- United States

- /

- Biotech

- /

- NasdaqGS:GBIO

3 US Penny Stocks With Market Cap Under $70M

Reviewed by Simply Wall St

As the S&P 500 edges toward new highs amidst mixed trading sessions, investors are paying close attention to smaller market segments for potential opportunities. Penny stocks, though an older term, continue to represent a compelling area of interest due to their association with smaller or emerging companies that might offer significant growth potential. By focusing on those with strong financials and solid fundamentals, investors can find unique opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $110.92M | ★★★★★★ |

| BAB (OTCPK:BABB) | $0.87505 | $6.41M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.87 | $12M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.97 | $2.09B | ★★★★☆☆ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2896 | $11.03M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $3.12 | $59.16M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.28 | $22.17M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9272 | $82.51M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.31 | $361.98M | ★★★★☆☆ |

Click here to see the full list of 710 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Grace Therapeutics (NasdaqCM:GRCE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grace Therapeutics, Inc. focuses on developing and commercializing pharmaceutical products for rare and orphan diseases in Canada, with a market cap of $37.72 million.

Operations: Grace Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $37.72M

Grace Therapeutics, Inc., with a market cap of US$37.72 million, is a pre-revenue company focusing on rare diseases. Despite being unprofitable, it has reduced losses over the past five years by 4.7% annually and maintains no debt. The management and board are relatively inexperienced with average tenures under two years. Recent presentations at industry events highlight its active engagement in the biotech community despite high share price volatility and negative return on equity (-20.68%). With short-term assets of US$16.1 million exceeding liabilities, Grace has more than a year's cash runway based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Grace Therapeutics.

- Examine Grace Therapeutics' earnings growth report to understand how analysts expect it to perform.

Generation Bio (NasdaqGS:GBIO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Generation Bio Co. develops non-viral genetic medicines for treating rare and prevalent diseases, with a market cap of $66.12 million.

Operations: The company's revenue is derived entirely from its Pharmaceuticals segment, totaling $18.58 million.

Market Cap: $66.12M

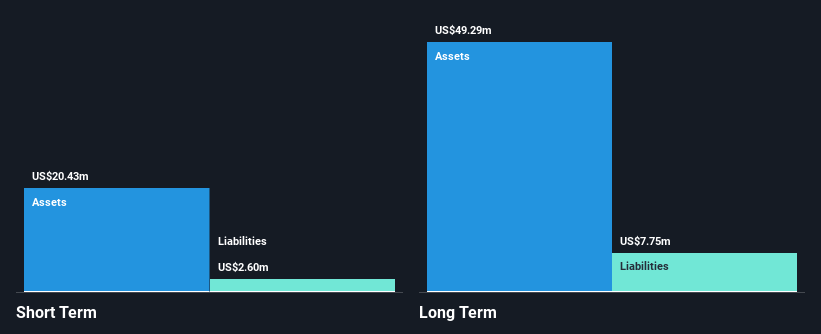

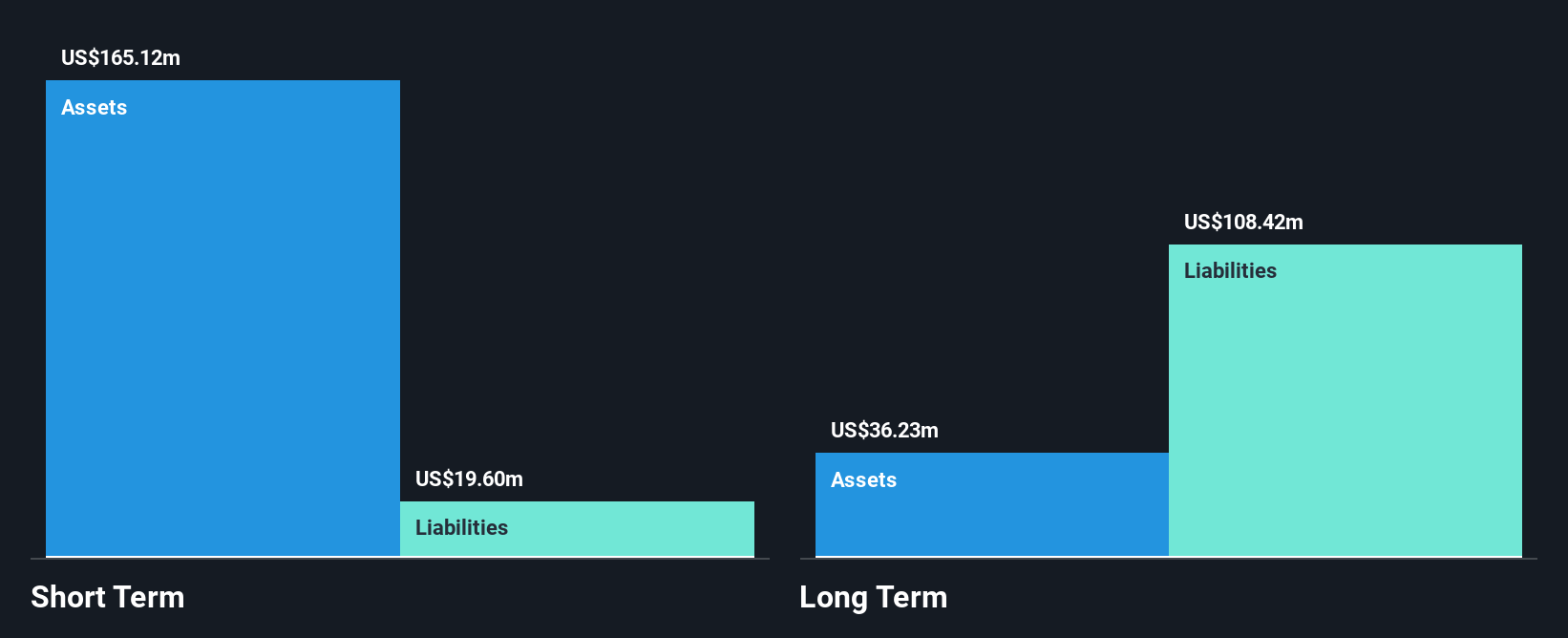

Generation Bio Co., with a market cap of US$66.12 million, is pre-revenue and focuses on genetic medicines. Recent executive changes include Kevin Conway as CFO and Phillip Samayoa as CSO, reflecting strategic shifts. The company is advancing its T cell-directed lipid nanoparticle (ctLNP) technology for siRNA therapeutics, addressing autoimmune diseases by modulating T cell function. Financially stable with no debt and short-term assets of US$191.3 million exceeding liabilities, it has a cash runway of over two years despite ongoing losses. A recent shelf registration filing indicates potential capital raising to support development efforts.

- Unlock comprehensive insights into our analysis of Generation Bio stock in this financial health report.

- Understand Generation Bio's earnings outlook by examining our growth report.

Koil Energy Solutions (OTCPK:KLNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Koil Energy Solutions, Inc. is an energy services company that offers equipment and support services to the energy and offshore industries, with a market cap of $26.26 million.

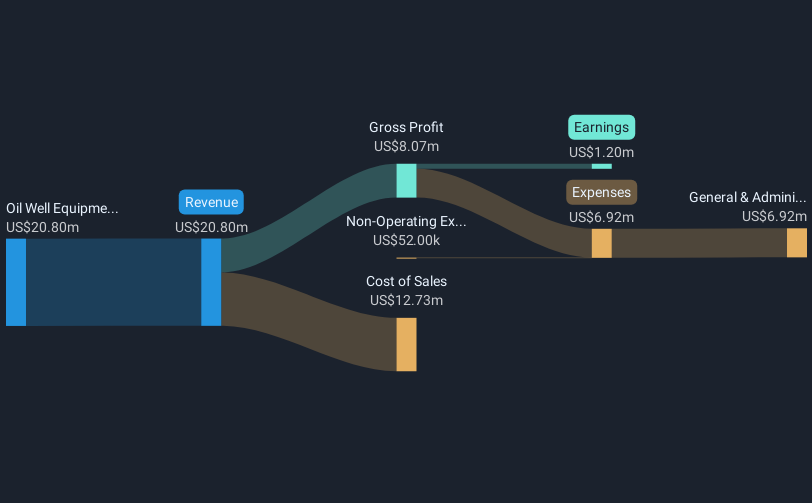

Operations: The company generates revenue of $20.80 million from its Oil Well Equipment & Services segment.

Market Cap: $26.26M

Koil Energy Solutions, with a market cap of US$26.26 million, has shown significant financial improvement, becoming profitable this year with a net income of US$2.08 million for the first nine months of 2024. The company's revenue from its Oil Well Equipment & Services segment reached US$16.79 million, marking growth from the previous year. It operates debt-free and maintains strong liquidity, as short-term assets exceed both short and long-term liabilities. Despite stable earnings quality and no shareholder dilution recently, Koil's share price remains highly volatile over recent months compared to most U.S. stocks.

- Get an in-depth perspective on Koil Energy Solutions' performance by reading our balance sheet health report here.

- Assess Koil Energy Solutions' previous results with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 710 US Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GBIO

Generation Bio

A biotechnology company, discovers, develops, and commercializes redosable therapeutics that reprogram T cells in vivo to reduce or eliminate the production and persistence of autoreactive T cells.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives