- United States

- /

- Food

- /

- NasdaqCM:BOF

Why We're Not Concerned Yet About BranchOut Food Inc.'s (NASDAQ:BOF) 29% Share Price Plunge

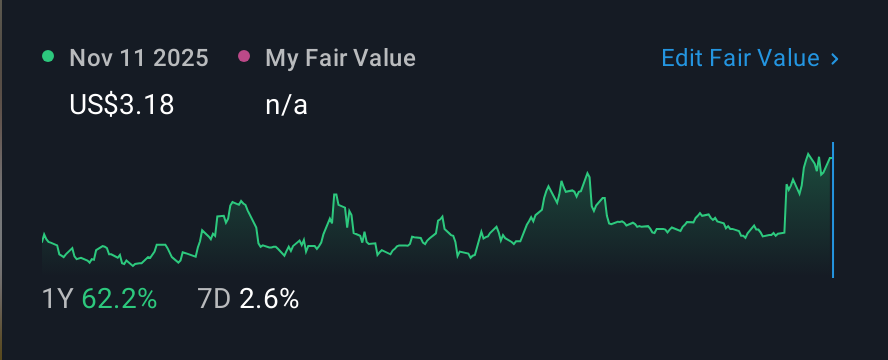

The BranchOut Food Inc. (NASDAQ:BOF) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 221% in the last twelve months.

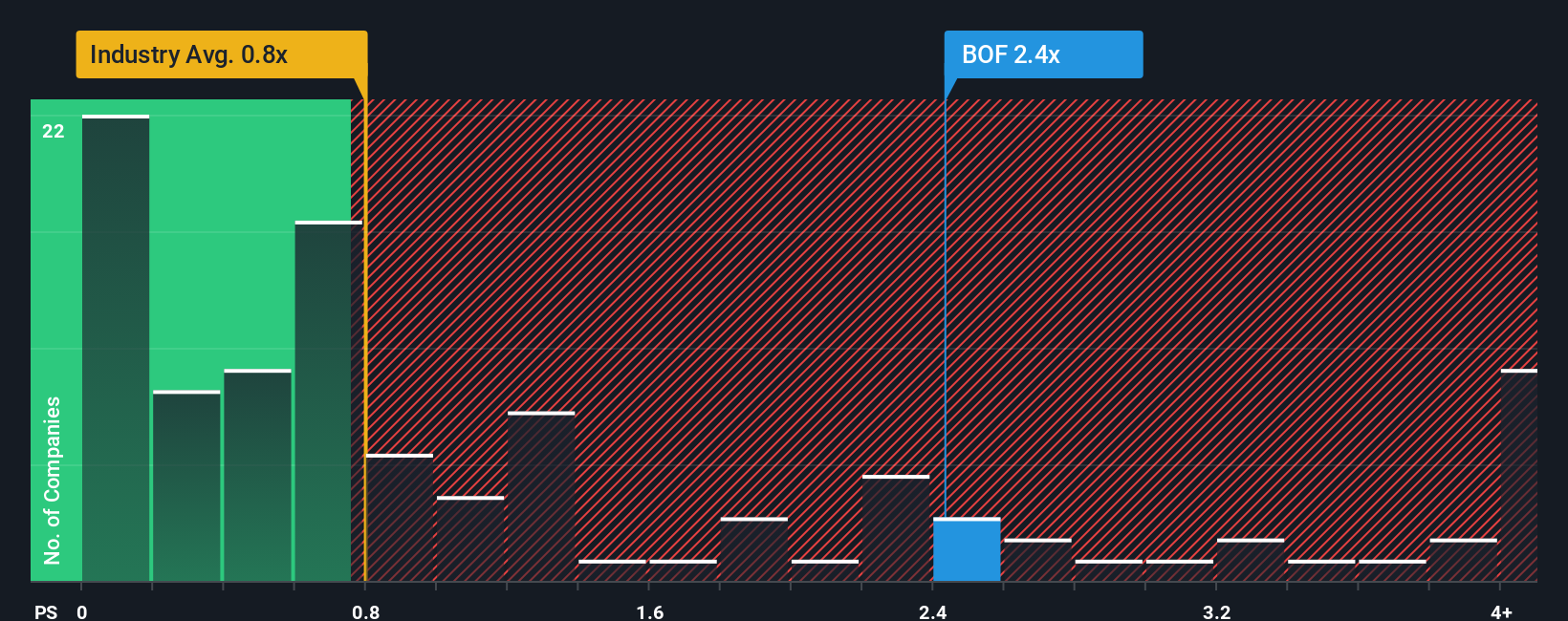

In spite of the heavy fall in price, when almost half of the companies in the United States' Food industry have price-to-sales ratios (or "P/S") below 0.8x, you may still consider BranchOut Food as a stock probably not worth researching with its 2.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for BranchOut Food

What Does BranchOut Food's P/S Mean For Shareholders?

BranchOut Food certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on BranchOut Food's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, BranchOut Food would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 95% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 4.0% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we can see why BranchOut Food is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

What Does BranchOut Food's P/S Mean For Investors?

BranchOut Food's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of BranchOut Food revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 4 warning signs for BranchOut Food (of which 2 make us uncomfortable!) you should know about.

If you're unsure about the strength of BranchOut Food's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BranchOut Food might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BOF

BranchOut Food

Develops, markets, sells, and distributes plant-based dehydrated fruit and vegetable snacks, and powders in the United States and Latin America.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives