- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Exxon Mobil (NYSE:XOM) Faces Legal Setback with $816M Verdict While Eyeing Strategic Texas Project with Mitsubishi

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Exxon Mobil.

Strengths: Core Advantages Driving Sustained Success For Exxon Mobil

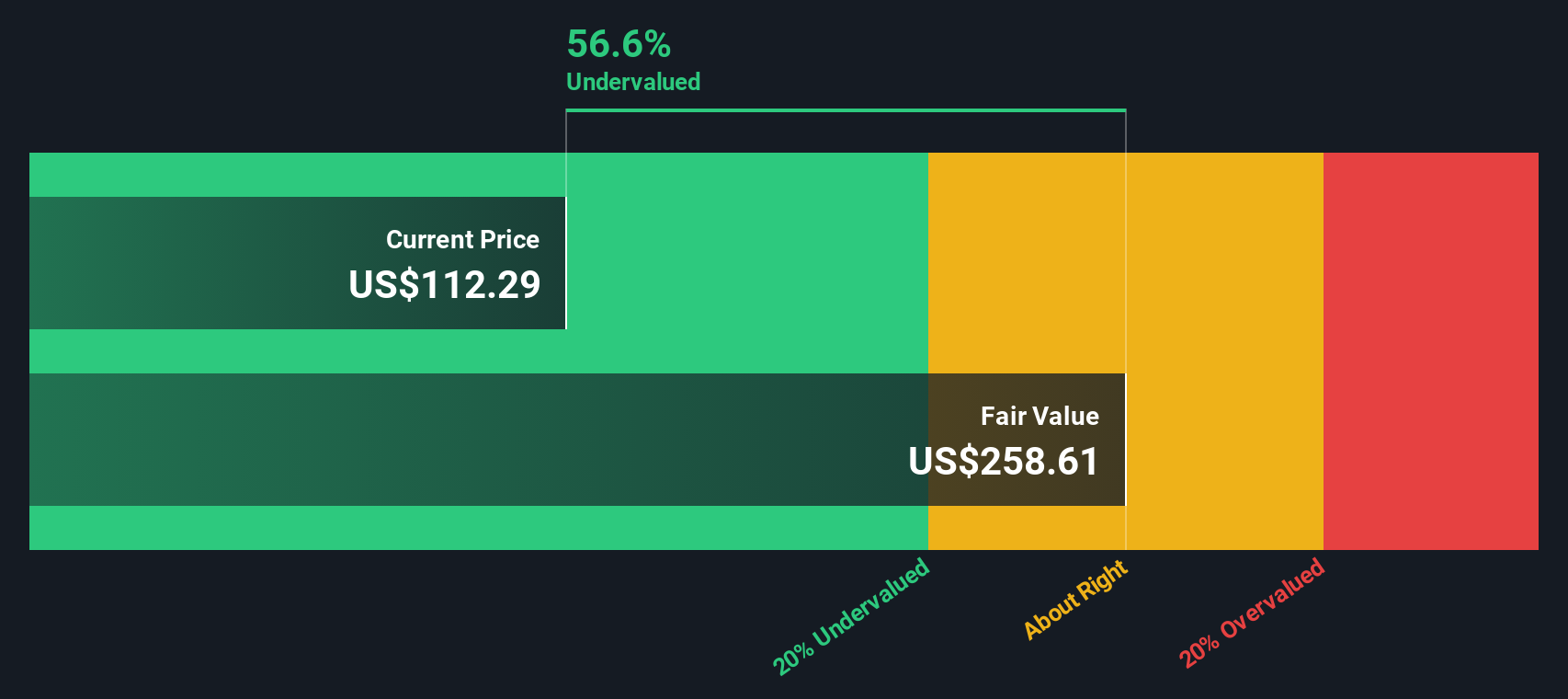

Exxon Mobil's performance remains robust, with second-quarter earnings reaching $9.2 billion, marking their second-best second quarter in the past decade. CEO Darren Woods highlighted the company's ability to deliver high-return performance products, with a 5% sequential increase in sales. Additionally, Exxon Mobil's strategic initiatives have positioned it to generate between $80 billion and $140 billion in cumulative surplus cash from 2024 to 2027. The company has also expanded its Vistamaxx performance polymer product line, achieving significant growth potential. Despite being considered expensive based on its Price-To-Earnings Ratio (15.1x) compared to the US Oil and Gas industry average (10x), Exxon Mobil is currently trading at $116, which is below the estimated fair value of $201.49, indicating it may be undervalued. This valuation suggests a strong market positioning and financial health.

Weaknesses: Critical Issues Affecting Exxon Mobil's Performance and Areas For Growth

Exxon Mobil faces several challenges, including a 34% decline in earnings over the past year, which is steeper than the Oil and Gas industry average of 31.9%. CEO Darren Woods noted that overall market conditions were soft in the second quarter, impacting demand and margins. Furthermore, the company's Return on Equity (ROE) stands at 12.8%, which is considered low compared to the industry benchmark. Despite its strong dividend coverage with a payout ratio of 45%, Exxon Mobil's dividend yield of 3.28% is lower than the top 25% of dividend payers in the US market (4.27%). Additionally, the company has experienced shareholder dilution, with total shares outstanding growing by 11.4% over the past year, which could impact investor confidence.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Exxon Mobil is well-positioned to capitalize on several growth opportunities. The company is progressing projects in Texas, with start-ups planned in 2025 that will significantly expand production at Proxxima. CEO Darren Woods emphasized targeting market segments with margins of several thousand dollars per ton and growth rates outpacing GDP. Additionally, Exxon Mobil's strategy is designed to deliver strong profitability irrespective of societal changes, reflecting its flexibility and resilience. The company is also making progress towards achieving $15 billion in savings between 2019 and 2027, as noted by CFO Kathryn Mikells. These initiatives, coupled with strategic alliances and product innovations, can enhance Exxon Mobil's market position and capitalize on emerging opportunities.

Threats: Key Risks and Challenges That Could Impact Exxon Mobil's Success

Exxon Mobil faces several external threats that could impact its growth and market share. CEO Darren Woods highlighted the complexity of the broader industry and business community, particularly in terms of carbon removal and government policies. The company also faces challenges in Europe, where regulatory policies are becoming more stringent. Additionally, a recent $816 million legal verdict against Exxon Mobil in a benzene case underscores the potential financial and reputational risks associated with legal issues. Competitive pressures and market volatility, particularly in the chemical business, further complicate the company's operational landscape. These factors could pose significant challenges to Exxon Mobil's long-term success.

Conclusion

Exxon Mobil's strong financial health and strategic initiatives position it well for future growth, despite facing several challenges. The company's ability to generate substantial surplus cash and expand its product lines indicates a solid market positioning. While it faces earnings declines and market pressures, its current trading price of $116, significantly below the estimated fair value of $201.49, suggests potential for substantial investor returns. However, the company must navigate regulatory hurdles and competitive pressures to sustain its long-term success.

Where To Now?

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States and internationally.

Excellent balance sheet established dividend payer.