- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Vita Coco (COCO) Valuation Check After New Rush Soccer Hydration Partnership

Reviewed by Simply Wall St

Vita Coco Company (COCO) just signed on as the Official Hydration Partner of Rush Soccer, a strategic move that plugs the brand directly into one of the largest youth soccer communities in the country.

See our latest analysis for Vita Coco Company.

That Rush Soccer deal lands on top of a strong run, with the share price up about 52 percent year to date and a powerful three year total shareholder return near 291 percent, suggesting momentum and confidence are building.

If this kind of growth story has your attention, it could be a good time to explore fast growing stocks with high insider ownership as you look for other compelling ideas.

Yet even with robust earnings growth and a fresh Rush Soccer partnership, Vita Coco still trades at a modest discount to analyst targets and intrinsic value estimates. This raises the question: is this a buyable mispricing, or is future growth already baked in?

Most Popular Narrative Narrative: 3.5% Undervalued

With Vita Coco last closing at $53.48 against a narrative fair value near the mid 50 dollar range, the story leans slightly in favor of upside.

Operational improvements in supply chain flexibility and scale including expanded sourcing regions, negotiated cost mitigations, and the potential for ocean freight rate normalization are expected to help manage input cost volatility, supporting longer term gross and net margin improvement.

Curious how modest revenue growth assumptions, rising margins, and a richer future earnings multiple can still argue for upside from here? The fine print matters.

Result: Fair Value of $55.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff uncertainty on coconut imports and volatile freight costs could still squeeze margins and challenge the idea that earnings power will steadily compound.

Find out about the key risks to this Vita Coco Company narrative.

Another Angle on Valuation

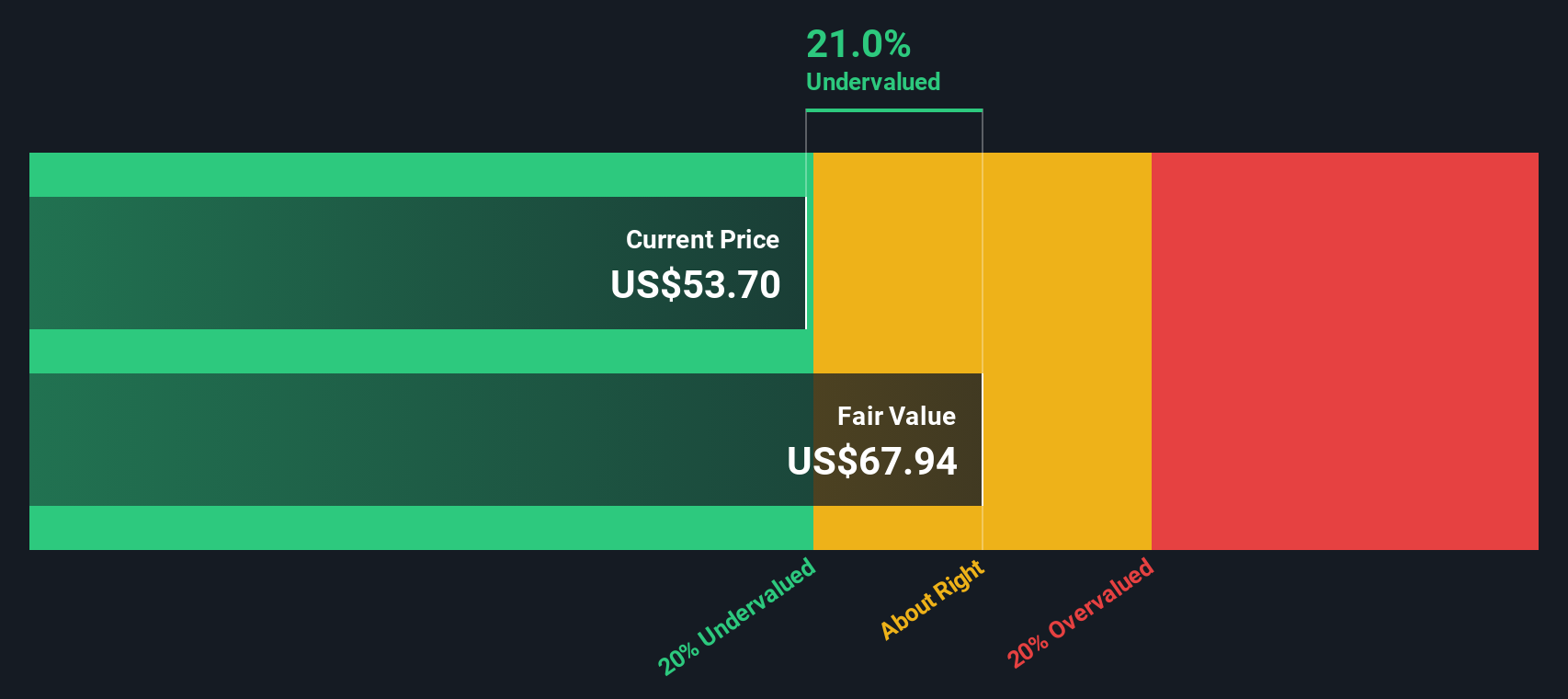

Our DCF view says Vita Coco is about 21 percent below fair value, pointing to upside if cash flows land as expected. However, that relies on steady tariff relief, resilient demand, and robust margins. If any of those slip, does this upside really hold?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Vita Coco Company Narrative

If you would rather dig into the numbers yourself and challenge this view, you can build a personalized narrative in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vita Coco Company.

Looking for more investment ideas?

Before you move on, consider strengthening your watchlist by using the Simply Wall Street Screener to spot opportunities that may be overlooked, starting right now.

- Explore early stage potential by focusing on these 3631 penny stocks with strong financials that already support their stories with solid balance sheets and improving fundamentals.

- Consider the next wave of innovation by reviewing these 24 AI penny stocks positioned at the intersection of powerful algorithms and scalable business models.

- Refine your income strategy by examining these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion