- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Assessing Vita Coco (COCO) Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Vita Coco Company (COCO) has captured investor attention as its share price continues to trend upward in recent weeks. The company’s performance has sparked interest among those looking for steady growth in the beverage space.

See our latest analysis for Vita Coco Company.

Vita Coco’s strong upward momentum is hard to miss, with a 14.85% 90-day share price return that hints at growing optimism among investors. Over the past year, total shareholder return sits at 37.23%, showing that both short-term and long-term performance have rewarded believers in the story so far.

If you’re curious about which other companies are showing impressive growth and strong insider backing, it’s a great moment to explore fast growing stocks with high insider ownership.

The big question now is whether Vita Coco’s share price still offers value, or if the market has already priced in the company’s impressive growth. Could there still be a buying opportunity here?

Most Popular Narrative: 2.5% Undervalued

With Vita Coco closing at $42.24 and the most popular narrative putting fair value at $43.33, sentiment points to a slight disconnect that suggests further upside. Market-watchers are closely monitoring whether robust category momentum and growth investments can continue to support this premium price.

Ongoing expansion into new product adjacencies (such as Vita Coco Treats and coconut milk-based beverages) is creating new consumption occasions and diversifying revenue streams, supporting topline growth and potentially enhancing gross margins with premium offerings.

Want to know the catalyst shaping this upbeat valuation? There is a bold call about Vita Coco’s future profit engine hiding in the details. Decoding how the narrative justifies this price comes down to striking margin forecasts and a future earnings multiple usually reserved for category disruptors. Do not miss the deep dive behind these influential projections.

Result: Fair Value of $43.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainty and volatile shipping costs could weigh on margins, creating potential headwinds for Vita Coco’s growth outlook.

Find out about the key risks to this Vita Coco Company narrative.

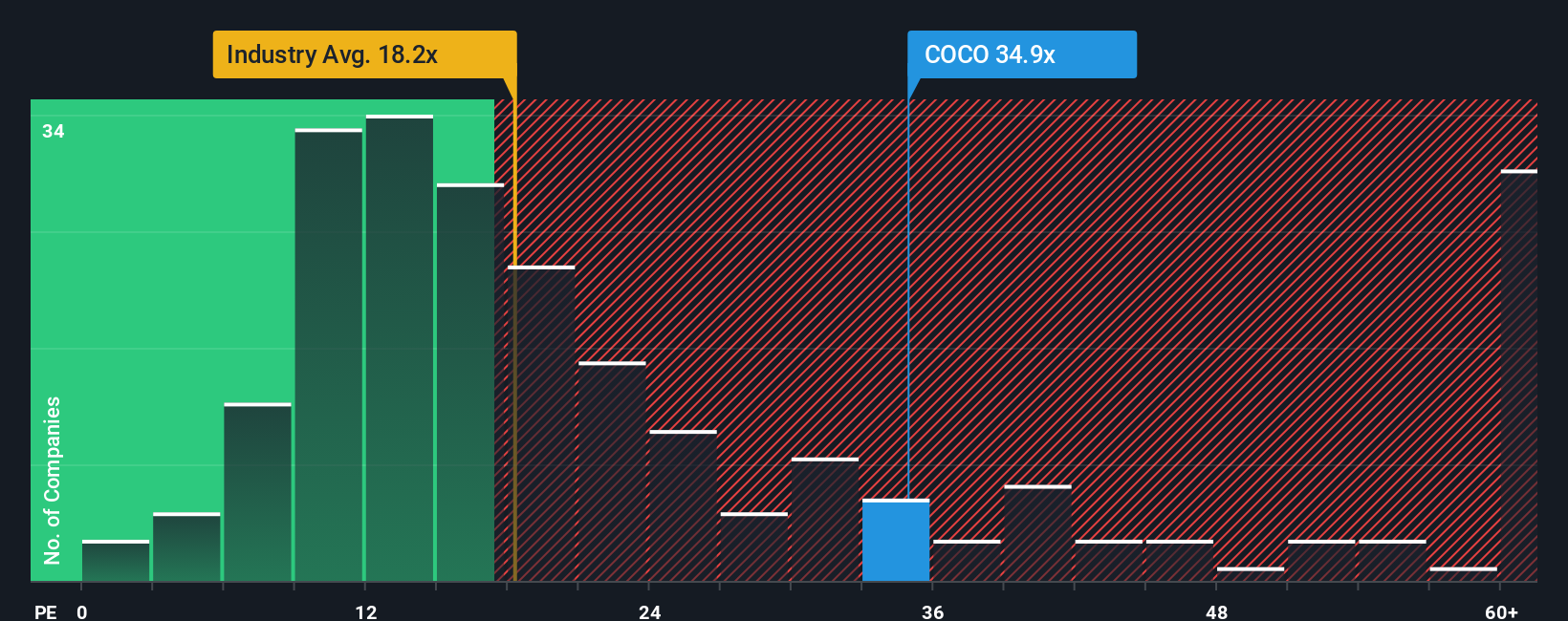

Another View: Market Multiples Paint a Different Picture

Taking a look at how the broader market values Vita Coco, the company’s price-to-earnings ratio stands at 37.3x. That is much higher than the global beverage industry average of 17.6x and above the fair ratio for Vita Coco itself, estimated at 18.8x. While the stock is cheaper than its closest peers at 54.2x, this wide gap may point to some valuation risk if the market readjusts to more typical levels. Is this premium justified by Vita Coco's growth, or is optimism running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vita Coco Company Narrative

If the current narrative does not quite fit your perspective, or you like to dig into the numbers yourself, it only takes a few minutes to craft your own view. Do it your way.

A great starting point for your Vita Coco Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Level up your strategy by checking out carefully selected investment ideas that offer strong growth or income potential. These screens highlight the kinds of stocks you do not want to miss.

- Unlock steady, long-term returns by tapping into these 21 dividend stocks with yields > 3%, which delivers yields over 3% for a reliable income stream.

- Accelerate your portfolio’s future with these 26 AI penny stocks as artificial intelligence reshapes industries in ways few anticipated just months ago.

- Get ahead of the market with these 866 undervalued stocks based on cash flows, which trades below its intrinsic value and is positioned for potential upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives