- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Celsius Holdings (CELH) Expands Partnership With PepsiCo; Acquires Rockstar Energy For US$585M

Reviewed by Simply Wall St

Celsius Holdings (CELH) recently enhanced its strategic position through a transformative partnership with PepsiCo, which included a $585 million equity investment and expanded distribution rights for key energy drink brands. This collaboration, strengthening Celsius's influence over its product portfolio, contributed to a 58% rise in its stock price over the last quarter. While major indexes like the S&P 500 and Dow saw gains, Celsius's substantial market movements were further supported by impressive Q2 sales reports, marking a significant contrast to the decline in tech stocks affecting these broader markets.

The recent partnership between Celsius Holdings and PepsiCo, involving an equity investment of US$585 million, has positioned Celsius to strengthen its brand and expand its distribution. This collaboration has already driven a significant 58% rise in Celsius's stock price in the last quarter. Over a five-year period, Celsius's total shareholder returns—including both share price appreciation and dividends—have surged by over 860%, underscoring its strong longer-term performance. Comparatively, over the last year, Celsius has not only outpaced the US Beverage industry, which faced a decline of 8.3%, but also exceeded the broader US Market, which returned 17.2%.

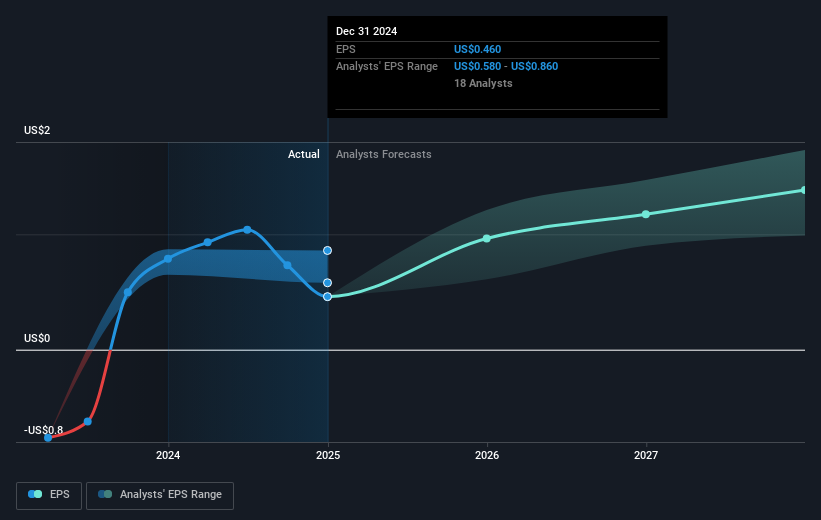

The alliance with PepsiCo is likely to contribute positively to future revenue and earnings forecasts. Analysts expect revenue to grow by 25.7% annually over the next three years, while profit margins are anticipated to increase from 5.8% to 15.6% in that timeframe. Despite the optimistic projections, Volvo's current share price of US$59.69 is slightly above the consensus analyst price target of US$57.92, indicating a 2.8% premium. This relatively small gap suggests a general consensus that the stock is fairly priced, but it's important for investors to carefully weigh the potential risks, such as rising input costs and dependence on key distribution partners, before forming their own conclusions.

Review our growth performance report to gain insights into Celsius Holdings' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives