- United States

- /

- Food

- /

- NasdaqGS:CPB

How Investors May Respond To Campbell's (CPB) Appointment of Todd Cunfer as CFO

Reviewed by Sasha Jovanovic

- Campbell’s recently appointed food industry veteran Todd E. Cunfer as Executive Vice President and Chief Financial Officer, succeeding Carrie L. Anderson after her departure on October 20, 2025.

- Cunfer brings over 25 years of finance and operational expertise from companies such as Freshpet, Simply Good Foods, and The Hershey Company, potentially influencing Campbell’s finance function and corporate strategy.

- We'll examine how Campbell’s leadership transition and the arrival of an experienced CFO could influence its long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Campbell's Investment Narrative Recap

To be a Campbell’s shareholder today, you need confidence in the company’s ability to maintain relevance in traditional packaged food while managing margin pressures and shifting consumer tastes. The appointment of Todd E. Cunfer as CFO introduces a proven finance executive, but doesn’t materially change the most pressing short-term catalyst: reviving snacks and soup demand, nor does it alleviate the biggest risk, persistent volume declines in core categories.

One of the most relevant recent announcements is Campbell’s updated fiscal year 2026 guidance, calling for net sales in line with or just below last year’s US$10,253 million. This underlines the importance of demand trends in the company’s key segments, while Cunfer’s arrival coincides with heightened scrutiny on execution in marketing and innovation.

However, investors should also be aware that pressure from persistent volume declines may...

Read the full narrative on Campbell's (it's free!)

Campbell's is projected to reach $10.2 billion in revenue and $868.6 million in earnings by 2028. This outlook is based on flat annual revenue growth of 0.0% and an earnings increase of $266.6 million from current earnings of $602.0 million.

Uncover how Campbell's forecasts yield a $34.58 fair value, a 14% upside to its current price.

Exploring Other Perspectives

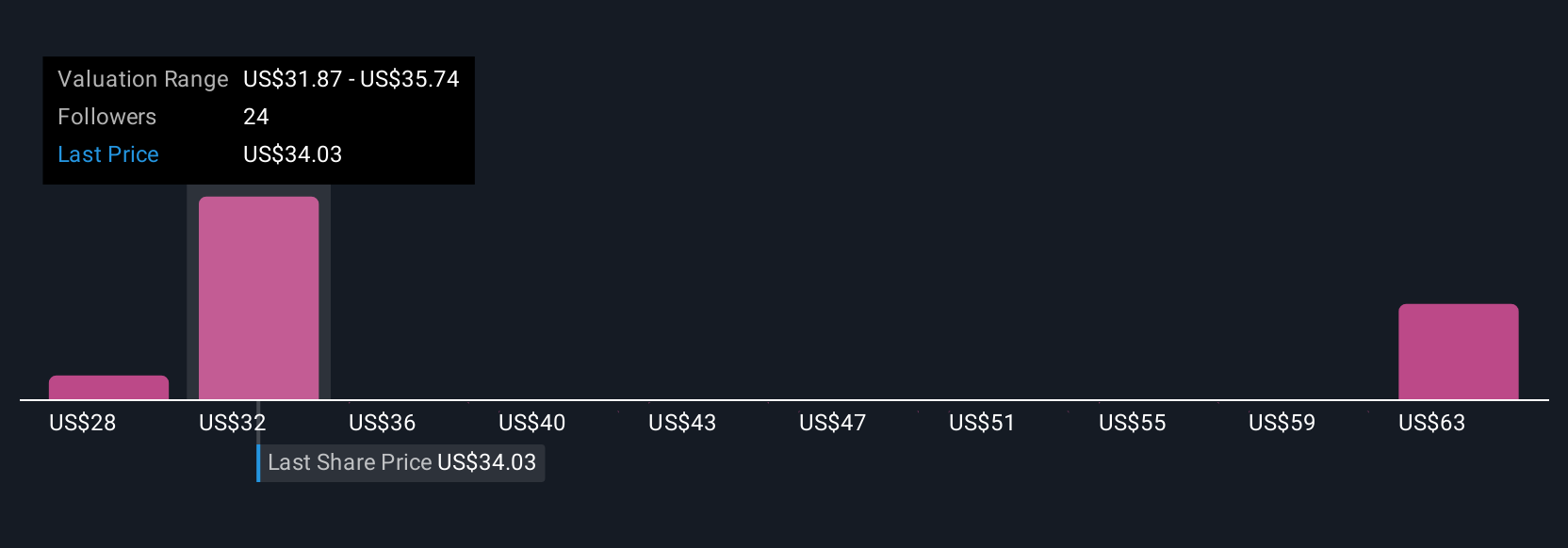

Simply Wall St Community members submitted 8 fair value estimates for Campbell’s that range widely from US$29 to US$63.91 per share. While optimism about cost savings and margin improvements is evident, sharply differing views reflect real uncertainty about the pace of revenue recovery and consumer demand.

Explore 8 other fair value estimates on Campbell's - why the stock might be worth over 2x more than the current price!

Build Your Own Campbell's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Campbell's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Campbell's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Campbell's overall financial health at a glance.

No Opportunity In Campbell's?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success