- United States

- /

- Beverage

- /

- NasdaqGS:COKE

Investors Aren't Entirely Convinced By Coca-Cola Consolidated, Inc.'s (NASDAQ:COKE) Earnings

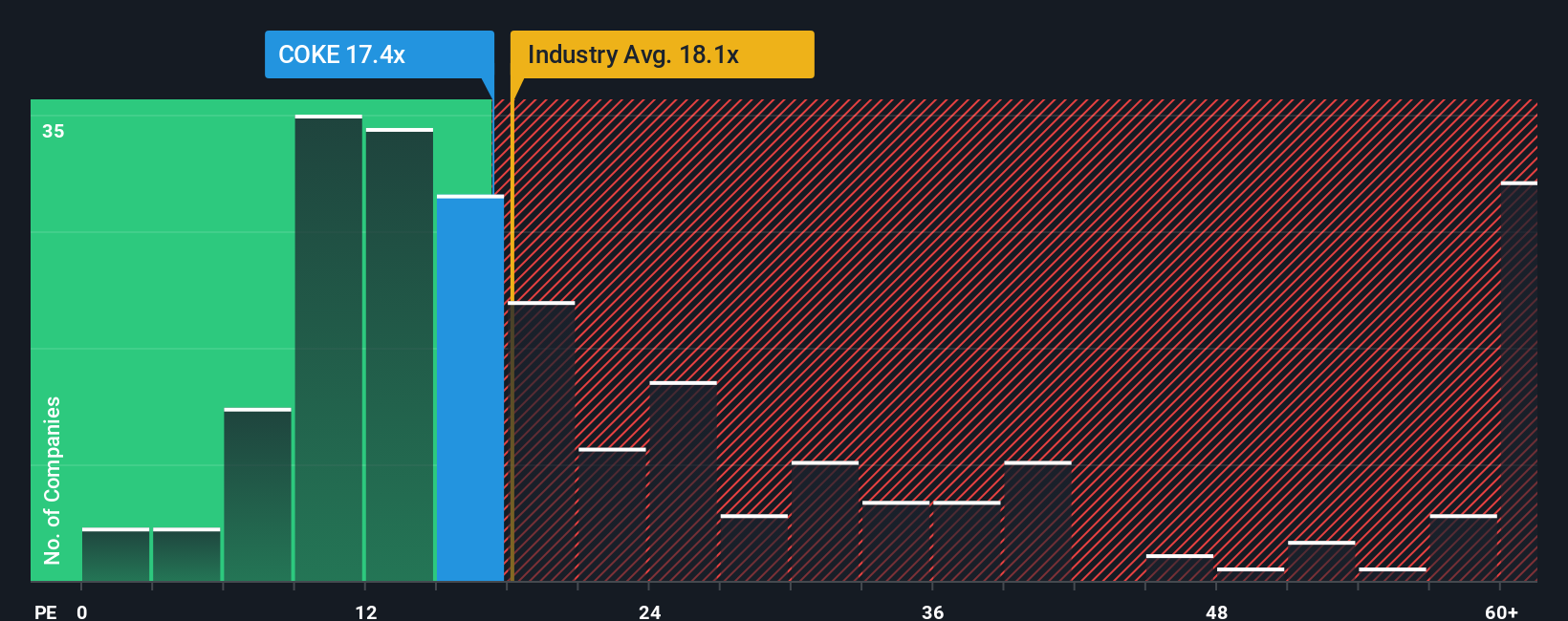

It's not a stretch to say that Coca-Cola Consolidated, Inc.'s (NASDAQ:COKE) price-to-earnings (or "P/E") ratio of 17.4x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen firmly for Coca-Cola Consolidated recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Coca-Cola Consolidated

Does Growth Match The P/E?

Coca-Cola Consolidated's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 24% last year. The latest three year period has also seen an excellent 125% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 15% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Coca-Cola Consolidated's P/E sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Coca-Cola Consolidated currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Coca-Cola Consolidated with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Coca-Cola Consolidated. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives