- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC): Assessing Valuation as Analyst Sentiment Dips and Sector Peers Outperform

Reviewed by Simply Wall St

If you are following Uranium Energy (UEC), you have probably noticed that the latest shift in market sentiment could leave investors at a crossroads. The company recently saw a larger drop in its share price compared to the broader market, catching the attention of many who track the sector. On top of that, analysts have maintained a cautious outlook, and expectations are muted with no change forecast in its upcoming earnings per share. All this unfolds while industry peers like Cameco ride a wave of higher revenues, making Uranium Energy’s position a focal point for anyone deciding what to do next.

Over the past year, Uranium Energy’s stock has actually gained over 100%. Its momentum over the past three months stands out as especially strong within the sector. However, these price moves come while the company manages ongoing losses from higher operating expenses, precisely as rivals announce fresh expansion and better financial results. Unlike its peers, Uranium Energy’s earnings trajectory has stalled and the gap in sentiment is widening. This contrast has brought increased attention to whether this is just a pause or a sign of deeper issues.

With all eyes on Uranium Energy’s next earnings report and new industry tailwinds, the real question is whether this is a chance to buy into potential upside or if the current price already reflects all the growth that is ahead.

Price-to-Book of 5.2x: Is It Justified?

Using the price-to-book ratio, Uranium Energy appears expensive relative to both its sector peers and the broader US Oil and Gas industry. The company trades at a 5.2x price-to-book ratio, which is significantly higher than the industry averages.

The price-to-book ratio compares a company’s market price to its book value. This helps investors determine whether a stock is overvalued or undervalued based on its assets alone. In asset-heavy industries like energy, this metric can help identify stocks priced above what their balance sheets would suggest.

In this situation, the market seems to be pricing Uranium Energy at a premium, likely based on expectations of future growth rather than on current profitability. With sector and industry benchmarks lower, the company’s valuation may be driven more by optimism than by present fundamentals.

Result: Fair Value of $10.48 (OVERVALUED)

See our latest analysis for Uranium Energy.However, unexpected jumps in operating expenses or continued net losses could quickly shift sentiment against Uranium Energy and undermine recent optimism.

Find out about the key risks to this Uranium Energy narrative.Another View: Our DCF Model Tells a Different Story

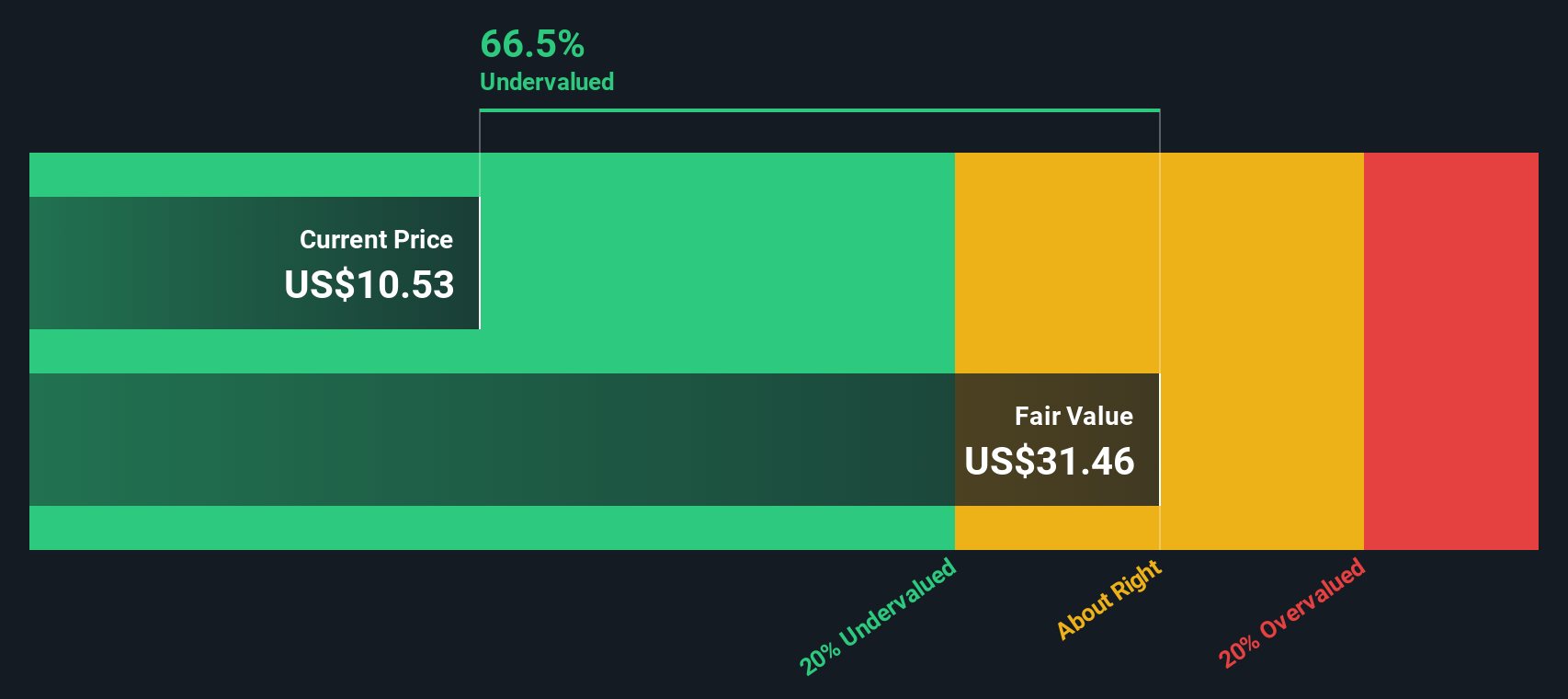

While Uranium Energy appears expensive when comparing the market value to its asset base, our DCF model indicates that the stock is trading well below its fair value. This raises the question of whether the market is underestimating future potential.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Uranium Energy Narrative

If you see things differently or want to base your decisions on your own research, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Uranium Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why stop with just one opportunity? Give yourself the edge by using Simply Wall Street’s powerful screener to uncover stocks with unique advantages. Make sure you don’t miss out on sectors and trends that could shape your investing success. Opportunities are waiting, and the next win could be just a click away.

- Grow your portfolio with high potential by zeroing in on penny stocks with strong financials making headlines for strong fundamentals and rapid gains.

- Tap into future-defining technology by seeking out AI penny stocks that stand at the forefront of artificial intelligence innovation and disruption.

- Boost your income and stability by selecting dividend stocks with yields > 3% poised to deliver reliable yields above 3%, providing peace of mind and steady returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives