- United States

- /

- Oil and Gas

- /

- NYSE:WMB

Does New CEO Chad Zamarin and Index Changes Shift the Bull Case for Williams Companies (WMB)?

Reviewed by Simply Wall St

- Williams Companies recently completed a US$1.5 billion registered senior notes offering and announced a CEO transition, with Chad Zamarin set to succeed Alan Armstrong while also joining the board.

- Alongside these leadership changes, Williams was simultaneously added to several major Russell growth and value indexes and dropped from midcap benchmarks, highlighting both evolving corporate direction and shifting market perceptions.

- We’ll explore how the appointment of Chad Zamarin as CEO could influence Williams Companies’ future business execution and growth outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Williams Companies Investment Narrative Recap

To be a shareholder in Williams Companies, one must believe in the company’s ability to deliver sustained growth through large-scale energy infrastructure projects while effectively managing capital allocation. The recent CEO transition to Chad Zamarin and a US$1.5 billion senior notes offering represent continuity in strategy, while index reclassifications do not materially affect the short-term catalysts or core risks facing the business at this time.

Of the recent announcements, the new US$1.5 billion debt issuance is most relevant, as future project execution relies heavily on access to capital. This financing comes at a time when Williams is ramping up investment in projects such as data center power solutions and the Transco Power Express, both critical to its earnings and revenue growth story.

In contrast, investors should be aware of the real risk that, despite strong project pipelines,...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' narrative projects $14.4 billion revenue and $3.3 billion earnings by 2028. This requires 9.2% yearly revenue growth and a $1.0 billion earnings increase from $2.3 billion today.

Uncover how Williams Companies' forecasts yield a $59.63 fair value, in line with its current price.

Exploring Other Perspectives

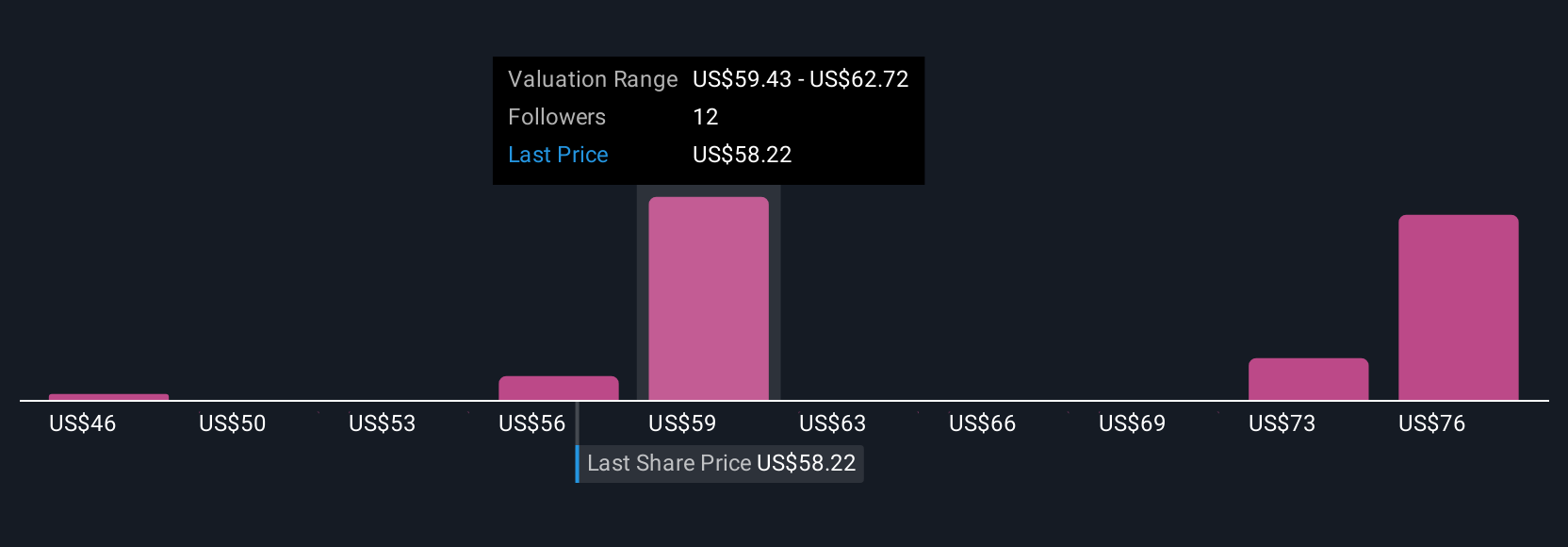

Five fair value estimates from the Simply Wall St Community put Williams’ worth anywhere between US$46.26 and US$79.17 per share. With execution risk prominent as major new projects unfold, now is a good time to explore how differing opinions may reflect the challenges and opportunities ahead for the company.

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

No Opportunity In Williams Companies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMB

Williams Companies

Operates as an energy infrastructure company primarily in the United States.

Slightly overvalued with limited growth.

Similar Companies

Market Insights

Community Narratives