- United States

- /

- Food

- /

- NasdaqGS:CALM

Should Cal-Maine Foods’ (CALM) Bid for Value-Added Eggs Spur a Rethink of Its Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Earlier this year, Cal-Maine Foods expanded its product portfolio with the acquisition of Echo Lake Foods, moving beyond traditional shell eggs into prepared products like pre-cooked omelets and protein pancakes.

- This move comes as consumer and regulatory shifts increase demand for cage-free and organic eggs, positioning the company to capture new market opportunities.

- We’ll explore how Cal-Maine Foods’ diversification into prepared foods influences its long-term investment case amid evolving egg industry regulations.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Cal-Maine Foods' Investment Narrative?

To own Cal-Maine Foods stock today, you need to believe there’s lasting value in the company’s scale in eggs and its push beyond traditional shell eggs. The acquisition of Echo Lake Foods marks a real shift in strategy, expanding into prepared egg-based foods just as demand for cage-free and organic eggs continues to be shaped by regulatory pressures. This could be material for the near term, adding new revenue streams and helping offset risks from supply disruptions and margin swings tied to regular egg production. However, the expansion comes as earnings are forecast to face steep declines over the next three years and recent price action has been weak, highlighting how sensitive results remain to commodity price cycles, disease outbreaks, and the volatility of both input costs and regulatory overhaul. The big question now is whether this diversification into prepared foods can soften the blow of those risks or if it only adds complexity during a challenging period for the core business. Yet, there’s one recent headwind that investors may be overlooking: the sustainability of Cal-Maine’s dividend track record.

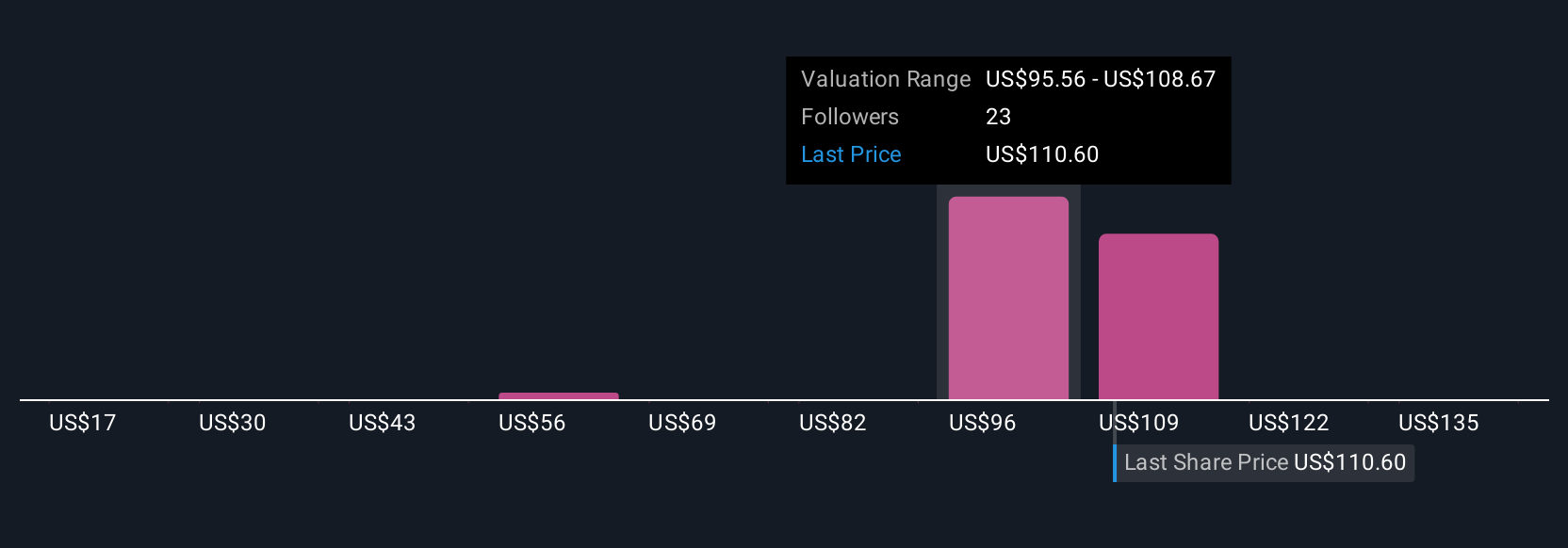

Despite retreating, Cal-Maine Foods' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 17 other fair value estimates on Cal-Maine Foods - why the stock might be worth less than half the current price!

Build Your Own Cal-Maine Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cal-Maine Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cal-Maine Foods' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CALM

Cal-Maine Foods

Engages in the production, grading, packaging, marketing, and distribution of shell eggs, egg products, and prepared foods.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success