- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group (XPRO) Is Up 10.2% After Record Cash Flow and Raised 2025 Guidance - Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In its third-quarter 2025 update, Expro Group Holdings N.V. reported sales of US$411.36 million and net income of US$13.96 million, alongside the completion of a large share repurchase program initiated in June 2022.

- The company achieved record adjusted free cash flow, raised its annual guidance for EBITDA and free cash flow, and secured multiple long-term international contracts, highlighting improvements in efficiency and operational execution.

- We'll explore how Expro's achievement of record free cash flow and updated guidance influences its long-term investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Expro Group Holdings Investment Narrative Recap

Expro Group Holdings offers investors a play on global energy demand and large-scale offshore projects, underpinned by a strong order backlog and record free cash flow. The recent buyback completion and raised EBITDA guidance signal operational confidence, but do not materially shift the near-term catalyst, which remains the pace of international project awards; the largest risk continues to be exposure to regulatory and geopolitical uncertainties impacting those key regions.

Of the recent announcements, Expro’s completion of its multiyear share repurchase program is closely aligned with the current narrative. While it highlights strong cash flow and management’s commitment to returning value, it has little short-term effect on the company’s exposure to shifts in global regulatory and geopolitical conditions, which still present the primary risk to future growth.

However, in contrast to recent operational highs, investors should pay close attention to how regulatory pressures in international markets could affect Expro’s...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings' outlook anticipates $1.7 billion in revenue and $83.2 million in earnings by 2028. This scenario assumes a 0.3% annual revenue decline and a $11.9 million increase in earnings from the current level of $71.3 million.

Uncover how Expro Group Holdings' forecasts yield a $13.40 fair value, in line with its current price.

Exploring Other Perspectives

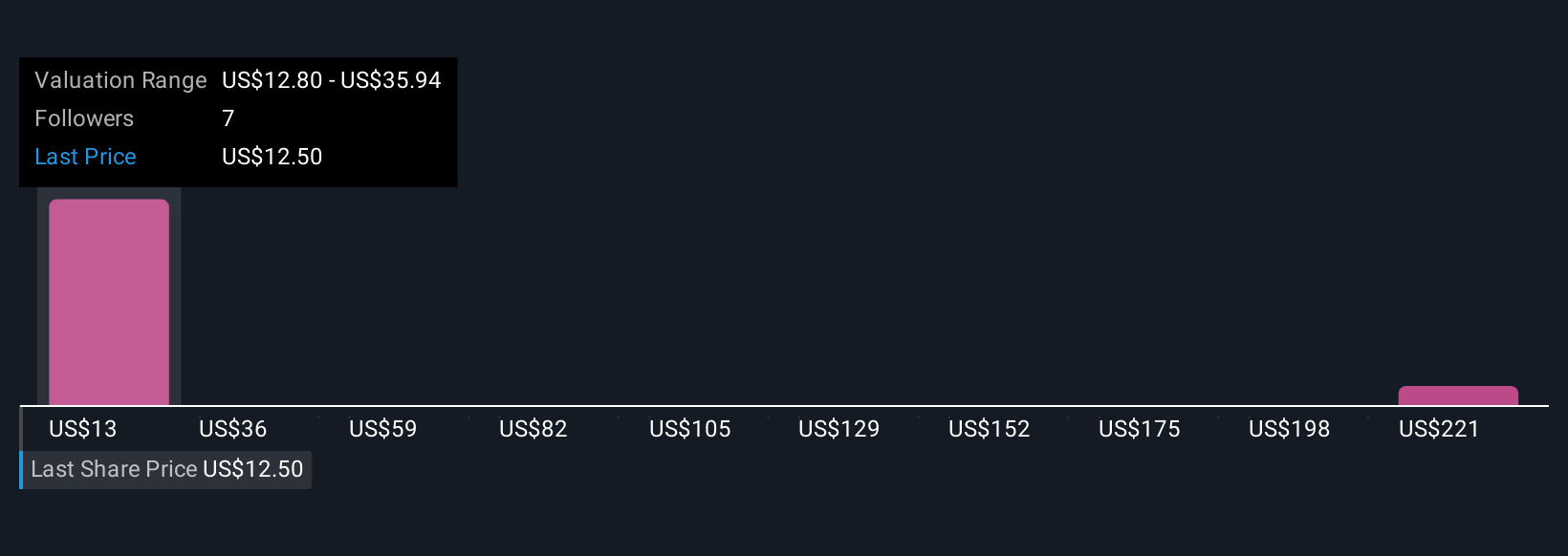

Three fair value estimates from the Simply Wall St Community span from US$13.40 to US$244.23 per share. While individual outlooks range widely, continued political and regulatory uncertainty in Expro’s target regions could play a crucial role in shaping future returns.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be worth just $13.40!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives