- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Should You Reconsider Exxon as Shares Rally on Clean Energy Investments in 2025?

Reviewed by Bailey Pemberton

If you are staring at Exxon Mobil's current stock price and wondering if now is the right time to make a move, you are definitely not alone. Investors have seen the stock climb 4.8% in the last week, tick up 1.8% over the last month, and notch an 8.1% gain year-to-date, hinting at some renewed optimism after a relatively quiet year. Pulling back even further, the long-term story is hard to ignore: up 19.5% in the past three years and a staggering 337.0% over five years, Exxon Mobil has certainly rewarded patience.

Some of this momentum can be traced to recent headlines around Exxon Mobil's ambitious investments in carbon capture and low-carbon energy projects. The company’s moves in this space have caught the eye of both Wall Street and Main Street, suggesting that Exxon may not just be an oil giant anymore but a potential energy transition leader. Of course, with energy stocks, sentiment can shift quickly as global economic outlooks and regulatory environments change, so it pays to stay sharp.

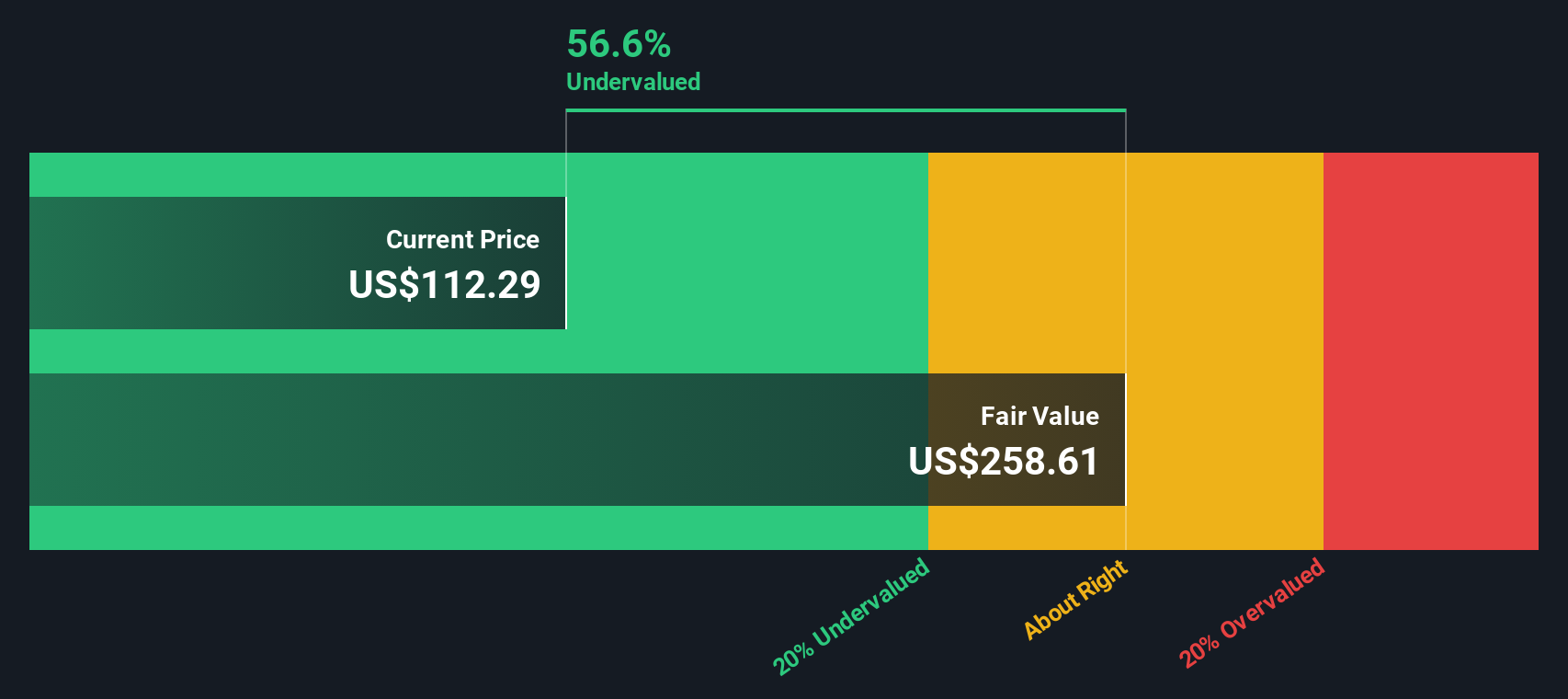

So, is Exxon Mobil undervalued despite the rally? Based on six different valuation checks, the company scores a 4 out of 6 when it comes to being considered undervalued, meaning it passes most, but not all, of the fundamental tests analysts like to see. In the sections ahead, we will break down those approaches one by one, and later, explore whether a more holistic perspective might be the most insightful way to judge Exxon’s true value.

Why Exxon Mobil is lagging behind its peers

Approach 1: Exxon Mobil Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation approach that projects a company’s expected free cash flows into the future, then discounts those amounts back to today’s value. The goal is to estimate what Exxon Mobil should be worth right now, based on how much cash it is likely to generate over time.

For Exxon Mobil, the latest twelve months’ free cash flow stands at $32.4 billion. Analysts project these cash flows to grow steadily, with ten-year projections reaching nearly $61.9 billion by 2035. While analysts generally provide forecasts for the next five years, estimates for later years are extrapolated based on industry assumptions and Simply Wall St methodologies.

After analyzing these long-term numbers and adjusting for risk, the DCF model calculates an estimated intrinsic fair value for Exxon Mobil stock of $288.47 per share. With the current share price sitting roughly 59.8% below this level, the model suggests that Exxon Mobil is significantly undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Exxon Mobil is undervalued by 59.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Exxon Mobil Price vs Earnings

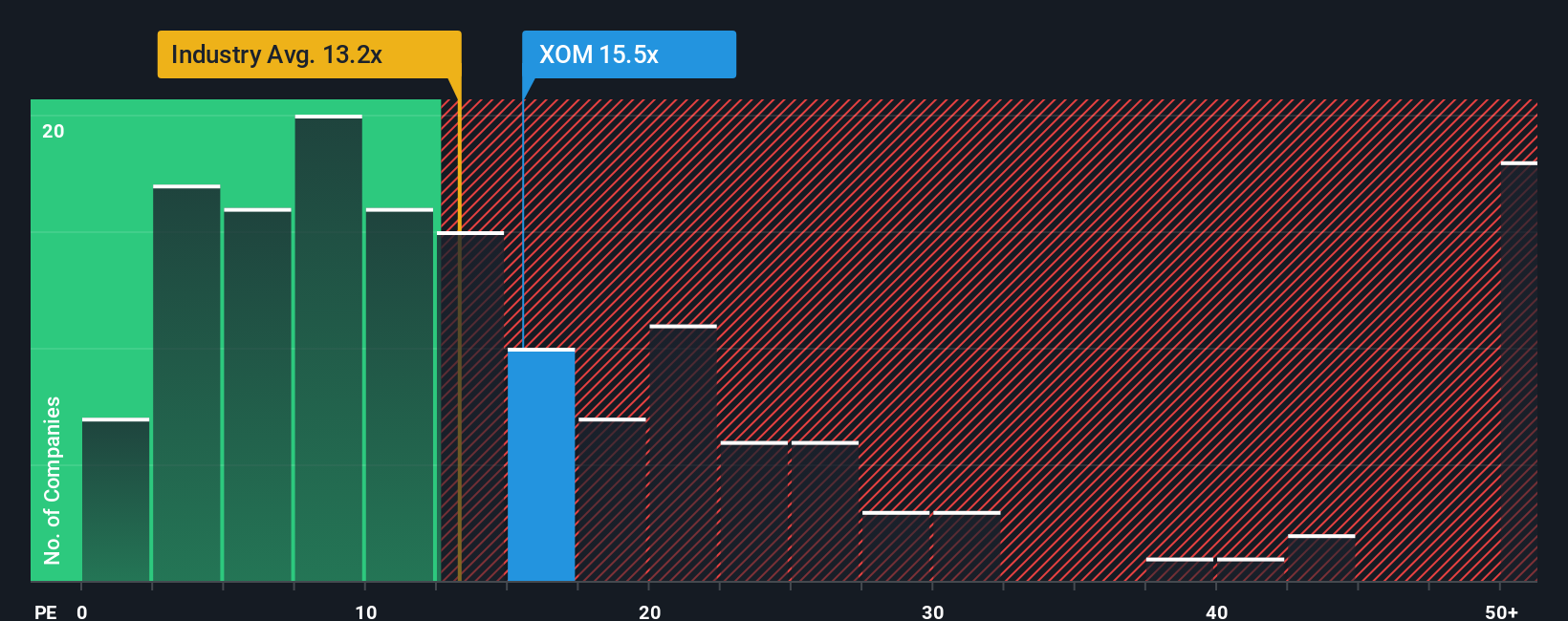

For profitable companies like Exxon Mobil, the Price-to-Earnings (PE) ratio is one of the most widely used valuation tools. It allows investors to see how much they are paying for each dollar of earnings, making it especially relevant for businesses with consistent profitability.

It is important to remember that what constitutes a “normal” or “fair” PE ratio often depends on factors such as growth forecasts, profit stability, and risk. Companies with higher expected growth or lower risk profiles usually command higher PE ratios, while those with slower growth or elevated risks tend to trade at lower multiples.

Currently, Exxon Mobil trades at a PE ratio of 15.94x. This is slightly above the Oil and Gas industry average of 13.09x, but notably below the average for its peers at 22.38x. To provide a more customized benchmark, Simply Wall St calculates a proprietary “Fair Ratio” for each company. Exxon Mobil’s Fair Ratio is 21.65x, a figure that accounts for its sector, growth trajectory, profit margins, market capitalization, and risk factors.

Unlike generic industry averages and peer comparisons, the Fair Ratio offers a more tailored reference point by factoring in Exxon’s unique qualities and outlook rather than just broad categories. That means it can often give a clearer picture of whether the stock is attractively valued or not.

With Exxon’s current PE ratio of 15.94x sitting well below its Fair Ratio of 21.65x, the implication is that shares are undervalued when taking all these holistic factors into account.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exxon Mobil Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a dynamic approach that connects your perspective on Exxon Mobil's future with financial forecasts and fair value estimates. This allows you to see the story behind the numbers.

A Narrative is simply your own investment thesis made actionable. It links your expectations about Exxon Mobil’s strategy, earnings, and margins directly to a clear financial forecast and an estimated fair value per share. On Simply Wall St’s Community page, millions of users can easily write or choose a Narrative that reflects their view and immediately compare their Fair Value to the live market price. This helps them see when to buy or sell, with no spreadsheets or guesswork required.

Narratives update automatically as fresh information, such as earnings reports or major headlines, becomes available, so your view always reflects the latest data. For instance, some investors currently set Exxon Mobil's fair value as high as $174 per share, reflecting confidence in Guyana’s growth and strong buybacks. Others are more cautious with Narratives at $126, weighing risks like inflation and regulatory pressures. This means you can instantly compare different outlooks and decide which story and price you believe in most.

Do you think there's more to the story for Exxon Mobil? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives