- United States

- /

- Food

- /

- NasdaqGS:CPB

Campbell’s (CPB): Exploring Valuation as Limited-Edition Sides Collection Sparks Fresh Holiday Buzz

Reviewed by Simply Wall St

Campbell's (CPB) has caught fresh attention following the announcement of its limited-edition Sides Collection, launched in partnership with Cynthia Rowley and Kit Keenan. The collaboration merges culinary tradition with designer flair just in time for the holiday season.

See our latest analysis for Campbell's.

This designer collaboration has injected some fresh attention into Campbell's amid an otherwise challenging year, as reflected by a year-to-date share price return of -25.8% and a 1-year total shareholder return of -26.4%. While the 1-week and 1-month share price returns have bounced into positive territory, longer-term momentum remains muted. This suggests that the limited-edition launch is creating short bursts of enthusiasm but has not fully shifted investor perceptions yet.

If Campbell's mix of legacy brand power and creative partnerships has you curious about what else is emerging, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After such a sharp drop in share price, but with a recent spark of renewed interest, does Campbell's represent an overlooked value play? Or is the market already anticipating a turnaround in its fundamentals and growth prospects?

Most Popular Narrative: 9.9% Undervalued

Campbell's most widely followed narrative places its fair value at $34.58 per share, about 10% above its last close at $31.17. The difference spotlights how the market is currently discounting Campbell's projected earnings growth and improving margins.

Ongoing execution of expanded cost savings initiatives and supply chain optimization, including the newly raised $375 million target, should progressively improve operational efficiency, bolster net margins, and generate incremental earnings growth over the next several years.

Want to see what’s fueling this upside potential? The narrative leans into operating efficiency, margin lift, and long-range profit forecasts that could even surprise the most skeptical value hunters. Find out how analyst assumptions stack up against current industry realities. Read the full narrative for the numbers and logic that build this fair value call.

Result: Fair Value of $34.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent input cost pressures and declining volumes in key categories could challenge Campbell's ability to deliver sustained profit growth in the coming years.

Find out about the key risks to this Campbell's narrative.

Another View: Looking at Market Ratios

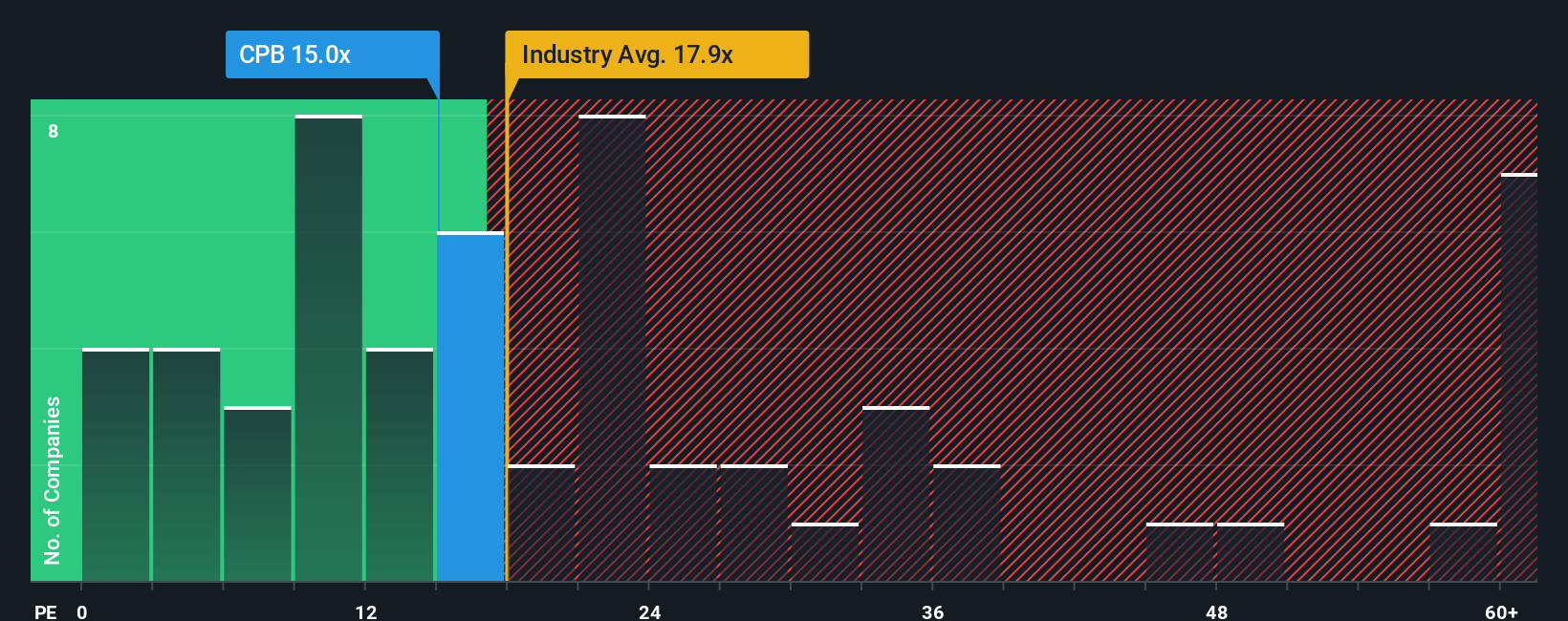

While many see Campbell's as undervalued using cash flow models, market ratios tell a different story. Its price-to-earnings ratio sits at 15.4x, making shares pricier than the peer average of 13.7x. However, Campbell's is still cheaper than the industry average and remains below its fair ratio of 18x. Does this suggest hidden safety, or does the gap to peers raise questions about future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Campbell's Narrative

If you'd like to dig into the numbers yourself or come to your own conclusion, you can shape your perspective in just a few minutes. Do it your way

A great starting point for your Campbell's research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one opportunity? Unlock new growth potential by finding high-yield stocks, disruptive trends, and untapped markets with the Simply Wall Street Screener.

- Capture reliable income by reviewing these 14 dividend stocks with yields > 3% with yields above 3% and add stability to your portfolio.

- Ride the next tech surge by tracking these 27 AI penny stocks pioneering artificial intelligence and automation breakthroughs.

- Uncover hidden value by seeking out these 881 undervalued stocks based on cash flows that offer promising upside based on real cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives