- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

How Investors May Respond To Centrus Energy (LEU) Convertible Note Financing and Dilution Concerns

Reviewed by Sasha Jovanovic

- Centrus Energy recently completed a US$700 million convertible note financing, drawing investor attention amid a booming uranium sector and prompting renewed debate about the company's valuation and financial strategy.

- Concerns about potential share dilution and profit-taking emerged even as Centrus maintains a strong order backlog, continued profitability, and benefits from increased federal support for domestic uranium production.

- We will explore how concerns over dilution following the major financing round might influence Centrus Energy’s long-term investment prospects.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Centrus Energy Investment Narrative Recap

To be a Centrus Energy shareholder right now is to believe in the long-term upswing in domestic nuclear fuel demand, government backing, and Centrus’ unique role as the only large-scale American uranium enricher. The recent US$700 million convertible note financing drew concerns about share dilution and caused heightened volatility, yet does not materially alter the most important near-term catalyst, execution and award of key federal contracts for advanced nuclear fuel, nor does it reduce the biggest risk: Centrus’ dependence on timely contract wins in a highly regulated industry.

One of the most relevant recent announcements is Centrus’ major expansion initiative at the Piketon, Ohio facility, involving projected multi-billion-dollar investments and significant federal support. This expansion, if contracted as expected, is positioned to support incremental capacity required by upcoming U.S. Department of Energy initiatives and could play a critical role as Centrus seeks to secure and deliver the next wave of government contracts.

However, investors should be aware that, despite these positive signals, there remains uncertainty around...

Read the full narrative on Centrus Energy (it's free!)

Centrus Energy's narrative projects $640.9 million in revenue and $70.3 million in earnings by 2028. This requires 13.6% yearly revenue growth and a $34.5 million decline in earnings from $104.8 million currently.

Uncover how Centrus Energy's forecasts yield a $258.05 fair value, a 33% downside to its current price.

Exploring Other Perspectives

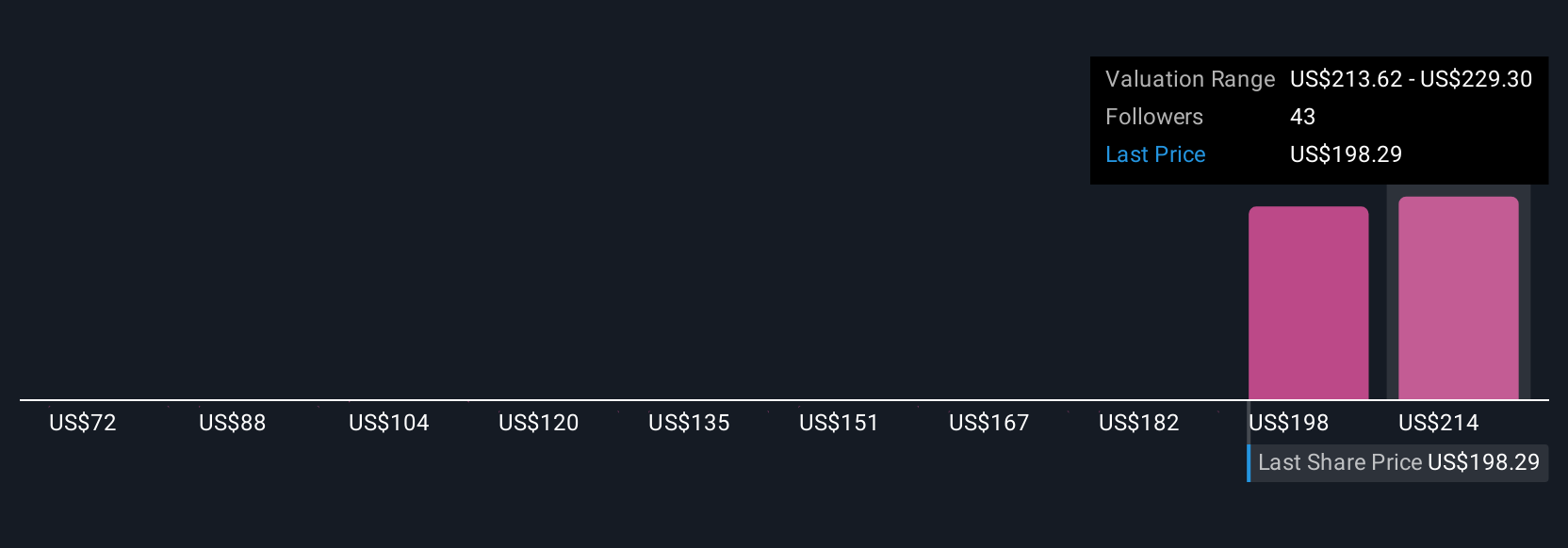

Simply Wall St Community members contributed 10 unique fair value estimates for Centrus Energy ranging from US$72.48 to US$310 per share. While many see upside tied to ongoing government contracts, others flag the high sensitivity to regulatory and contract delays as a key factor in the company’s potential performance, highlighting the importance of considering several viewpoints before making any decisions.

Explore 10 other fair value estimates on Centrus Energy - why the stock might be worth less than half the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives