 217% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Ultimately business performance will determine whether the stock price continues the positive long term trend.

View our latest analysis for National Beverage

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

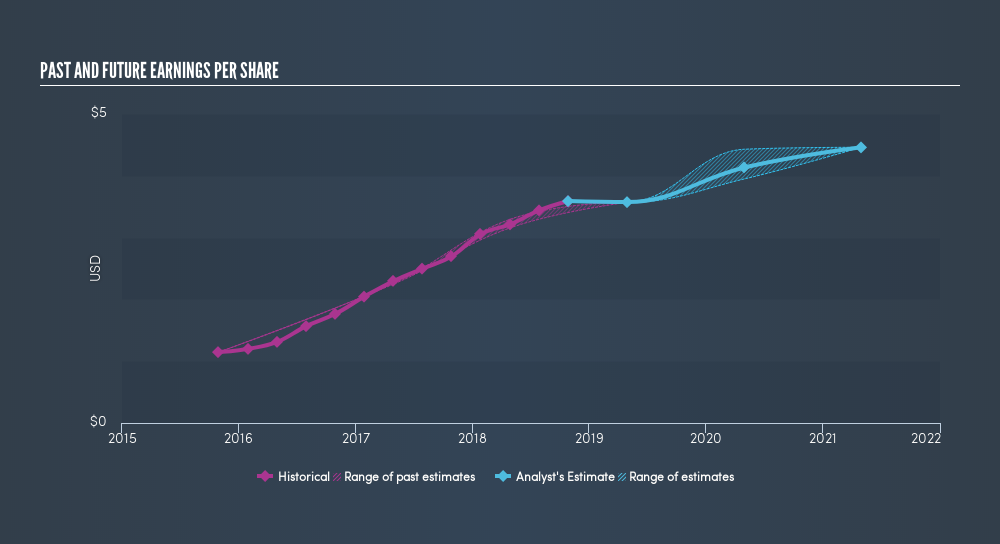

Over half a decade, National Beverage managed to grow its earnings per share at 30% a year. So the EPS growth rate is rather close to the annualized share price gain of 26% per year. This indicates that investor sentiment towards the company has not changed a great deal. In fact, the share price seems to largely reflect the EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how National Beverage has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling National Beverage stock, you should check out this FREEdetailed report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of National Beverage, it has a TSR of 243% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 6.0% in the last year, National Beverage shareholders lost 27% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 28% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Keeping this in mind, a solid next step might be to take a look at National Beverage's dividend track record. This freeinteractive graph is a great place to start.

If you are like me, then you will not want to miss this freelist of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:FIZZ

National Beverage

Through its subsidiaries, develops, produces, markets, and sells a portfolio of sparkling waters, juices, energy drinks, and carbonated soft drinks in the United States and Canada.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives