- United States

- /

- Beverage

- /

- NasdaqCM:BLNE

Eastside Distilling, Inc. (NASDAQ:EAST) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Eastside Distilling, Inc. (NASDAQ:EAST) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 81% share price decline.

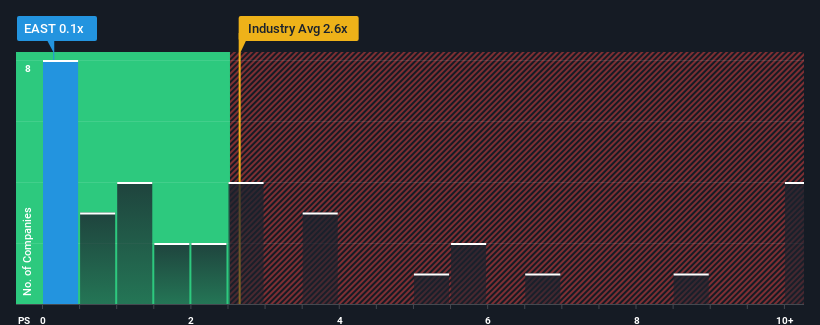

Following the heavy fall in price, Eastside Distilling's price-to-sales (or "P/S") ratio of 0.1x might make it look like a strong buy right now compared to the wider Beverage industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 6x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Eastside Distilling

What Does Eastside Distilling's Recent Performance Look Like?

Eastside Distilling could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Eastside Distilling.How Is Eastside Distilling's Revenue Growth Trending?

Eastside Distilling's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 99% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 4.2%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Eastside Distilling's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Eastside Distilling's P/S?

Having almost fallen off a cliff, Eastside Distilling's share price has pulled its P/S way down as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Eastside Distilling's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

You need to take note of risks, for example - Eastside Distilling has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Eastside Distilling might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BLNE

Eastside Distilling

Acquires, manufactures, blends, bottles, imports, exports, markets, and sells various alcoholic beverages.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives