- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO) Is Up 8.4% After Strong Q3 Profit and Benicia Closure Announcement – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Valero Energy recently reported robust third-quarter 2025 results, with net income rising to US$1.1 billion and continued large-scale share buybacks totaling US$4.57 billion since September 2023. The company also advanced major optimization projects and announced the planned closure of its Benicia refinery by April 2026 following unsuccessful talks with California officials.

- An important insight is that Valero maintained high refinery utilization rates and strong shareholder returns amid industry challenges, underlining the competitive advantage refiners have recently experienced versus oil producers.

- We'll examine how Valero's strong profit growth and operational investments influence its investment narrative and long-term outlook.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Valero Energy Investment Narrative Recap

To invest in Valero Energy today, you need to believe in the company’s ability to generate solid profits and shareholder value, even as it faces regulatory obstacles and closure costs from the Benicia refinery. The recent strong third-quarter earnings and large-scale share buybacks support this view, with the Benicia closure and related impairment charge presenting the most immediate risk; however, the news does not materially change the main profit catalyst, which remains high refinery utilization and optimizing existing assets.

The completion of over US$4.57 billion in share repurchases since September 2023 directly speaks to management’s continued focus on enhancing returns, even during periods of elevated industry costs, directly tying back to the company’s financial discipline, a current driver for supporting per-share earnings and potentially mitigating the impact of asset closures.

By contrast, investors should be aware that the sizable Benicia impairment charge and future closure-related costs could...

Read the full narrative on Valero Energy (it's free!)

Valero Energy is projected to generate $116.8 billion in revenue and $3.8 billion in earnings by 2028. This outlook assumes an annual revenue decline of 0.2% and a $3.04 billion increase in earnings from the current level of $760 million.

Uncover how Valero Energy's forecasts yield a $175.63 fair value, a 3% upside to its current price.

Exploring Other Perspectives

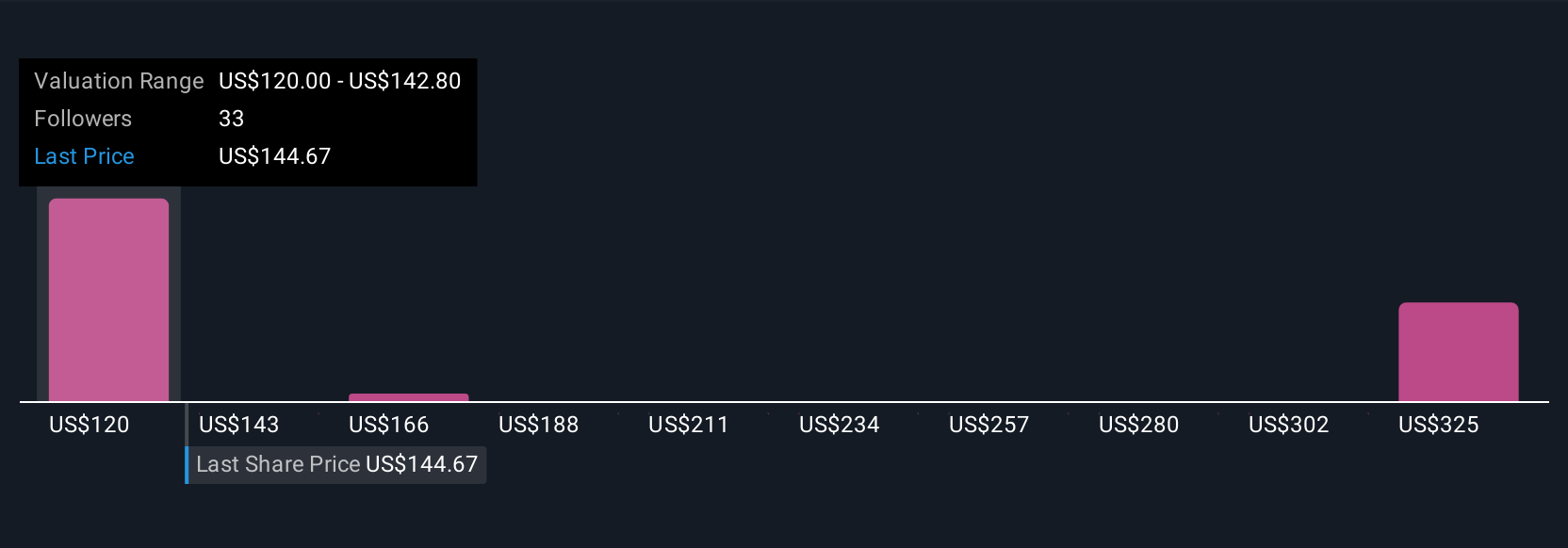

Four individual Simply Wall St Community fair value estimates for Valero Energy range from US$128 to US$307, showing wide divergence. While share buybacks and operational efficiency have recently supported the stock, high one-off impairment costs and West Coast uncertainty remain important factors that could shift future performance.

Explore 4 other fair value estimates on Valero Energy - why the stock might be worth 25% less than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives