- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro Group Holdings (XPRO): Valuation Insights Following Record Free Cash Flow and Upgraded Growth Outlook

Reviewed by Simply Wall St

Expro Group Holdings just reported its highest quarterly free cash flow ever, an achievement that comes alongside a raised outlook for annual EBITDA and cash flow. The company also announced new long-term contracts with major industry players, reinforcing growth in the context of a softer commodity backdrop.

See our latest analysis for Expro Group Holdings.

Momentum has picked up for Expro’s share price recently, with an 11% return over the past month and a striking 58% gain in the last 90 days. This reflects renewed investor confidence following operational wins and the completion of its share buyback program. While the one-year total shareholder return is 2.5%, gains have accelerated in the short term as the company focuses on efficiency and cash generation.

If you’re curious about what’s fueling growth in other corners of the market, this could be an ideal moment to broaden your investing lens and check out fast growing stocks with high insider ownership

With this rapid turnaround and efficient capital deployment, the key question now is whether Expro’s shares are undervalued at current levels or if recent gains already reflect all the company’s renewed growth prospects. Is there still room for buyers to benefit, or has the market priced in future potential?

Most Popular Narrative: 2% Overvalued

With Expro’s recent closing price at $13.71 just above the narrative’s fair value of $13.40, analysts are split on whether the current rally has overshot future earnings potential. This subtle premium reflects both optimism and caution in the company’s outlook.

“Recent updates from the Street reveal a mix of optimism and caution surrounding Expro Group Holdings. The latest pricing revisions reflect both the company's operational strengths and ongoing challenges in the broader energy market.”

Want to know what’s driving these conflicting forecasts? The growth story hinges on robust margins, bold revenue bets, and a future profit multiple that could reset expectations. Ready to unpack how these projections add up or come apart? Discover the full logic behind this valuation.

Result: Fair Value of $13.40 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical instability and the industry’s ongoing shift toward renewables could quickly disrupt growth projections if external pressures become more intense.

Find out about the key risks to this Expro Group Holdings narrative.

Another View: Discounted Cash Flow Paints a Different Picture

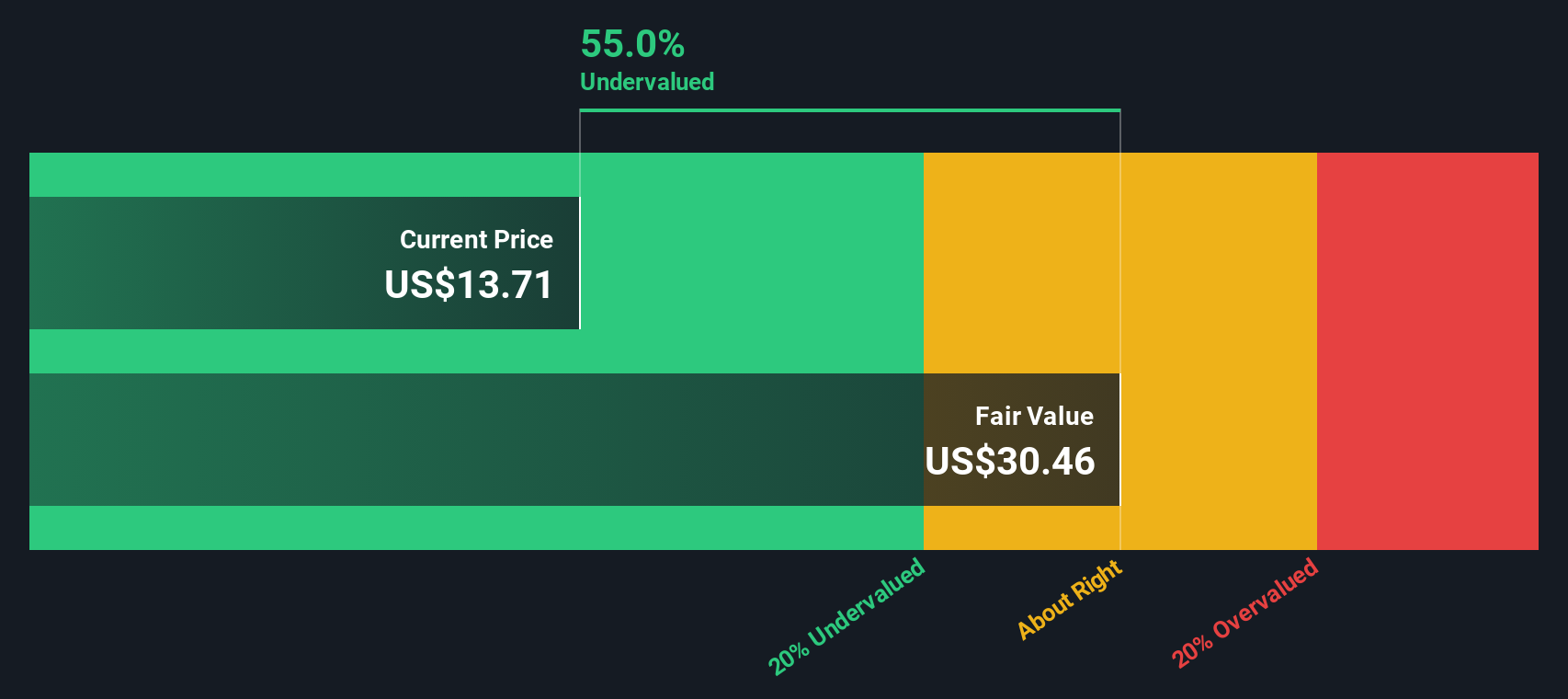

While some analysts see Expro’s shares as trading slightly above fair value based on future earnings projections, our DCF model tells a different story. From this perspective, the stock actually appears deeply undervalued. This suggests that market pessimism could be masking longer-term earnings potential. Which scenario will play out as fundamentals evolve?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expro Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expro Group Holdings Narrative

If you want to dive into the numbers yourself or believe a different conclusion makes sense, you can assemble your own evidence-backed narrative in just a few minutes. Do it your way

A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Your next great stock opportunity might be just a click away, so don't let fresh ideas pass you by. Stay ahead and spot trends before the crowd with these focused stock screens:

- Capitalize on massive breakthroughs in medicine and patient care by checking out these 33 healthcare AI stocks as it makes headlines in healthcare innovation.

- Boost your portfolio's income with these 17 dividend stocks with yields > 3%, which offers attractive yields and consistent cash returns.

- Ride the digital finance wave and seize unique opportunities among these 80 cryptocurrency and blockchain stocks that are powering the evolution of blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives