- United States

- /

- Food

- /

- NasdaqGS:BYND

Two Factors are Currently Missing to Trigger Beyond Meat's (NASDAQ:BYND) Short Squeeze

Beyond Meat, Inc. (NASDAQ: BYND) is back at the IPO start line after almost 3 years of hopes, dreams, and a stock price rollercoaster.

In the wake of yet another earnings result, the stock remains under pressure. Yet, it is not written-off, as the turnaround could be sudden and volatile.

Check out our latest analysis for Beyond Meat

Q4 Earnings Results

- GAAP EPS: US$1.27 (miss by US$0.56)

- Revenue: US$100.7m (miss by US$3.3m)

- Revenue growth: -1.2% Y/Y

- FY 2022 Revenue Guidance: US$560m – US$620m

Reflecting on the results, CEO Ethan Brown claimed that investments in team, infrastructure, and product scaling weighed heavily on expenses and suppressed the gross margin. He noted that the company expects to substantially moderate the operating expenses this year to help restore profitability.

Meanwhile, the joint venture with PepsiCo is planning to launch plant-based jerky as the first product. Yet, CFO Phil Hardin stated that the expensive process of the new product could drag down the Q1 profits.

Short Interest Remains High

While slightly down from the peak, according to ShortSqueeze, short interest remains high at 34% of the float, with 4.7 days to cover.

The question remains: Can Beyond Meat short squeeze like it happen with several stocks over the last 13 months? It is a possibility, but it misses 2 catalysts to do so.

The first is the interest from option market speculators who buy out of the money call options, forcing the market makers to hedge their risk by buying shares.

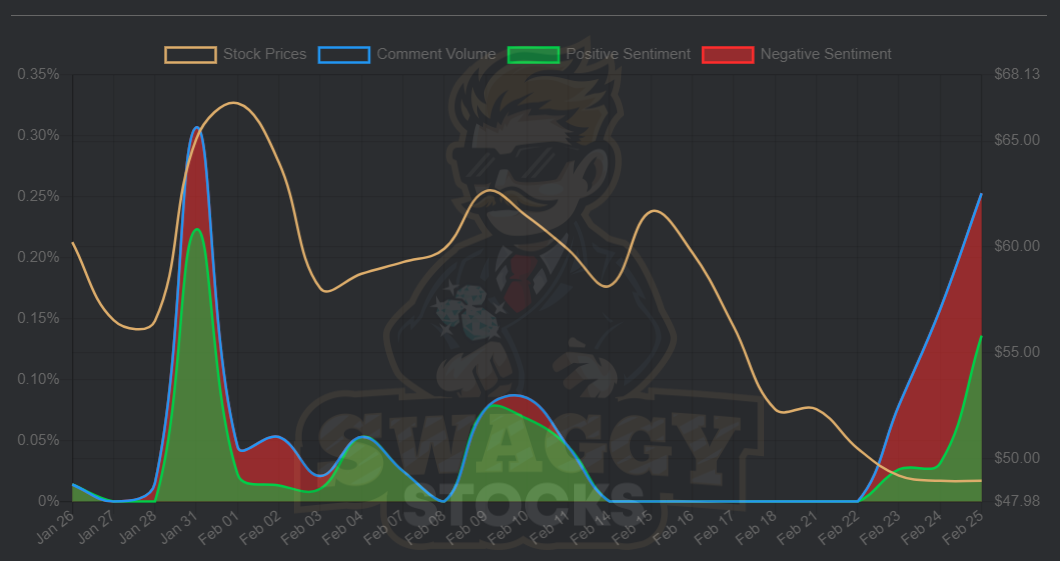

Observing the current sentiment from the Wall Street Bets, it seems that the negative sentiment prevails at the moment.

Finally, the stock needs a positive news catalyst. While there are other possibilities, the most prominent one could be the broad adaptation by McDonald's, as McPlant burger is allegedly doing well in early tests at 8 locations.

An Outlook on Profitability

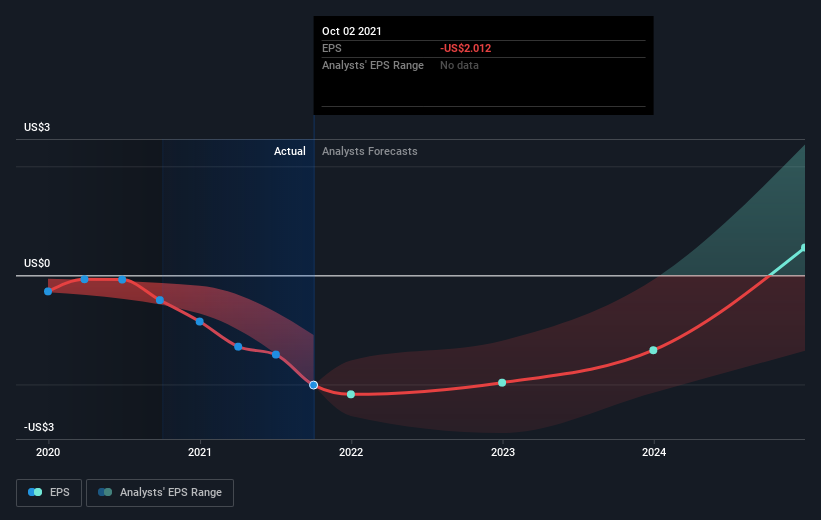

The consensus from 19 of the American Food analysts is that the company will post a final loss in 2023, before turning a profit of US$31m in 2024. So, the company is predicted to break even approximately 2 years from today.

To meet this breakeven date, we calculated the company's rate to grow year on year. It turns out an average annual growth rate of 44% is expected, which is somewhat optimistic. Should the business grow at a slower pace, it will become profitable later than expected.

Given this is a high-level overview, we won't go into details of Beyond Meat's upcoming projects, though, bear in mind that, by and large, a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Furthermore, Beyond Meat currently has a debt-to-equity ratio of over 2x. Generally, the rule of thumb is debt shouldn't exceed 40% of your equity, and the company has considerably exceeded this. Note that a higher debt obligation increases the risk around investing in the loss-making company.

Next Steps:

Throughout history, many pioneers have failed while paving the way for their followers to succeed. While heavily shorted and pressured, Beyond Meat is still far from being written-off, as the latest partnership with PepsiCo and Mcdonald's could provide the broad adaptation necessary for it to succeed.

To take advantage of that volatility or manage their risk, investors should pay close attention to the sentiment, or as the legendary investor Peter Lynch often suggested - go outside and try the products. Ask consumers the questions and gauge the leading indicators in real-time.

We've also compiled a list of essential factors you should further research:

- Valuation: What is Beyond Meat worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Beyond Meat is currently mispriced by the market.

- Management Team: An experienced management team at the helm increases our confidence in the business – take a look at who sits on Beyond Meat's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives