- United States

- /

- Oil and Gas

- /

- NYSE:WTI

W&T Offshore, Inc.'s (NYSE:WTI) Share Price Is Matching Sentiment Around Its Revenues

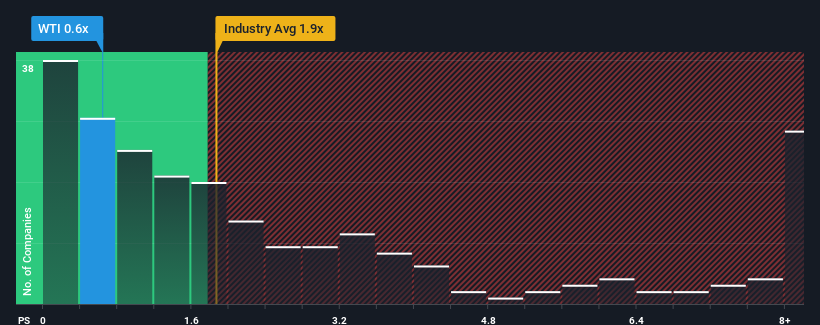

You may think that with a price-to-sales (or "P/S") ratio of 0.6x W&T Offshore, Inc. (NYSE:WTI) is a stock worth checking out, seeing as almost half of all the Oil and Gas companies in the United States have P/S ratios greater than 1.8x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for W&T Offshore

How Has W&T Offshore Performed Recently?

W&T Offshore has been struggling lately as its revenue has declined faster than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. You'd much rather the company improve its revenue performance if you still believe in the business. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Keen to find out how analysts think W&T Offshore's future stacks up against the industry? In that case, our free report is a great place to start.How Is W&T Offshore's Revenue Growth Trending?

In order to justify its P/S ratio, W&T Offshore would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 22%. Even so, admirably revenue has lifted 32% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 1.3% over the next year. That's shaping up to be materially lower than the 70% growth forecast for the broader industry.

With this information, we can see why W&T Offshore is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On W&T Offshore's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that W&T Offshore maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 3 warning signs for W&T Offshore (2 are concerning!) that we have uncovered.

If you're unsure about the strength of W&T Offshore's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if W&T Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WTI

W&T Offshore

An independent oil and natural gas producer, engages in the acquisition, exploration, and development of oil and natural gas properties in the Gulf of America.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives