- United States

- /

- Energy Services

- /

- OTCPK:VTDR.F

Vantage Drilling (OTCPK:VTDR.F) Profit Margins Swing Positive, Discounted P/E Spurs Debate on Turnaround

Reviewed by Simply Wall St

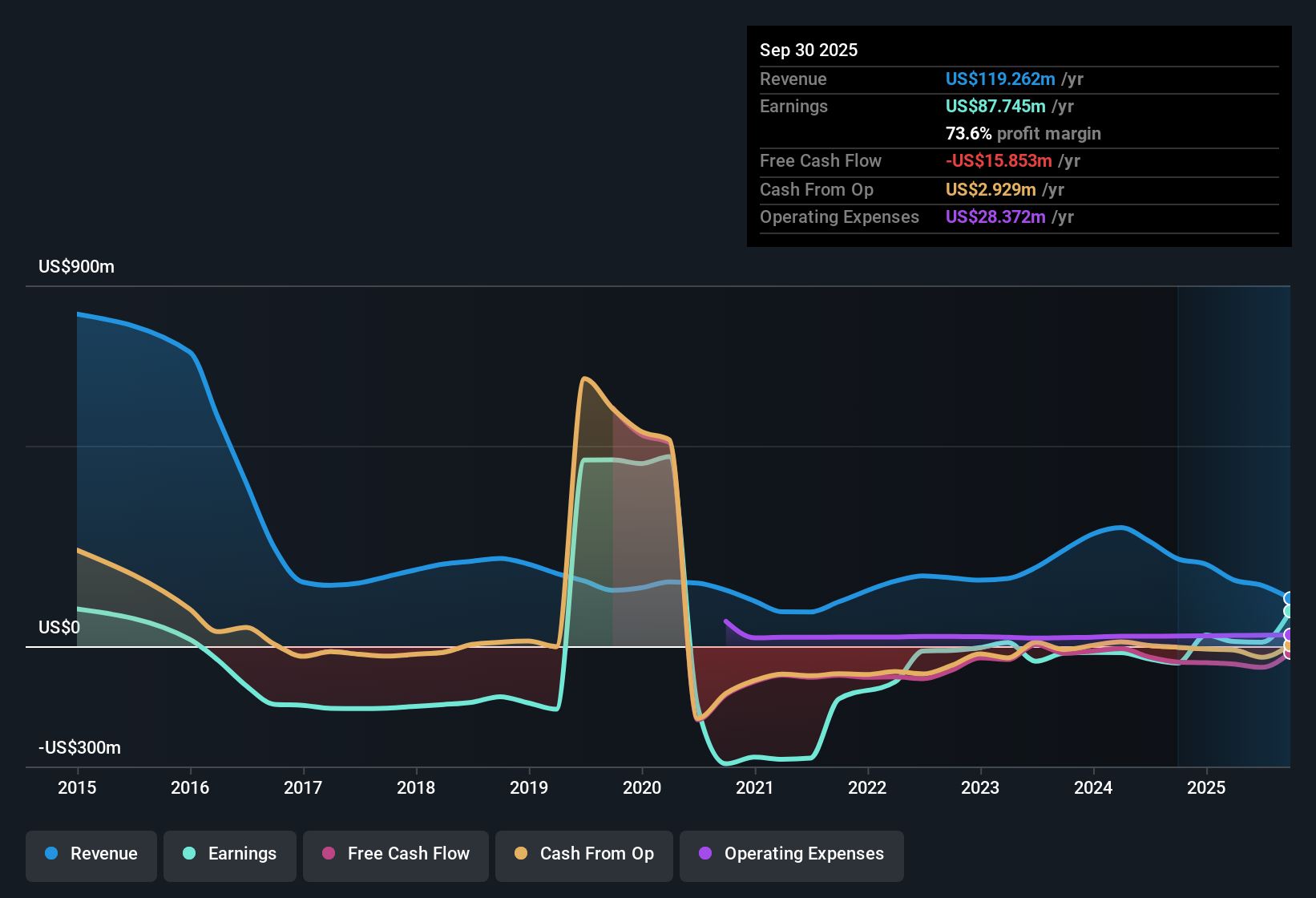

Vantage Drilling International (OTCPK:VTDR.F) just posted its Q3 2025 results, reporting total revenue of $23.3 million and EPS of $5.01. Looking back, the company has seen revenue fluctuate from $26.5 million in Q1 2025 down to $23.3 million this quarter, and quarterly EPS swing from a loss to a solid profit. Margins tell the story; after several periods of net losses, the company has stepped into profitability, setting the stage for a new look from investors.

See our full analysis for Vantage Drilling International.Next, we’ll pit these headline results against the prevailing community narratives. Let’s see where the numbers support the current story and where they raise some flags.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Multiple Sits Far Below Peers

- Vantage Drilling trades at a Price-To-Earnings ratio of 1.9x, sharply below the US Energy Services industry average of 16.8x and the peer group on 20.4x. This highlights an unusually discounted valuation in its sector.

- Despite rising profitability, consensus narrative points out the gap between Vantage’s rapid earnings growth (up 75.7% annually over five years) and its low relative valuation. This raises the question of whether the market is still pricing in old risks.

- Net profit margins have shifted from negative to positive in the last twelve months, supporting optimism around durability of recent profit gains.

- With the current share price at $12.00, some may argue the discount is more than justified by improving fundamentals, while others remain cautious given the company’s history of volatility.

- To see why analysts are divided after these results, check the full data for both upside and risk signals. 📊 Read the full Vantage Drilling International Consensus Narrative.

Profit Margins Turn the Corner

- Net income has moved from a loss of $16.0 million in Q2 to a profit of $67.2 million this quarter. This reflects a decisive shift to positive margins after a challenging period.

- Some observers are watching closely as margins and profits rebound, but the narrative also notes that over the last twelve months, a significant portion of earnings came from non-cash items, making quality as important as the headline profit swing.

- There are claims that the dramatic profit jump is less impressive if driven by accounting factors rather than cash flow.

- This debate centers on whether current profitability marks a sustainable turnaround or is simply a temporary fluctuation in the numbers.

Rapid Earnings Growth Adds Fuel

- Trailing twelve-month earnings accelerated by an average of 75.7% per year over the last five years, with net income for the past year totaling $87.7 million.

- The prevailing view questions if this growth can be maintained. While surging profits support a bullish case, high earnings volatility and illiquid shares create execution risk that some may not want to overlook.

- Peer companies with less dramatic swings have not experienced such steep discounts, showing how Vantage’s risk profile influences its valuation.

- Investors must weigh strong historical growth against the real constraints of market liquidity and non-cash earnings quality.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Vantage Drilling International's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Vantage Drilling’s surge in profits, heavy reliance on non-cash items and inconsistent earnings suggest their impressive turnaround may not be sustainable.

If you want more consistency in performance, use stable growth stocks screener (2074 results) to find companies that deliver reliable growth and steady profits across changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:VTDR.F

Vantage Drilling International

Operates as an offshore drilling company that provides offshore contract drilling services in the United States and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success