- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Williams Companies (NYSE:WMB) Leverages LNG Demand Despite Low Gas Prices and Market Fluctuations

Reviewed by Simply Wall St

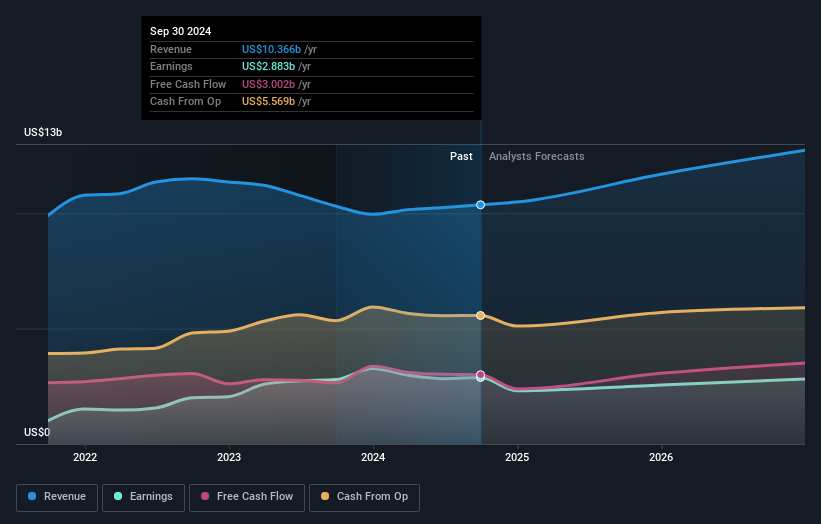

Williams Companies (NYSE:WMB) has recently showcased its financial resilience through record performance in adjusted EBITDA, bolstered by strategic expansions and acquisitions such as the Gulf Coast storage. The company's recent increase in its 2024 guidance midpoint underscores its confidence in sustained growth, despite challenges from low natural gas prices and market fluctuations. This report will explore key areas including Williams' strategic growth projects, market vulnerabilities, emerging opportunities, and the impact of regulatory challenges.

Dive into the specifics of Williams Companies here with our thorough analysis report.

Innovative Factors Supporting Williams Companies

Williams Companies has consistently demonstrated financial health, evidenced by its record performance in adjusted EBITDA, driven by strategic expansions in natural gas transportation and acquisitions like the Gulf Coast storage. CEO Alan Armstrong emphasized their success in executing growth projects, which has been pivotal in maintaining high returns on investments. Notably, the company achieved a 22.9% return on invested capital from 2018 to 2023, nearly double the sector median. This reflects their strong market positioning and financial acumen. Furthermore, Williams has raised its 2024 guidance midpoint, showcasing confidence in its continued performance and strategic execution. The company's Price-To-Earnings Ratio of 23.9x, while higher than the industry average, aligns with its growth metrics and market positioning.

Vulnerabilities Impacting Williams Companies

Williams faces challenges such as the impact of low natural gas prices, which continue to exert pressure on its operations. CFO John Porter highlighted resilience in growth conditions, yet the company remains vulnerable to external market fluctuations. Temporary production reductions by producer customers further underscore this vulnerability, affecting operational efficiency. Additionally, asset sales have unfavorably impacted growth, presenting concerns about maintaining a strong asset base. The company's revenue growth forecast of 7.7% annually lags behind the broader US market, indicating potential challenges in keeping pace with industry trends.

Emerging Markets or Trends for Williams Companies

Williams is well-positioned to capitalize on emerging opportunities through its expansion projects and contracted growth. The Southeast Supply Enhancement Project is a key driver, expected to significantly contribute to EBITDA. The company is strategically aligned to meet increasing demand for natural gas, spurred by LNG exports and industrial reshoring. Armstrong expressed confidence in their infrastructure's role in supporting current and future energy demands. Additionally, the growing demand from data centers and industrial sectors presents new avenues for revenue growth, enhancing Williams' market position and potential for long-term success.

Market Volatility Affecting Williams Companies's Position

Regulatory and permitting challenges pose significant threats to Williams' expansion efforts, with potential hurdles in obtaining necessary approvals for new projects. Armstrong remains hopeful for reforms that could alleviate these obstacles. Economic and market risks, including competition, further complicate the situation as the company navigates broader macroeconomic pressures. Inflation and cost pressures are additional concerns, with potential impacts on project returns. Armstrong emphasized the need for conservative cost management to mitigate these risks, ensuring sustained profitability and growth amidst a volatile market environment.

Explore the current health of Williams Companies and how it reflects on its financial stability and growth potential.Conclusion

Williams Companies has demonstrated strong financial performance and strategic growth, as evidenced by its impressive return on invested capital and successful expansion projects. However, the company faces challenges from low natural gas prices and market fluctuations, which could impact its operational efficiency and asset base. Williams is well-positioned to leverage emerging market opportunities, particularly in natural gas demand driven by LNG exports and industrial reshoring. The company's Price-To-Earnings Ratio of 23.9x, while higher than industry averages, reflects its growth potential and strategic positioning, suggesting confidence in its future performance. This valuation, although considered high, aligns with Williams' strategic initiatives and potential for long-term success, indicating that investors may be willing to pay a premium for its growth prospects.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

```If you're looking to trade Williams Companies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives