- United States

- /

- Energy Services

- /

- NYSE:VAL

Valaris (NYSE:VAL): Assessing Valuation After Securing Major BP Drilling Contract in Egypt

Reviewed by Simply Wall St

Valaris (NYSE:VAL) shares are getting fresh attention after the company secured a five-well drilling contract with BP Exploration Delta Limited for its VALARIS DS-12 vessel in Egypt. The project is slated to start in mid-2026. This deal adds meaningful visibility to Valaris’s project pipeline and reflects continued interest in offshore drilling opportunities.

See our latest analysis for Valaris.

While Valaris’s new contract highlights growing optimism for its offshore opportunities, momentum has really picked up in the share price, with a 17% climb over the past week and a 26% year-to-date share price return. However, the one-year total shareholder return is a more modest 11%, and the three-year total shareholder return remains in negative territory. This underscores that while short-term excitement is building, the longer-term track record is still recovering.

If a rebound story like this has you thinking bigger, now’s a smart time to consider fast growing stocks with high insider ownership.

So, after the recent surge in Valaris shares, investors have to ask: is there real value left on the table, or has the market already priced in all of the expected growth from these new contracts?

Most Popular Narrative: 8.8% Overvalued

With Valaris recently closing at $56.68 and the widely followed narrative placing fair value at $52.10, this perspective argues that upside may already be reflected in the current price. Let’s see what’s behind this calculated stance.

The industry is experiencing a tightening supply-demand dynamic for technologically advanced rigs. Seventh-generation drillship utilization is expected to exceed 90% by 2026, and day rates for these rigs are averaging 25% higher than prior generations. This may position Valaris's fleet for higher pricing power, increased margins, and improved fleet utilization.

What’s the real reason analysts believe the valuation is stretched? One financial driver stands out: future margins and contract rates are set to test new levels, forcing investors to recalculate risk and reward. Uncover the assumptions that create this valuation tension.

Result: Fair Value of $52.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, offshore drilling demand may weaken if global energy transition efforts accelerate or if overcapacity returns. This could put pressure on contract rates and margins.

Find out about the key risks to this Valaris narrative.

Another View: What Do Market Ratios Say?

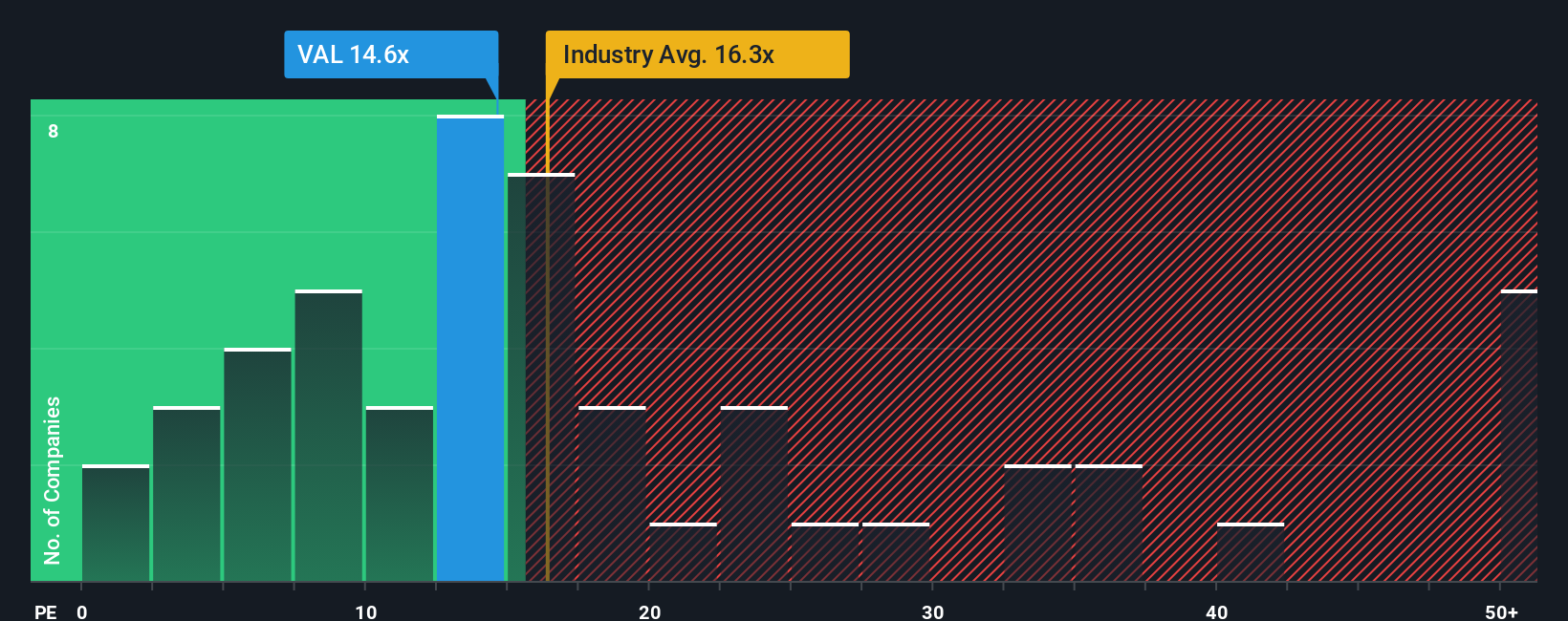

Looking at the price-to-earnings ratio, Valaris trades at 14.7x, which is lower than both the US Energy Services industry average of 16.3x and its peer group average of 18.4x. The fair ratio, calculated at 19.6x, suggests there is room for the market to re-rate higher. Does this create an overlooked value or simply reflect lingering doubts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valaris Narrative

If you see the numbers differently or want to dive deeper, you can easily build your own view and narrative in just a few minutes using the following tool: Do it your way.

A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep their radar up for standout opportunities. Don’t let today’s winners distract you from the next wave of market leaders shaping tomorrow’s returns.

- Capture the potential for double-digit yields by reviewing these 17 dividend stocks with yields > 3% and tap into stable returns from companies with rising income streams.

- Accelerate your strategy in tech by targeting innovation leaders with these 27 AI penny stocks, where growth meets advanced artificial intelligence breakthroughs.

- Maximize value in your portfolio as you assess these 880 undervalued stocks based on cash flows. Get ahead of the crowd by focusing on businesses trading below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives