- United States

- /

- Energy Services

- /

- NYSE:VAL

Why Valaris (VAL) Is Up 17.3% After Landing $140 Million BP Drilling Contract and Backlog Surge

Reviewed by Sasha Jovanovic

- Valaris Limited announced it secured a five-well contract valued at approximately US$140 million with BP Exploration Delta Limited for its VALARIS DS-12 drillship in Egypt, scheduled to begin in the second quarter of 2026 and expected to last 350 days, along with three additional option wells.

- This agreement, alongside recent contract extensions in the UK North Sea and asset sales, has increased Valaris’s contract backlog to around US$4.5 billion as of October 2025, reflecting expanded operational reach and revenue visibility.

- We’ll examine how the multi-well BP contract and backlog growth may shape Valaris’s investment narrative and future earnings profile.

Find companies with promising cash flow potential yet trading below their fair value.

Valaris Investment Narrative Recap

To believe in Valaris right now, investors need confidence that offshore drilling demand and long-cycle project awards will remain strong enough to support the company’s significant contract backlog, high-specification fleet, and earnings growth potential. The recent BP contract in Egypt directly strengthens revenue visibility but does not materially lessen the short-term risk of industry overcapacity or the forecast dip in rig utilization that could pressure day rates and earnings in 2026. This BP contract adds US$140 million to Valaris’s backlog and aligns with the company’s reported US$4.5 billion in contracted work as of late October. Together with recent contract wins and extensions, such as the multi-year Gulf of America deals with Anadarko, these contracts offer the clearest line of sight for the “backlog supports stability” catalyst even as utilization headwinds remain for the sector. Yet, it is equally important for investors to recognize that overcapacity and rig competition could impact realized margins if contract momentum slows or utilization troughs in coming periods...

Read the full narrative on Valaris (it's free!)

Valaris is expected to generate $2.4 billion in revenue and $453.7 million in earnings by 2028. This outlook assumes a yearly revenue decline of 1.2% and an increase in earnings of $178.2 million from the current $275.5 million.

Uncover how Valaris' forecasts yield a $52.10 fair value, a 8% downside to its current price.

Exploring Other Perspectives

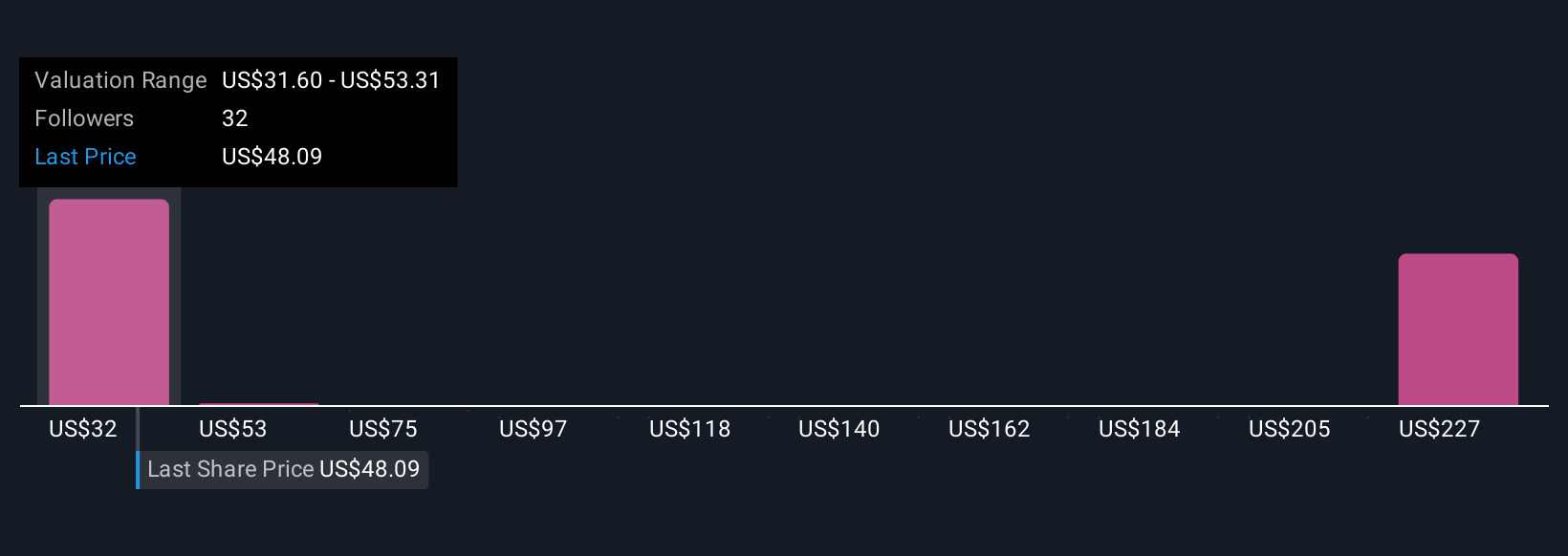

Fair value estimates from the Simply Wall St Community span a wide range, from US$31.60 to US$249.16, across eight different analyses. While some forecasts point to significant upside, remember that overcapacity and utilization risks could affect whether Valaris delivers on its backlog-fueled growth potential, so reviewing multiple viewpoints can offer a clearer sense of what’s at stake.

Explore 8 other fair value estimates on Valaris - why the stock might be worth over 4x more than the current price!

Build Your Own Valaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valaris' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives