- United States

- /

- Electrical

- /

- NYSE:ETN

Eaton (NYSE:ETN) Launches AbleEdge Home Energy System, Boosting Residential Segment Growth Prospects

Reviewed by Simply Wall St

Click here and access our complete analysis report to understand the dynamics of Eaton.

Strengths: Core Advantages Driving Sustained Success For Eaton

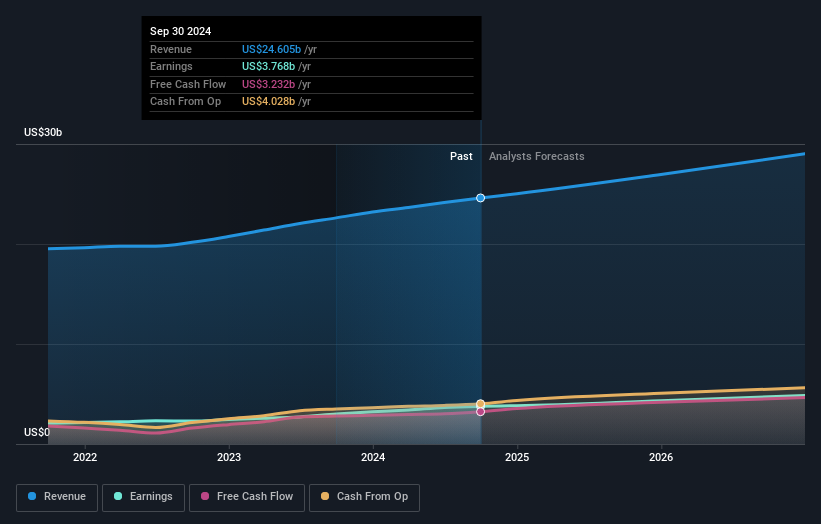

Eaton has demonstrated robust financial performance, with an all-time record adjusted EPS of $2.73 in the latest quarter, up 24% from the prior year, as noted by Craig Arnold, Chairman and CEO. The company also achieved record segment margins of 23.7%, up 210 basis points from last year. The strength in orders and backlogs supports a positive long-term growth outlook, with expectations for sustained growth. Additionally, Eaton is investing over $1 billion in incremental capital to support growth initiatives. The company's current share price is less than 20% higher than the analyst's target price, indicating limited upside potential, while it is considered good value compared to peers but expensive relative to the industry average. Eaton's management team and board of directors are experienced, contributing to strategic goals and stability.

Weaknesses: Critical Issues Affecting Eaton's Performance and Areas For Growth

Despite its strengths, Eaton faces several challenges. Performance issues in the aerospace segment have led to a 100 basis points decline in operating margin year-over-year, driven by inefficiencies and higher costs, as highlighted by Olivier Leonetti, Executive Vice President and CFO. The residential market segment, though small, has shown weakness, and the vehicle segment experienced a 3% organic revenue decline. Eaton's Price-To-Earnings Ratio of 36x is higher than the US Electrical industry average of 19x, indicating it is expensive relative to the industry. Additionally, Eaton's earnings growth forecast of 10.6% per year is slower than the US market average of 15.2% per year, suggesting potential areas for improvement in growth strategies.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

Eaton has several opportunities to leverage for growth. The company is investing in mega projects, with a backlog now standing at $1.6 trillion, up 25%, and expanding its presence in the data center market with $1.3 billion in electrical customer negotiations. Strategic investments, such as in NordicEPOD, will enhance participation in the European data center market. Eaton's focus on key megatrends like electrification, energy transition, reindustrialization, and digitalization supports growth in about 80% of its end markets. The company's innovative product announcements, such as the AbleEdge home energy management system, further position it to capitalize on emerging opportunities in the energy transition sector.

Threats: Key Risks and Challenges That Could Impact Eaton's Success

Competition remains a significant threat, with modest investments from rivals like Cleveland-Cliffs in transformer manufacturing. Economic factors, including ramping spending that tends to be back-end loaded, could impact margins. Regulatory and operational risks, such as the ability to produce at the rate of order reception, also pose challenges. Market risks in Europe, where results have been weaker, could affect Eaton's performance. Additionally, the company's earnings are forecast to grow slower than the market, which may impact its competitive positioning. These factors highlight the need for strategic risk management to mitigate potential adverse impacts on growth and market share.

Conclusion

Eaton's strong financial performance, evidenced by record adjusted EPS and segment margins, underpins its positive long-term growth outlook. However, challenges in specific segments like aerospace and vehicles, combined with a high Price-To-Earnings Ratio of 36x, suggest that the company is expensive relative to the industry average of 19x. While Eaton's strategic investments in mega projects and key megatrends present significant growth opportunities, the company's forecasted earnings growth of 10.6% per year lags behind the US market average of 15.2%, indicating potential areas for improvement. Given that Eaton's current share price is less than 20% higher than the analyst's target price, the upside potential appears limited, emphasizing the importance of strategic risk management to navigate competitive and economic challenges for sustained future performance.

Summing It All Up

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Eaton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ETN

Flawless balance sheet with solid track record and pays a dividend.