- United States

- /

- Food

- /

- NasdaqCM:EDBL

Positive Sentiment Still Eludes Edible Garden AG Incorporated (NASDAQ:EDBL) Following 66% Share Price Slump

To the annoyance of some shareholders, Edible Garden AG Incorporated (NASDAQ:EDBL) shares are down a considerable 66% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 95% loss during that time.

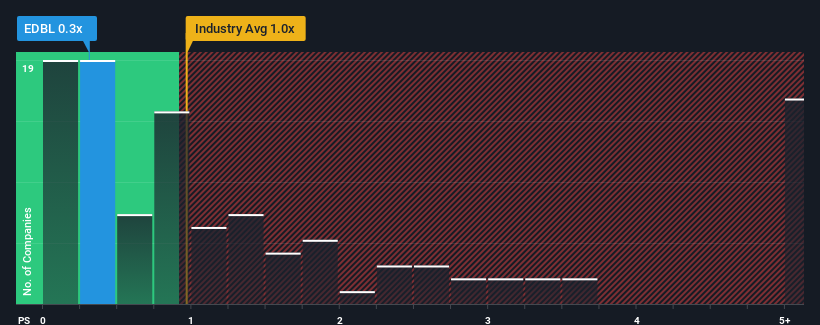

Following the heavy fall in price, when close to half the companies operating in the United States' Food industry have price-to-sales ratios (or "P/S") above 1x, you may consider Edible Garden as an enticing stock to check out with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Edible Garden

How Edible Garden Has Been Performing

Recent times have been advantageous for Edible Garden as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Edible Garden.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Edible Garden would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The strong recent performance means it was also able to grow revenue by 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 16% as estimated by the only analyst watching the company. With the industry only predicted to deliver 2.1%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Edible Garden's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Edible Garden's recently weak share price has pulled its P/S back below other Food companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Edible Garden's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Having said that, be aware Edible Garden is showing 6 warning signs in our investment analysis, and 5 of those are significant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Edible Garden, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Edible Garden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EDBL

Edible Garden

Edible Garden AG Incorporated, together with its subsidiaries, operate as a controlled environment agriculture farming company.

Excellent balance sheet slight.

Market Insights

Community Narratives