- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO): Exploring Valuation After Strong Multi-Month Share Price Climb

Reviewed by Simply Wall St

See our latest analysis for Valero Energy.

Valero’s recent momentum is impressive, with the company’s share price return over the past year outpacing much of the industry. Strong gains have accelerated in recent months. While big headlines can move markets, this kind of consistent performance suggests renewed optimism around Valero’s growth prospects and a shift in how investors perceive its longer-term value.

If today’s numbers have you thinking bigger, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

But given such rapid gains, questions arise. Is Valero’s rally a sign the stock remains undervalued, or has the strong run-up already factored in all the good news, leaving little room for upside from here?

Most Popular Narrative: 2.9% Undervalued

According to the most popular narrative, the value assigned to Valero shares slightly tops the last close price, hinting at modest upside under current assumptions. The narrative's methodology provides a deeper look into the building blocks behind this near-fair valuation.

The SEC unit optimization project at St. Charles, expected to start up in 2026, is projected to increase the yield of high-value products and could potentially boost future revenues and earnings. Anticipated tight product supply and demand balances, along with low product inventories, are expected to support refining fundamentals during the driving season and may enhance refining margins and revenues.

Want to know which numbers are fueling this valuation? The full narrative breaks down bold profit margin expectations, a shrinking share count, and a market multiple that could surprise even industry insiders. Dive in to see which forecasts make or break the case for Valero's fair value.

Result: Fair Value of $180.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, substantial asset impairments or sustained struggles in Valero’s renewable segment could quickly shift sentiment and undermine the current optimistic outlook.

Find out about the key risks to this Valero Energy narrative.

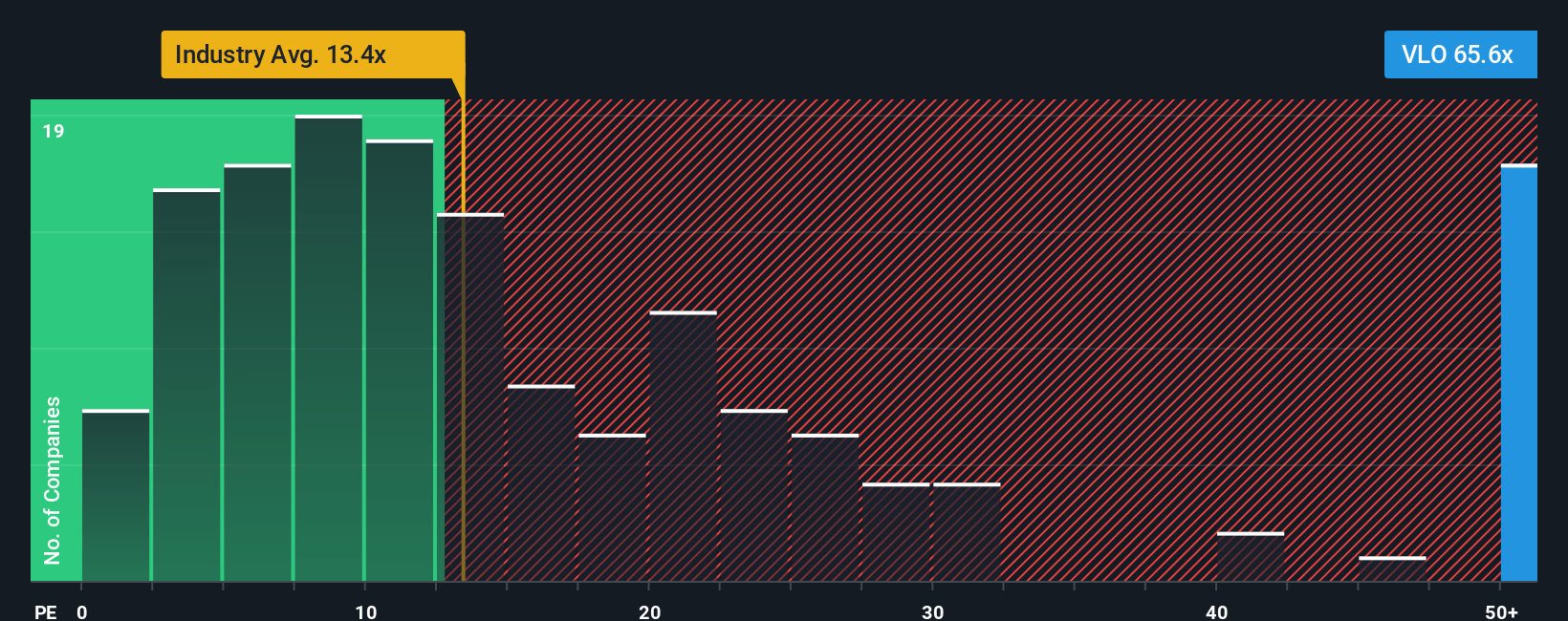

Another View: Multiples Raise a Red Flag

While the fair value calculation points to upside, the price-to-earnings ratio of 35.9x is markedly higher than the US oil and gas sector average of 13.4x and even above peers at 24.9x. The current valuation also stands well above the fair ratio of 22.2x. This gap suggests investors are paying a significant premium relative to industry benchmarks and historic norms. Should the market correct, is there enough growth ahead to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valero Energy Narrative

If you’re not convinced by the current outlook or want to dig deeper, you can weigh the evidence for yourself and build a personal thesis on Valero in just a few minutes. Do it your way

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Put yourself ahead of other investors and unlock new opportunities with some of the most promising and unconventional picks our community is watching right now.

- Capitalize on fast-growing sectors and stay ahead of the digital revolution. Explore these 24 AI penny stocks that are powering tomorrow’s most impactful AI innovations.

- Boost your income potential and take advantage of reliable yield by checking out these 16 dividend stocks with yields > 3% offering strong payouts above 3%.

- Expand your portfolio’s edge by hunting for these 27 quantum computing stocks and invest in companies shaping the forefront of quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives