- United States

- /

- Building

- /

- NYSEAM:TGEN

3 Growth Companies With Insider Ownership Up To 33%

Reviewed by Simply Wall St

As the U.S. stock market experiences a wave of optimism with major indexes poised for weekly and monthly gains, driven by strong performances from tech giants like Amazon, investors are increasingly looking towards growth companies with robust insider ownership as potential opportunities. In this environment, stocks with significant insider stakes can be appealing due to the confidence they reflect in the company's future prospects and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 115.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11% | 30.4% |

| Celsius Holdings (CELH) | 10.8% | 31.6% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 31.1% |

| AppLovin (APP) | 27.5% | 25.7% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We'll examine a selection from our screener results.

Tecogen (TGEN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tecogen Inc. designs, manufactures, markets, and maintains cogeneration products for various sectors in the United States, with a market cap of $281.47 million.

Operations: The company's revenue is derived from three segments: Products ($8.52 million), Services ($16.14 million), and Energy Production ($1.61 million).

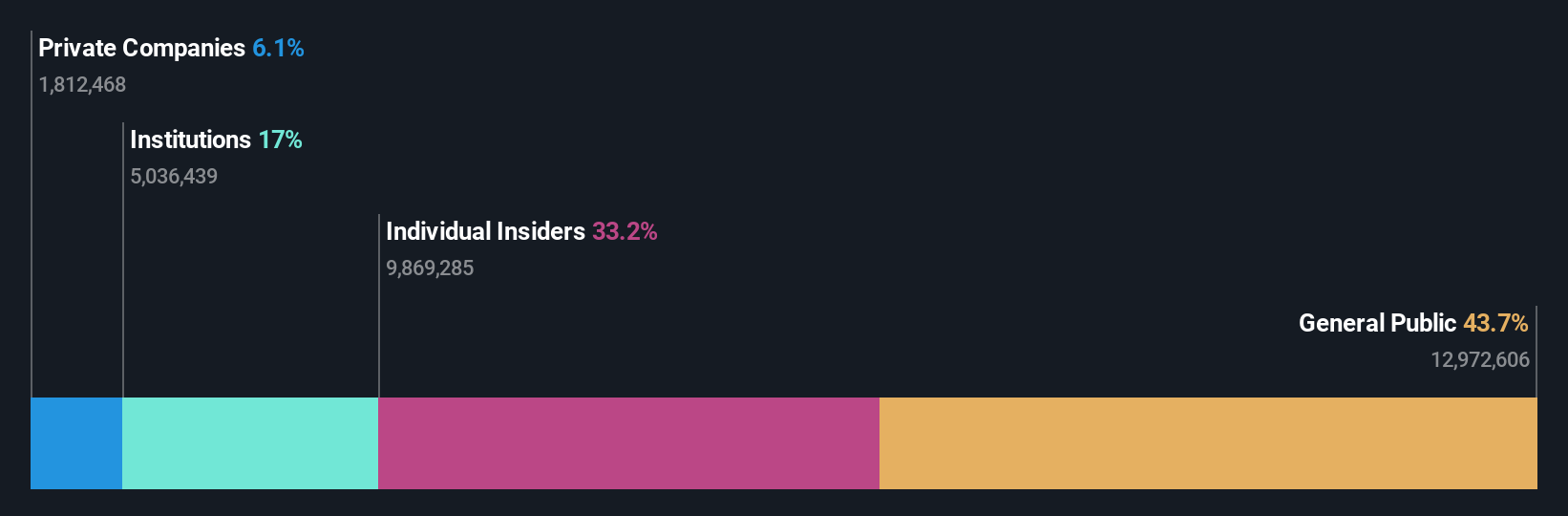

Insider Ownership: 33.2%

Tecogen's recent addition to the S&P Global BMI Index underscores its growth trajectory, supported by high insider ownership. Despite a volatile share price and past shareholder dilution, Tecogen shows promising revenue growth, forecasted at 44.8% annually—outpacing the market average of 10.3%. Recent prepayment of $1 million in promissory notes eliminated outstanding debt and future interest charges. The company is expected to achieve profitability within three years, indicating robust potential for future performance.

- Take a closer look at Tecogen's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Tecogen is trading beyond its estimated value.

Guild Holdings (GHLD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guild Holdings Company, with a market cap of $1.24 billion, operates in the United States through its subsidiary by originating, selling, and servicing residential mortgage loans.

Operations: Guild Holdings generates revenue primarily from its Origination segment, contributing $862.76 million, and its Servicing segment, which adds $115.26 million.

Insider Ownership: 11.5%

Guild Holdings demonstrates potential with high insider ownership, though recent earnings reveal challenges. The company reported a decrease in revenue and net income for the second quarter of 2025 compared to the previous year. Despite this, Guild's earnings are forecasted to grow significantly at 62.8% annually, surpassing the US market average of 15.7%. A special dividend and share buyback indicate shareholder value focus, but interest payments remain inadequately covered by earnings.

- Click here and access our complete growth analysis report to understand the dynamics of Guild Holdings.

- According our valuation report, there's an indication that Guild Holdings' share price might be on the expensive side.

TXO Partners (TXO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TXO Partners, L.P. is an oil and natural gas company engaged in acquiring, developing, optimizing, and exploiting conventional reserves in North America with a market cap of approximately $723.15 million.

Operations: The company's revenue is primarily derived from the exploration and production of oil, natural gas, and natural gas liquids, totaling $332.27 million.

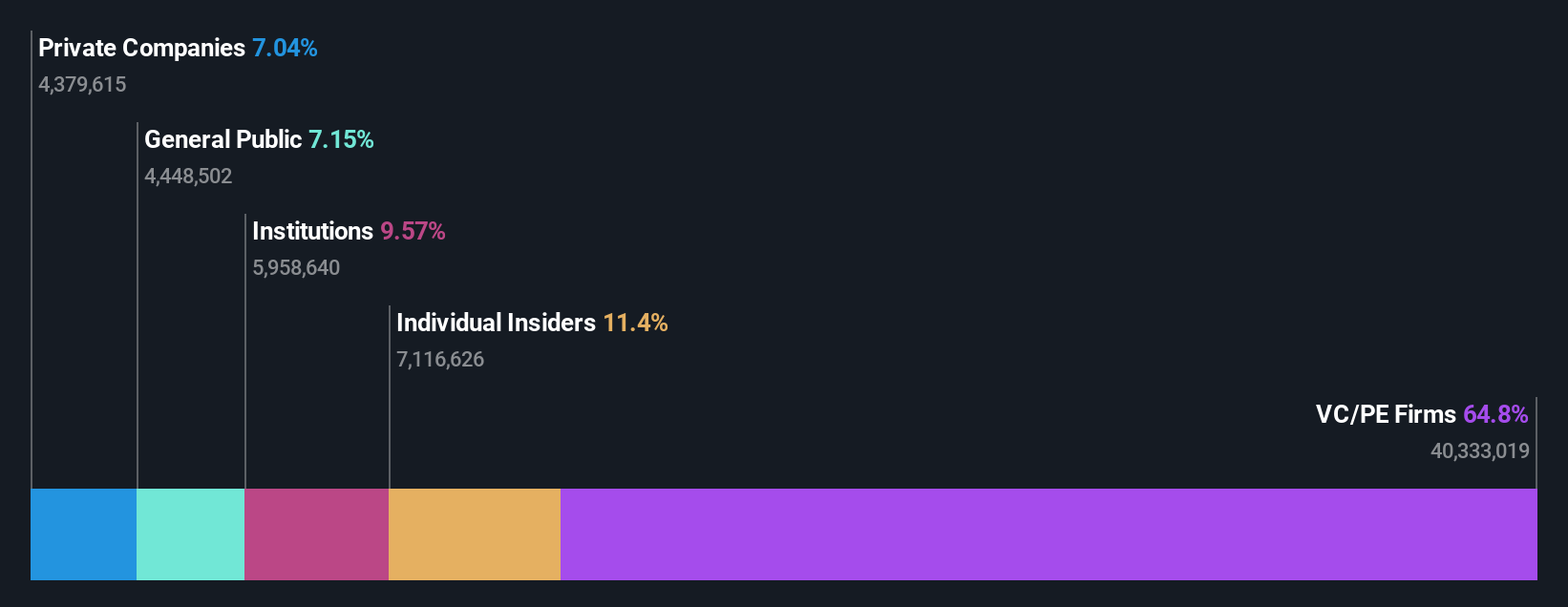

Insider Ownership: 24.4%

TXO Partners shows potential with substantial insider ownership, though recent earnings indicate challenges. The company reported a net loss for Q2 2025 despite revenue growth to US$89.88 million. Revenue is forecasted to grow at 12.1% annually, outpacing the US average of 10.3%. However, earnings growth is expected at a significant 33.9% per year over three years, surpassing market expectations but dividends remain inadequately covered by earnings or free cash flows.

- Navigate through the intricacies of TXO Partners with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, TXO Partners' share price might be too pessimistic.

Taking Advantage

- Embark on your investment journey to our 202 Fast Growing US Companies With High Insider Ownership selection here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Tecogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:TGEN

Tecogen

Designs, manufactures, markets, and maintains cogeneration products for multi-family residential, commercial, recreational, and industrial use in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives