- United States

- /

- Oil and Gas

- /

- NYSE:WES

Does the Recent Occidental Midstream Acquisition Signal Upside for Western Midstream in 2025?

Reviewed by Bailey Pemberton

If you are on the fence about Western Midstream Partners right now, you are not alone. The stock has quietly built up an impressive track record, with a 1-year return of 6.3% and a jaw-dropping 101.8% gain over the past three years. Even if you stretch out to five years, the performance is striking, up 562.4%. Yet, the most recent movements might seem a little more subdued, with a 0.4% return in the last week and 1.5% in the past month. Some investors may wonder if the excitement is winding down or if there is more to the story beneath the surface.

Part of what is driving this mixed picture could be shifting market sentiment around midstream energy stocks versus broader macroeconomic currents. While headlines have recently focused on energy infrastructure deals and evolving regulatory frameworks, Western Midstream's fundamentals remain in focus for many value-minded investors. In fact, by our latest analysis, the company is undervalued in 5 out of 6 key checks, resulting in an impressive value score of 5.

So, what does all this mean going forward? To get closer to the answer, we will break down the main valuation approaches analysts use to assess whether Western Midstream Partners is actually as undervalued as the score suggests. And, a little further on, we will look at a smarter way of thinking about valuation that goes beyond the standard methods.

Approach 1: Western Midstream Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model assesses the true worth of a stock by projecting its future cash flows and discounting them back to their present value. This provides investors with an estimate of what the company is fundamentally worth based on its ability to generate cash over time.

For Western Midstream Partners, the latest numbers show strong Free Cash Flow (FCF), totaling $1.41 billion for the most recent period. Analysts give full projections for the next five years and forecast FCF growth up to $1.90 billion by 2029. Beyond these analyst estimates, Simply Wall St extends forecasts further using modest growth rates, painting a consistent picture of robust cash generation deep into the next decade.

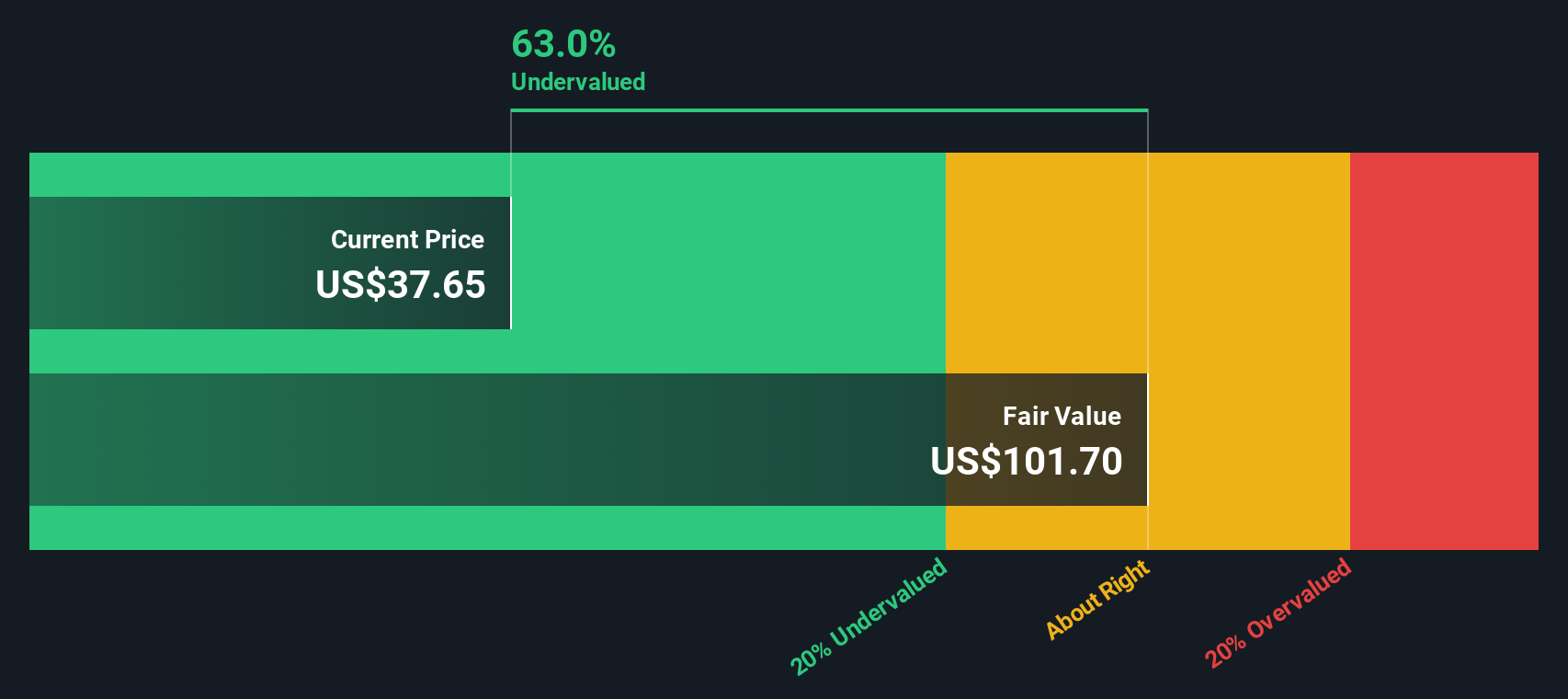

Applying the DCF model with a two-stage approach, these future cash flows are discounted back to today's dollars and arrive at an intrinsic value of $102.07 per share. This is substantially higher than the current market price and implies the stock trades at a notable 62.2% discount.

In summary, the DCF analysis signals that Western Midstream Partners appears deeply undervalued relative to its future earning power.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Western Midstream Partners is undervalued by 62.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Western Midstream Partners Price vs Earnings

When evaluating profitable companies like Western Midstream Partners, the Price-to-Earnings (PE) ratio is one of the most widely used valuation measures. This metric provides a quick snapshot of how much investors are willing to pay for each dollar of current earnings, making it especially relevant for companies with a strong earnings track record.

It is important to remember that a "fair" PE ratio varies depending on several factors. Higher growth expectations, lower risks, and a more robust profit margin typically justify a higher PE. In contrast, slower growth and higher risk should translate to a lower multiple. That context matters when comparing Western Midstream Partners to its industry and peers.

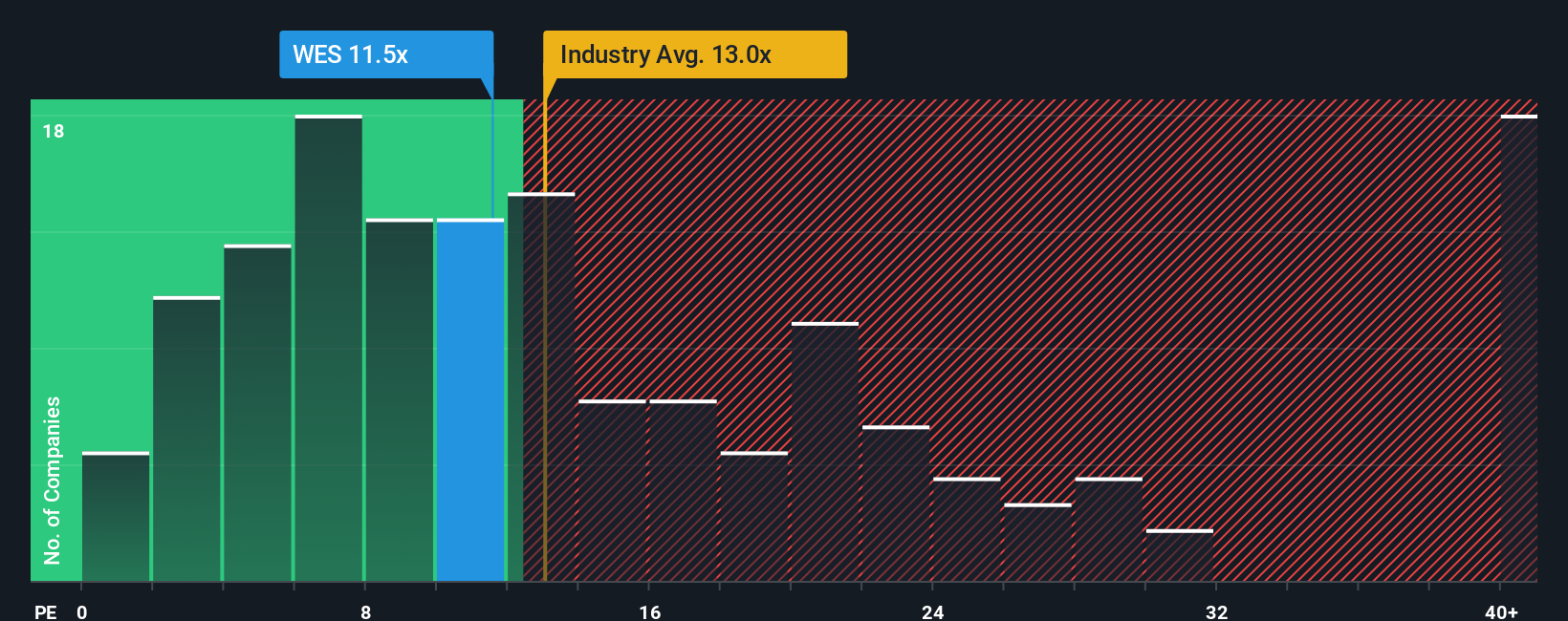

Currently, Western Midstream Partners trades at a PE of 11.84x. This is lower than both the Oil and Gas industry average of 13.37x and the peer group’s average of 23.02x. While these benchmarks are useful, they do not always tell the whole story about what constitutes fair value for a specific company.

This is where Simply Wall St’s proprietary "Fair Ratio" comes in, taking into account the company’s growth outlook, industry profile, profit margin, market capitalization, and risk factors to determine a more precise fair multiple. For Western Midstream Partners, the Fair Ratio is calculated to be 18.01x. Because this model is tailored to the company’s fundamentals and environment, it offers a more reliable basis for investors than simple peer or industry comparisons.

With the current PE of 11.84x well below the Fair Ratio of 18.01x, Western Midstream Partners again appears undervalued using this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Western Midstream Partners Narrative

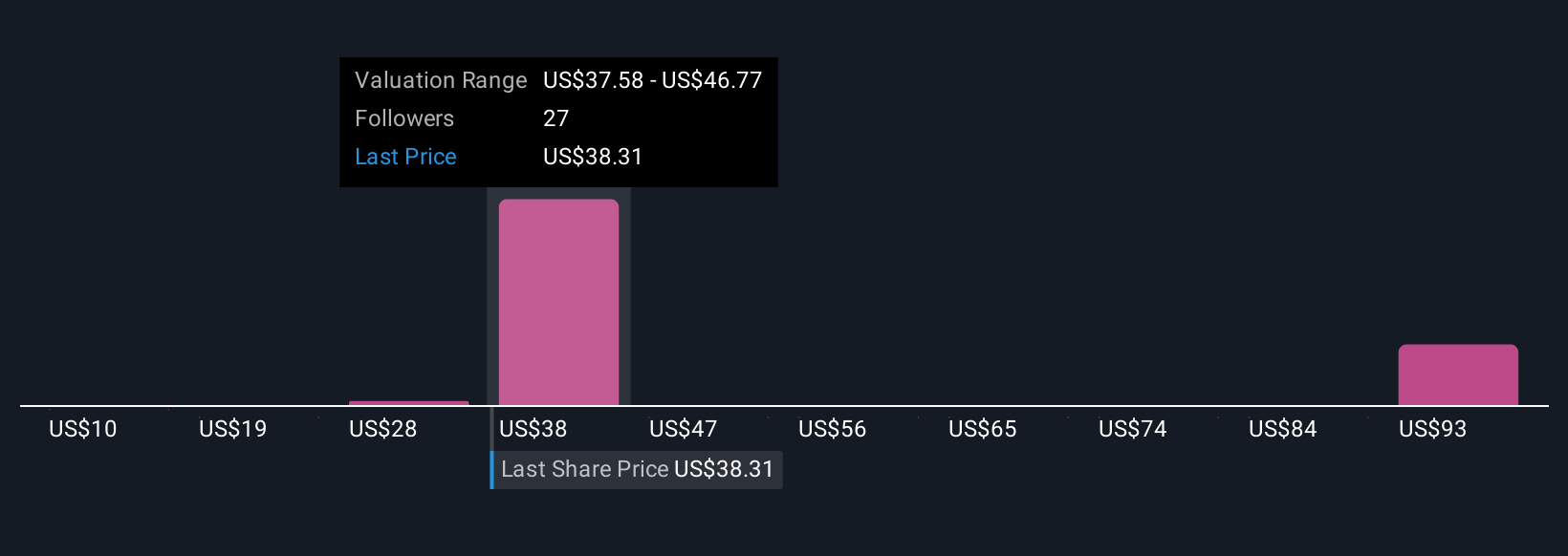

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a way to connect the story you believe about a company, based on what you think about its future revenue, earnings, and profit margins, to a financial forecast and a fair value. This approach allows you to turn your perspective into actionable analysis rather than just looking at numbers in isolation.

On Simply Wall St’s Community page, you will find Narratives used by millions of investors as an easy, interactive tool to outline, track, and even debate the story behind each stock. Narratives help you decide when to buy or sell by comparing your estimated Fair Value with the current Price, and they update dynamically with new news or earnings releases. This gives you a living forecast aligned with real events.

For example, among those analyzing Western Midstream Partners right now, the highest Narrative values it at $46.00 due to expectations of robust revenue and margin growth from new capacity projects, while the lowest estimates just $36.00, focusing on risks tied to capital spending and industry cycles. This shows how your view and assumptions directly shape what you believe is a fair stock price.

Do you think there's more to the story for Western Midstream Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Midstream Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WES

Western Midstream Partners

Operates as a midstream energy company primarily in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives