- United States

- /

- Food

- /

- NasdaqCM:FAMI

Some Farmmi (NASDAQ:FAMI) Shareholders Have Copped A Big 65% Share Price Drop

Farmmi, Inc. (NASDAQ:FAMI) shareholders should be happy to see the share price up 16% in the last week. But that isn't much consolation to those who have suffered through the declines of the last year. During that time the share price has sank like a stone, descending 65%. The share price recovery is not so impressive when you consider the fall. Arguably, the fall was overdone.

See our latest analysis for Farmmi

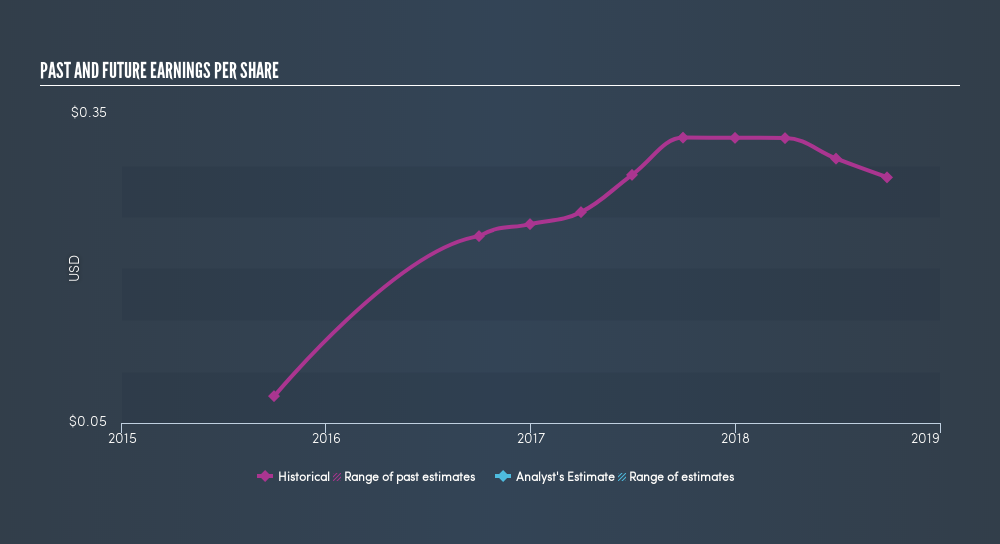

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Unfortunately Farmmi reported an EPS drop of 12% for the last year. The share price decline of 65% is actually more than the EPS drop. This suggests the EPS fall has made some shareholders are more nervous about the business. The P/E ratio of 4.54 also points to the negative market sentiment.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Farmmi's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Given that the market gained 1.0% in the last year, Farmmi shareholders might be miffed that they lost 65%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 41%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. You could get a better understanding of Farmmi's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:FAMI

Farmmi

Through its subsidiaries, engages in processing and sale of agricultural products in China, the United States, Japan, Canada, Europe, Korea, and the Middle East.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives