- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC) Sells $600M in Equity: Is This a Shift in Growth Strategy?

Reviewed by Sasha Jovanovic

- Uranium Energy Corp. recently launched a US$600 million at-the-market equity sales program with Goldman Sachs as lead manager, alongside filing a universal shelf registration for various securities and raising about US$204 million last month to support a new American uranium facility.

- This wave of capital-raising comes as uranium was newly added to the U.S. Critical Minerals List, highlighting its importance for national security and domestic energy production.

- We’ll explore what Uranium Energy’s expanded financing initiatives mean for its investment narrative as it prioritizes growth in American uranium infrastructure.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

What Is Uranium Energy's Investment Narrative?

For anyone looking at Uranium Energy Corp., the investment story comes down to believing in the long-term value of expanding a domestic uranium supply as part of the broader U.S. energy and security agenda. The company’s new US$600 million at-the-market equity program and recent US$204 million raise are aimed squarely at scaling up American uranium infrastructure, a focus reinforced by uranium’s fresh spot on the U.S. Critical Minerals List. This influx of capital is set to support key growth projects, potentially accelerating development timelines, an important factor for any short-term catalysts tied to production capacity or government contracts. However, with shares having recently declined more than the broader market and an anticipated quarterly loss on the horizon, risk from share dilution and ongoing unprofitability could remain front of mind. These new financing moves, while bolstering the cash position, may not dramatically shift the biggest risks facing the business in the short term. But underlying risks from ongoing losses and recent share price moves remain relevant for investors to consider.

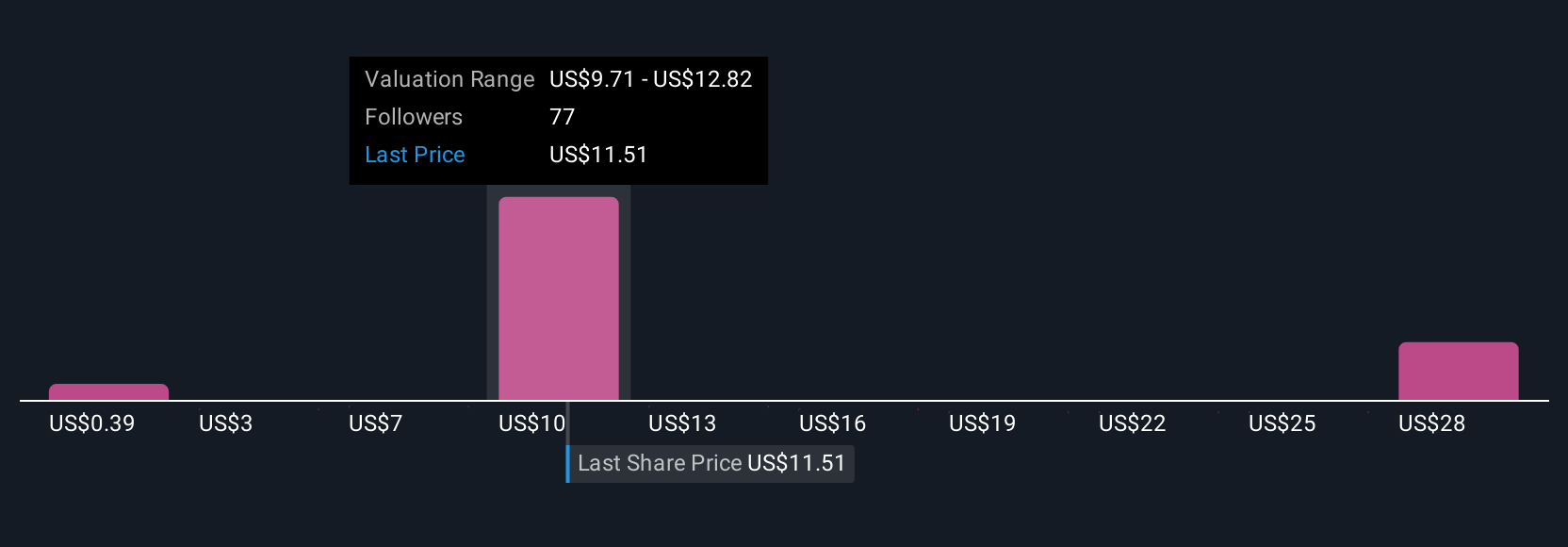

Despite retreating, Uranium Energy's shares might still be trading 16% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 28 other fair value estimates on Uranium Energy - why the stock might be worth as much as 45% more than the current price!

Build Your Own Uranium Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Uranium Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Uranium Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Uranium Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives