- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Exxon Mobil (XOM): Revisiting Valuation as Shares Show Modest Movement

Reviewed by Simply Wall St

See our latest analysis for Exxon Mobil.

Stepping back, Exxon Mobil’s share price has shown subdued momentum compared to boom periods in the energy sector, with a year-to-date share price return of 6.95% and a one-year total shareholder return of just 1.12%. Despite some volatility in oil markets and pockets of positive news, the long-term picture remains robust. This is highlighted by a five-year total shareholder return of over 250%, which underscores Exxon’s enduring value for patient investors.

If you’re in the mood to look beyond energy names, now is the perfect time to explore fast growing stocks with high insider ownership.

With Exxon Mobil trading at a notable discount to analyst targets, yet recent gains have been modest, the question for investors is clear: is this a compelling entry point, or has the market already accounted for the company’s future growth?

Most Popular Narrative: 13.1% Undervalued

Exxon Mobil’s most prominent narrative sets a fair value of $132 per share, above the recent closing price of $114.77. This perspective credits strong operational shifts and future earnings power as major forces supporting a higher valuation.

*A technology-focused approach through the Low Carbon Solutions (LCS) business leverages core competencies. Instead of competing in renewable electricity generation, XOM leverages its engineering and geological expertise to focus on decarbonizing heavy industry through Carbon Capture and Storage (CCS) and low-carbon hydrogen.*

What if there is more than meets the eye in Exxon’s transformation? A bold new bet on emerging markets, significant revenue shifts, and ambitious profit goals drive this target. The full story hides the precise numbers behind that upside. Curious which projections move the needle? Unlock the details that shape this compelling valuation.

Result: Fair Value of $132 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent oil price volatility and heightened ESG scrutiny could quickly reshape the outlook and challenge the case for Exxon Mobil's continued outperformance.

Find out about the key risks to this Exxon Mobil narrative.

Another View: What Do Market Ratios Show?

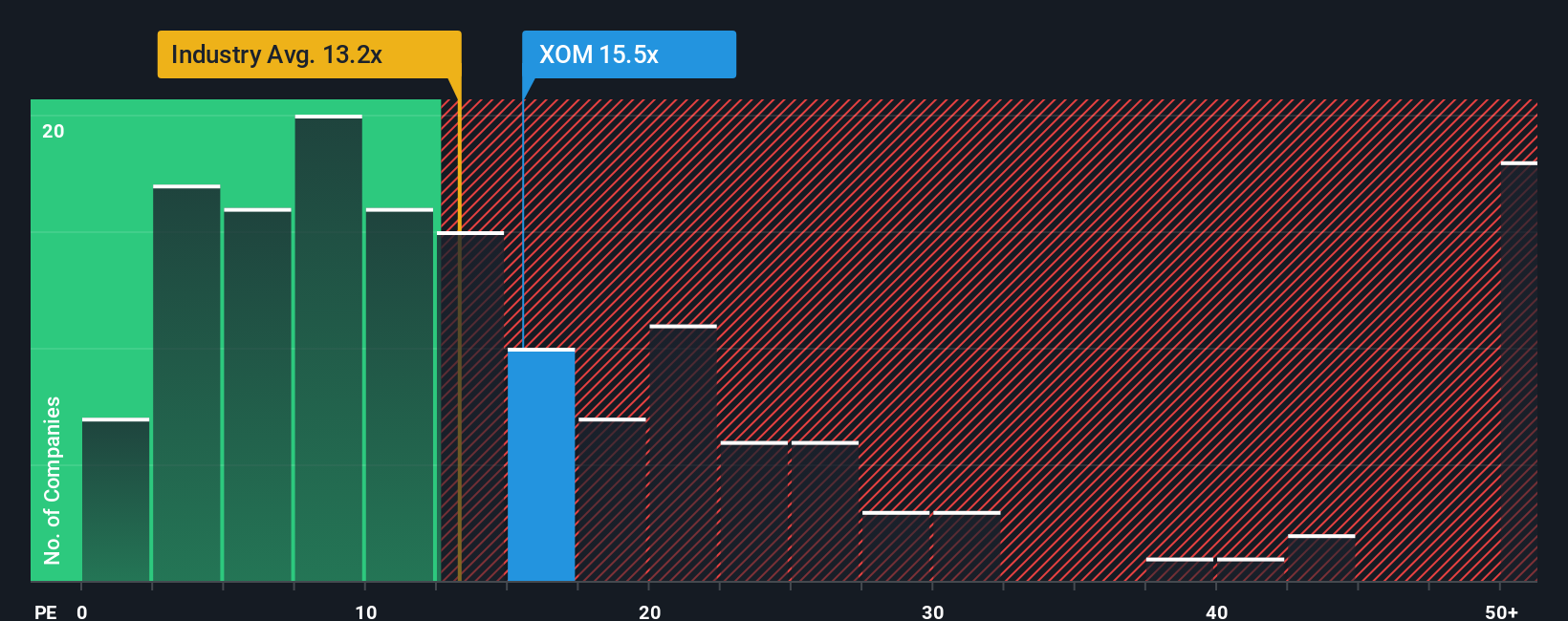

Looking at Exxon's valuation through the lens of its price-to-earnings ratio, the story looks different. Shares trade at 16.2 times earnings, which is higher than both the US Oil and Gas industry average of 13.3x and Exxon's peer average of 23.7x. However, compared to its fair ratio of 22.7x, Exxon appears to provide investors with a margin of safety and may signal potential upside if the market eventually recognizes its value. Still, this gap also suggests the stock could face valuation risk if investor sentiment shifts. Could these ratios foreshadow a re-rating, or are they a warning that upside is limited?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Exxon Mobil Narrative

If you see the numbers differently or want to approach Exxon's story in your own way, you can put together a personal narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exxon Mobil.

Looking for More Investment Ideas?

Don’t miss out on other standout opportunities. There is a universe of stocks offering growth, dividends, and innovation beyond Exxon Mobil. See what else could be powering ahead in today’s markets.

- Capture reliable income by tapping into these 15 dividend stocks with yields > 3% for stocks offering superior yields and consistent payouts.

- Position yourself in tomorrow’s breakthroughs by reviewing these 25 AI penny stocks that are driving cutting-edge advancements in artificial intelligence and transforming industries.

- Snap up potential value plays ahead of the curve using these 926 undervalued stocks based on cash flows for stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Guyana, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success