- United States

- /

- Oil and Gas

- /

- NYSE:VG

Venture Global (VG) Scales Up LNG Capacity but Does It Signal a Lasting Competitive Lead?

Reviewed by Sasha Jovanovic

- Venture Global, Inc. has quickly scaled up to become the second-largest LNG exporter in the United States, operating two facilities in Louisiana and beginning construction on the massive 28 million metric tons per annum CP2 export project.

- This development positions Venture Global to potentially overtake its competitors and become the country's largest LNG exporter once CP2 is completed.

- We'll explore how the commencement of the CP2 export facility elevates Venture Global's investment narrative within the evolving U.S. LNG market.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Venture Global's Investment Narrative?

For anyone considering Venture Global, the big picture rests on confidence in the future of U.S. LNG exports and the company’s ability to capture market share as new capacity comes online. The start of construction on CP2, now amplified by recent inclusion among favored LNG stocks by hedge funds, could act as a key short-term catalyst for sentiment, even if it doesn’t immediately alter underlying fundamentals. With revenue and earnings showing sizable year-over-year gains but also some quarter-to-quarter variability, the company’s earnings profile reflects both promise and volatility. The risk outlook shifts with the latest news, heightening focus on execution risk, especially as the CP2 build-out demands substantial capital. Legal challenges from class action lawsuits remain a material overhang, and questions about management depth and board experience continue to warrant attention for anyone attracted by the company’s undervalued share price and ambitious growth targets.

On the flip side, recent legal disputes still hang over Venture Global and could affect its trajectory.

Despite retreating, Venture Global's shares might still be trading 24% above their fair value. Discover the potential downside here.Exploring Other Perspectives

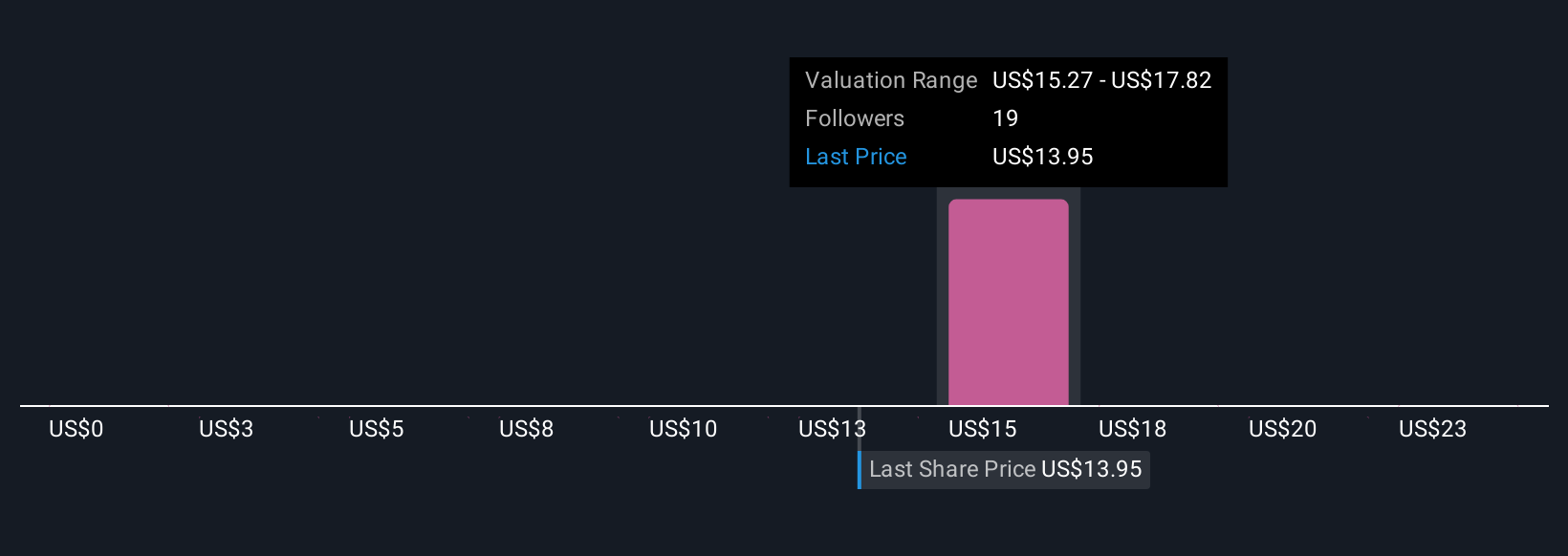

Simply Wall St Community members have provided six different fair value estimates, ranging from as low as US$2.55 to as high as US$25.45. These diverse viewpoints exist alongside ongoing CP2 development and unresolved legal cases, factors that could influence future performance in unpredictable ways. Explore these community perspectives for a well-rounded view.

Explore 6 other fair value estimates on Venture Global - why the stock might be worth less than half the current price!

Build Your Own Venture Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Venture Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Venture Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Venture Global's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Good value with very low risk.

Similar Companies

Market Insights

Community Narratives