- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Williams Companies (WMB): Evaluating Valuation as Shares Climb to 12% Monthly Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Williams Companies.

Williams Companies’ recent surge brings its share price to $64.06, building on a steady run this year and reflecting renewed appetite for dependable energy infrastructure stocks. With a 1-year total shareholder return of 37.5%, momentum is clearly in the company’s favor as investors show confidence in its long-term fundamentals.

If you want to see what else is trending in the market, now is a great time to broaden your investing perspective and discover fast growing stocks with high insider ownership

With shares near their all-time highs and only a modest discount to analyst targets, the real question is whether Williams Companies offers real value at current levels, or if the market is already factoring in all future growth.

Most Popular Narrative: 2.1% Undervalued

The latest narrative points to Williams Companies’ fair value sitting slightly above its current market price, hinting at modest upside. The valuation reflects both sector strength and recent company milestones, with debate centering on whether projected growth justifies today’s trading levels.

Williams' investment and leadership in decarbonization, including methane reduction and renewable natural gas projects, are fostering regulatory goodwill, accelerating project permitting, and attracting new, resilient long-term contracts. These initiatives are expected to provide sustainable margin expansion and lower risk premiums.

Curious what financial expectations power this bullish stance? The narrative leans on aggressive future growth and higher margins, all driving an ambitious profit target and a standout valuation multiple. Which high-stakes forecasts are really steering the story? Unpack the decisive assumptions shaping this fair value call now.

Result: Fair Value of $65.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Any slowdown in permitting or shifts in global energy policy could quickly challenge growth expectations and pressure Williams' valuation narrative.

Find out about the key risks to this Williams Companies narrative.

Another View: How Does Williams Stack Up on Valuation?

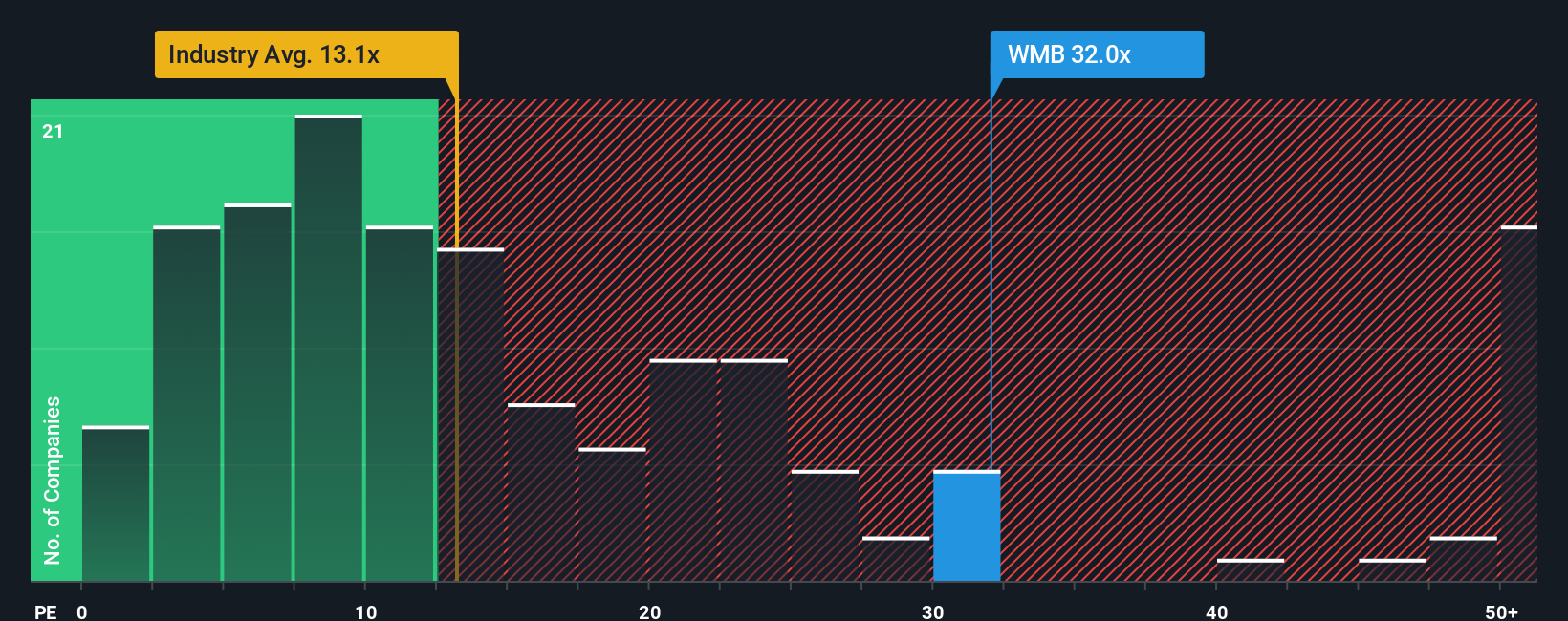

While the earlier analysis calls the shares undervalued, a look at the most common valuation measure tells a different story. Williams Companies trades at a price-to-earnings ratio of 32.2x, which is more than double the US Oil and Gas average of 13.5x and well above its own fair ratio of 20.4x. This premium price suggests the market is already factoring in a lot of optimism, which raises the risk of future disappointments if growth doesn’t deliver. Which outlook do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams Companies Narrative

If these conclusions do not fit your investing style, you can dig into the numbers yourself and build a custom story about Williams Companies in just a few minutes. Do it your way

A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for a single stock when you could be broadening your portfolio with opportunities others might overlook. Head over now to uncover powerful trends shaping tomorrow's winners.

- Turn your attention to steady income by checking out these 19 dividend stocks with yields > 3% with yields above 3%. This can guide you to companies rewarding shareholders year after year.

- Spot promising players riding the artificial intelligence wave when you assess these 24 AI penny stocks, where growth potential meets tomorrow’s technology today.

- Tap into rare values by reviewing these 900 undervalued stocks based on cash flows, highlighting shares trading below what their future cash flows suggest they’re truly worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives