- United States

- /

- Food

- /

- NasdaqGS:CALM

Cal-Maine Foods (CALM): A Fresh Look at Valuation After Echo Lake Foods Acquisition and Shifting Industry Trends

Reviewed by Simply Wall St

Cal-Maine Foods (CALM) has been getting attention from investors after it acquired Echo Lake Foods, bringing new prepared food offerings such as omelets and pancakes. With more states requiring cage-free eggs, along with ongoing supply challenges from avian flu, the company’s outlook has shifted in interesting ways.

See our latest analysis for Cal-Maine Foods.

Momentum has cooled for Cal-Maine Foods in recent months, with the share price sliding 28% over the past quarter despite notable moves such as the Echo Lake Foods acquisition and a growing focus on specialty eggs. Even so, long-term holders have seen a strong 77% total shareholder return over three years, which highlights this stock's potential for resilient gains even through challenging cycles.

If Cal-Maine's strategy shift has you thinking about where the next wave of growth could be, now is the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

Given Cal-Maine’s strong long-term returns and the current stock price being well below analyst targets, investors have to ask themselves whether Cal-Maine is undervalued at these levels or if the market is already factoring in future growth.

Price-to-Earnings of 3.2x: Is it justified?

Cal-Maine Foods is trading at a price-to-earnings (P/E) ratio of 3.2x, a level that positions it well below peers and the broader food industry. However, it remains above its estimated fair P/E of 2.5x. At a last close price of $82.99, this means investors are paying more for current earnings than what the fair ratio analysis suggests is reasonable.

The price-to-earnings ratio is a widely used metric that shows what investors are willing to pay for each dollar of company earnings. For Cal-Maine, a low P/E compared to industry averages may signal undervaluation, but being above the fair P/E suggests some optimism is already priced in or that past earnings might not persist.

Compared to the US Food industry's average P/E of 20.9x and peer average of 19.1x, Cal-Maine's P/E stands out as exceptionally low. This could indicate market skepticism about the sustainability of its earnings performance, especially with expected profit declines ahead. If the market were to adjust closer to the fair P/E of 2.5x, there could be further downward pressure on valuation.

Explore the SWS fair ratio for Cal-Maine Foods

Result: Price-to-Earnings of 3.2x (OVERVALUED)

However, slowing revenue growth and shrinking net income could weigh on Cal-Maine’s outlook if these trends continue in the coming quarters.

Find out about the key risks to this Cal-Maine Foods narrative.

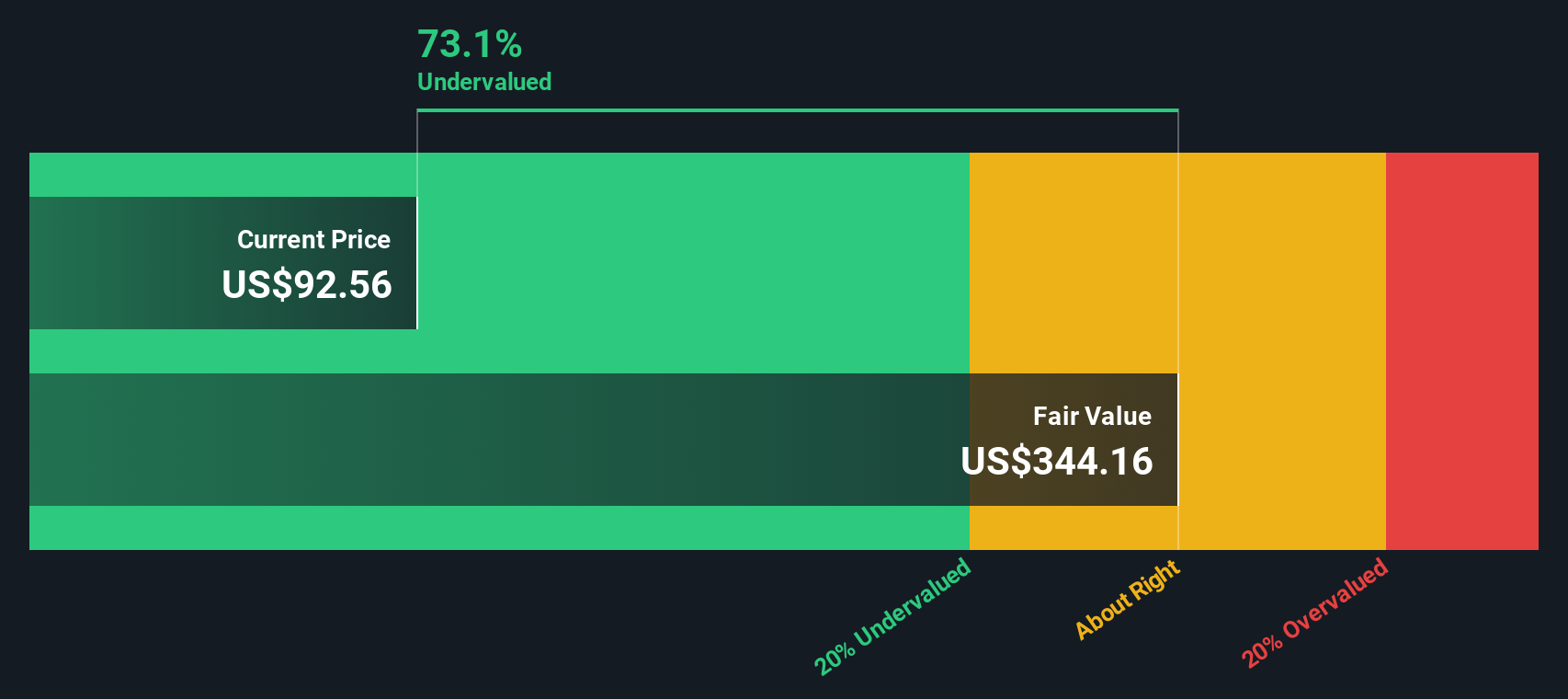

Another View: SWS DCF Model Suggests Deep Undervaluation

While the price-to-earnings ratio makes Cal-Maine appear somewhat expensive versus its fair ratio, our DCF model paints a dramatically different picture. According to this approach, the stock is trading at a steep 70% discount to its estimated fair value. Could the market be missing Cal-Maine’s long-term potential, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cal-Maine Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cal-Maine Foods Narrative

If you see the numbers differently or want to dive deeper into the data, shaping your own perspective takes just a few minutes. Do it your way.

A great starting point for your Cal-Maine Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunities abound for investors who are ready to take charge and capture what others might miss. Don’t wait and let innovative opportunities pass you by. Your next profitable move could be just a click away.

- Supercharge your returns with these 927 undervalued stocks based on cash flows, packed with stocks trading below their intrinsic value, each with potential for a dramatic upside.

- Earn passive income by checking out these 15 dividend stocks with yields > 3%, which consistently pay strong yields above 3% and could bolster your portfolio’s stability.

- Seize the momentum in artificial intelligence by investing in these 25 AI penny stocks, leading today’s advancements with pioneering applications and technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CALM

Cal-Maine Foods

Engages in the production, grading, packaging, marketing, and distribution of shell eggs, egg products, and prepared foods.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success