- United States

- /

- Oil and Gas

- /

- NYSE:WMB

The Bull Case For Williams (WMB) Could Change Following $3.1B Data Center Power Project Expansion – Learn Why

Reviewed by Sasha Jovanovic

- Williams Companies recently announced an investment of approximately US$3.1 billion in two power projects aimed at supplying electricity to data centers in grid-constrained regions, backed by 10-year fixed-rate agreements with a major investment-grade customer.

- This initiative brings Williams' total capital to about US$5 billion for power innovation projects, signaling a clear commitment to support the surging energy demands fueled by artificial intelligence and digital infrastructure growth.

- We'll explore how this move into long-term power agreements for data center supply could impact Williams Companies' investment outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Williams Companies Investment Narrative Recap

To be a shareholder in Williams Companies today, you need to believe in the ongoing strength of natural gas and the crucial role of pipelines and power infrastructure in the digital economy. The recent announcement of a US$3.1 billion investment in power projects targeted at data centers does not materially affect the most important near-term catalyst, accelerating demand from LNG exports and AI-driven data center growth, but does incrementally increase the company's long-term capital commitments, which may bring higher execution and leverage risks.

Of the company's recent developments, the successful commissioning of the Southeast Energy Connector and Texas to Louisiana Energy Pathway stands out. These projects, completed just months before the new data center power initiative, directly addressed system constraints while increasing natural gas delivery capacity, underpinning Williams’ ability to keep pace with rising service demand and reinforcing the company’s reliance on growing infrastructure throughput.

Yet, in contrast, investors should also be aware of the heightened risk that comes with larger, long-cycle capital projects if...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' narrative projects $14.5 billion in revenue and $3.3 billion in earnings by 2028. This requires 8.6% yearly revenue growth and a $0.9 billion earnings increase from $2.4 billion today.

Uncover how Williams Companies' forecasts yield a $65.41 fair value, in line with its current price.

Exploring Other Perspectives

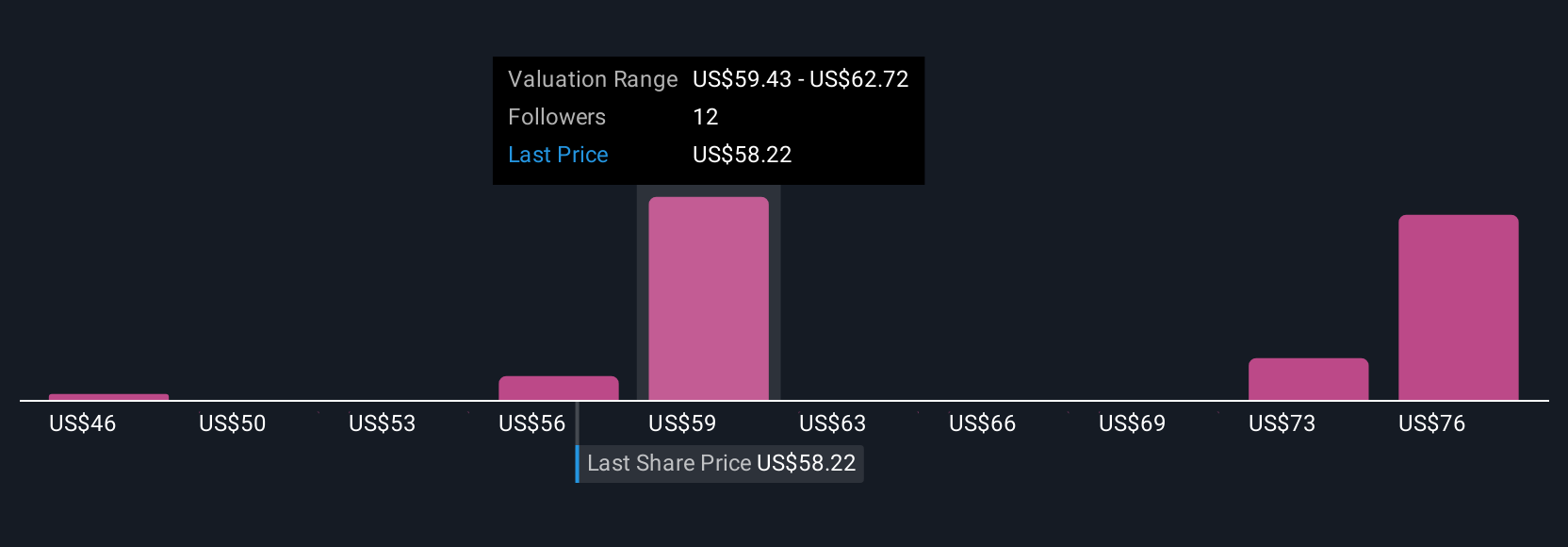

Seven unique fair value estimates from the Simply Wall St Community ranged from US$46.26 to US$74. The company’s new multibillion-dollar projects add focus to future growth, but opinions on earnings resilience still vary significantly, so consider the full spectrum of perspectives before deciding your next step.

Explore 7 other fair value estimates on Williams Companies - why the stock might be worth as much as 15% more than the current price!

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Limited growth with questionable track record.

Similar Companies

Market Insights

Community Narratives