- United States

- /

- Oil and Gas

- /

- NYSE:WES

Has Western Midstream’s Growth Potential Changed After Anadarko Midstream Asset Acquisition?

Reviewed by Bailey Pemberton

If you are eyeing Western Midstream Partners and wondering whether now’s the right time to buy, sell, or hold, you are not alone. The recent stock movement has turned a few more heads, and for good reason. Over just the past week, shares ticked up by 1.3%, a modest gain, but if you zoom out, a much bigger story emerges. Despite some short-term dips, with the stock down 1.5% for the month and about 3.9% year-to-date, Western Midstream Partners has delivered a steady climb in the long run. The company posted a 6.9% gain over the past year, 75.4% over three years, and a 515.0% return in five years. That kind of performance attracts attention, especially when broader market volatility and shifting risk perceptions in the energy sector are at play.

But is the stock still undervalued after such a strong track record? Here is where it gets interesting. Western Midstream Partners recently achieved a value score of 5 out of 6 on a comprehensive set of undervaluation checks. That is a strong signal, but context matters. In the next section, we will dig into the various approaches analysts are using to assess the company’s valuation. There is an even more insightful way to view valuation waiting for you at the end of the article.

Approach 1: Western Midstream Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s intrinsic value by projecting its expected future cash flows and then discounting those cash flows back to their value today. This approach helps investors determine what the business is truly worth, based on its ability to generate cash in the future.

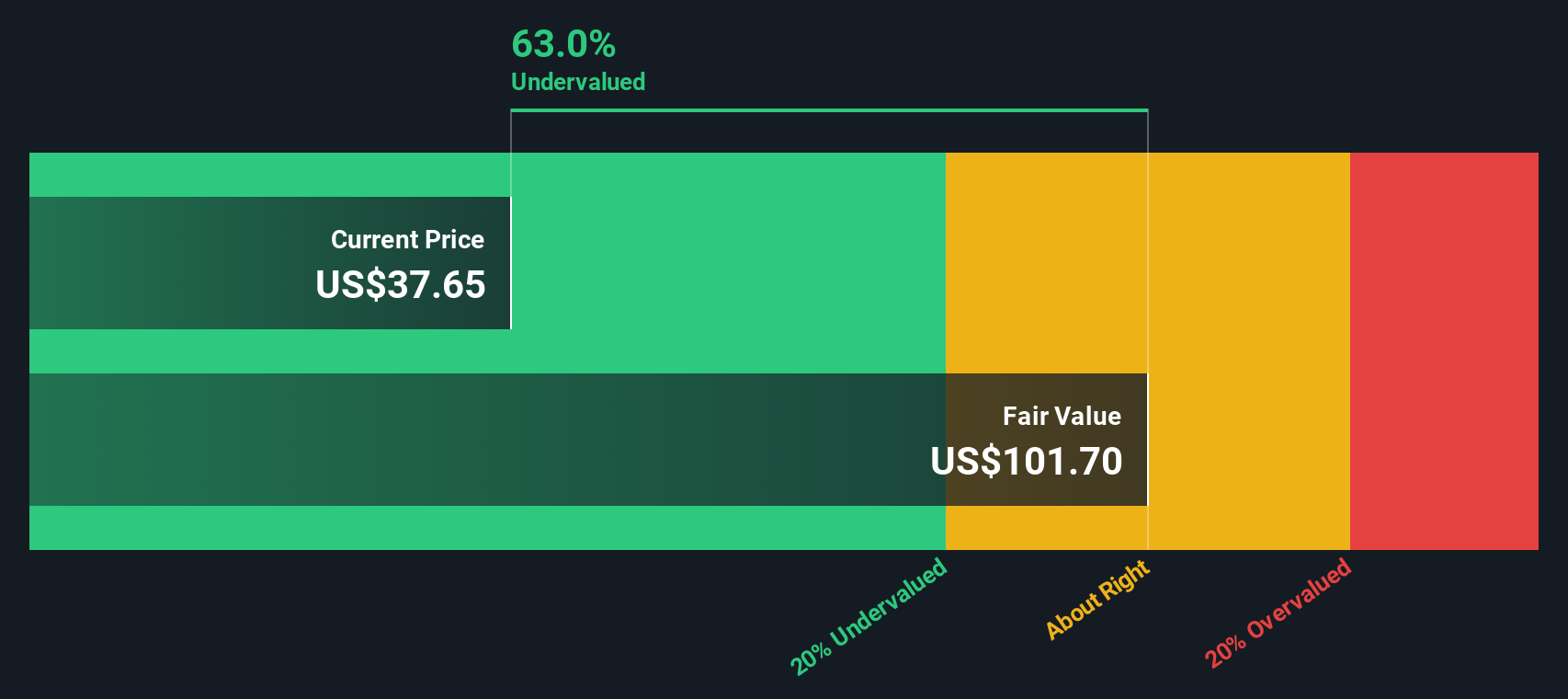

For Western Midstream Partners, analysts estimate the company’s current Free Cash Flow (FCF) at over $1.41 billion. Based on a blend of analyst input and long-term projections, FCF is expected to rise steadily, reaching approximately $1.90 billion by 2029. Analysts provide detailed forecasts for the next five years. Projections beyond that are extrapolated, resulting in a decade-long cash flow outlook that continues to grow, though at a slower pace.

Applying the DCF model, Western Midstream Partners’ estimated fair value is $101.81 per share. With recent trading levels implying the stock is about 62.9% undervalued compared to its intrinsic value, this DCF analysis presents a compelling case for potential further upside.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Midstream Partners is undervalued by 62.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Midstream Partners Price vs Earnings

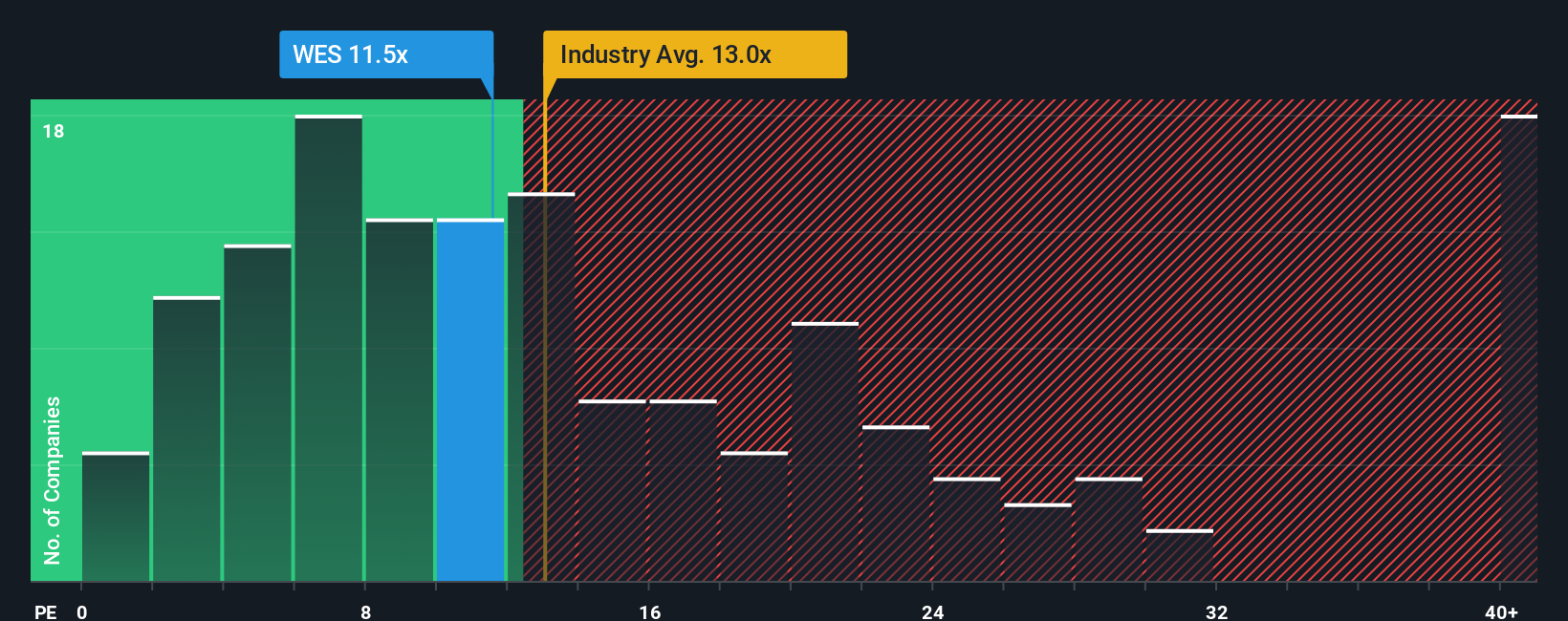

For profitable companies like Western Midstream Partners, the Price-to-Earnings (PE) ratio is a widely used and meaningful valuation tool. It reflects how much investors are willing to pay for each dollar of earnings, making it especially relevant for businesses generating steady profits. A lower PE can signal undervaluation, while a higher PE may suggest the stock is expensive compared to its earnings power.

However, the ideal or “fair” PE ratio is not one size fits all. Higher growth prospects or lower risk can justify a premium, pushing the normal PE ratio higher. Slower growth or elevated risks might warrant a lower figure. By comparing a company’s PE to meaningful benchmarks, investors can assess whether it is fairly valued in the current market context.

Western Midstream Partners currently trades at a PE ratio of 11.58x, below both the Oil and Gas industry average of 12.58x and well under the average of its peers at 21.85x. Simply Wall St’s proprietary Fair Ratio, which accounts for the company’s specific earnings growth, profit margins, industry, risks, and market capitalization, sits at 17.99x. This Fair Ratio goes beyond simple peer or industry comparison by factoring in nuances that make Western Midstream Partners unique within its sector.

With the stock trading notably below its Fair Ratio, the PE analysis suggests Western Midstream Partners remains undervalued on this basis and offers further evidence of potential upside for patient investors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Midstream Partners Narrative

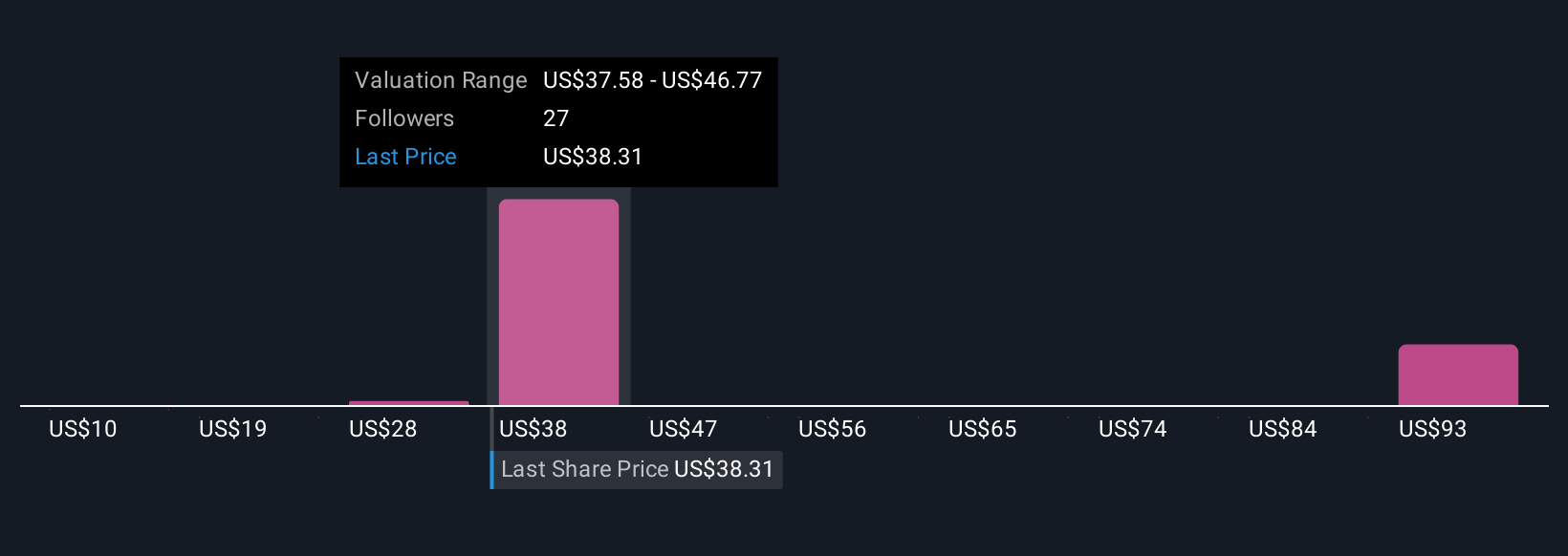

Earlier, we mentioned there is an even better way to understand a company’s value. Let’s introduce you to Narratives. A Narrative is a simple yet powerful tool that lets investors create a story or perspective about a company’s future, connecting forecasts for revenue, earnings, and margins to their own assumed fair value and investment decisions.

Instead of relying purely on ratios or historical returns, Narratives help you link Western Midstream Partners’ business story to real numbers and then translate those expectations into a personalized fair value estimate. This bridges the gap between “what you believe will happen” and “what the stock is worth.”

Narratives are easy to use and available to everyone in the Simply Wall St Community page, already used by millions of investors. They update automatically whenever new news, earnings releases, or data changes so your view always incorporates the latest information.

You can use Narratives to compare the current share price against your or others’ fair value and decide whether Western Midstream Partners looks like a buy, hold, or sell at any time. For example, one investor’s Narrative could justify a $46 target due to confidence in new project expansions and margin gains, while another may see $36 as fair value if concerned about potential delays or earnings risks.

Do you think there's more to the story for Western Midstream Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Midstream Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WES

Western Midstream Partners

Operates as a midstream energy company primarily in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives