- United States

- /

- Food

- /

- NasdaqGS:BYND

Despite Beyond Meat, Inc.'s (NASDAQ:BYND) Efforts, Short Interest Keeps Growing

Pioneers rarely get the lion's share of the spoils – on the contrary, they are often right but too early. As we're approaching the 3rd anniversary of Beyond Meat, Inc.'s (NASDAQ: BYND) public trading debut, the stock is almost back to the starting line, with profitability remaining a significant milestone down the road.

See our latest analysis for Beyond Meat

Latest Developments

Beyond Meat caught the attention of the broad market after KFC announced a limited-time run for KFC-Beyond Meat fried chicken.

While we might debate the quality of meatless chicken (and the healthiness of any fried food), industry insiders have been warning about the potential shortage of chicken tenders, as labor shortages and severe weather have impacted the supply. In this scenario, BYND's meatless chicken might be an attractive substitute.

Meanwhile, the company announced the finalization of the lease for a new state-of-art R&D center in China. The Shangai-based center will be a hub for developing new plant-based meat products for customers in the Asia-Pacific region.

Yet, despite these positive catalysts, Bank of America rates the stock as Underperform, as their analyst Peter Galbo notes the slowing rate of growth for the meatless category, as well as the uncertainty of the full-scale McPlant product rollout with McDonald's. McPlant products are currently offered at just 8 McDonalds locations, with the national launch unlikely to happen in 2022.

BofA has a price target of US$55, 17.5% below the current trading price.

When will BYND reach profitability?

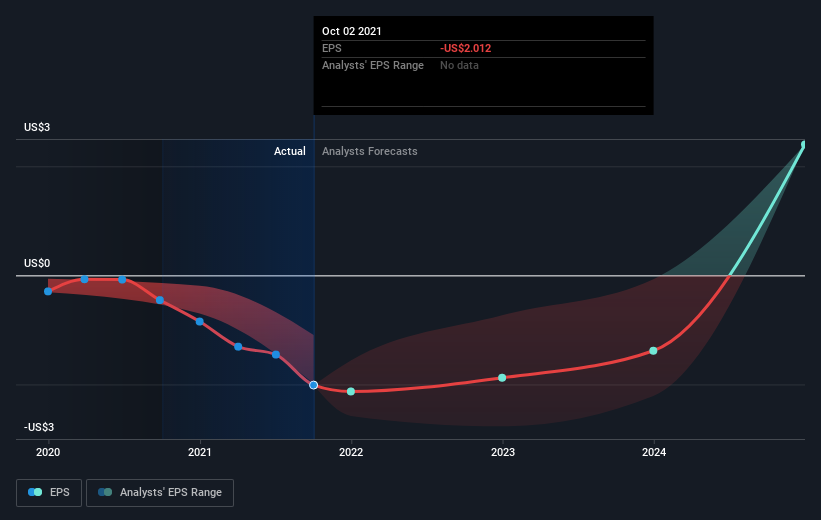

According to the 16 industry analysts covering Beyond Meat, the consensus is that breakeven is near. They expect the company to post a final loss in 2023 before turning a profit of US$150m in 2024. So, the company is predicted to break even approximately 2 years from now. To meet this breakeven date, we calculated the company's rate to grow year on year. It turns out an average annual growth rate of 47% is expected, which is highly buoyant.

Should the business grow at a slower rate, it will become profitable later than expected.

Given this is a high-level overview, we won't go into details of Beyond Meat's upcoming projects, though, take into account that, by and large, a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

Finally, there's one issue worth mentioning. Beyond Meat currently has a debt-to-equity ratio of over 2x. Typically, debt shouldn't exceed 40% of your equity, and the company has considerably exceeded this. A higher level of debt requires more stringent capital management, which increases the risk around investing in the loss-making company.

Next Steps:

As both positive and negative catalysts exist, Beyond Meat remains a high-risk growth story. Meanwhile, the stock remains heavily shorted, with a short percent of the float climbing up to 37.21%.

Beyond Meat's key fundamentals are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Beyond Meat, take a look at Beyond Meat's company page on Simply Wall St. We've also put together a list of relevant factors you should further research:

- Valuation: What is Beyond Meat worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Beyond Meat is currently mispriced by the market.

- Management Team: An experienced management team at the helm increases our confidence in the business – take a look at who sits on Beyond Meat's board and the CEO's background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you're looking to trade Beyond Meat, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives