- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Targa Resources (TRGP): Examining Valuation After Recent Share Price Weakness

Reviewed by Kshitija Bhandaru

See our latest analysis for Targa Resources.

Looking at the bigger picture, Targa Resources has seen share price momentum fade recently, with the stock slipping in the short term and total shareholder return rising just 0.1% over the past year. This comes as the sector experiences steady growth and evolving expectations.

If you’re curious about what else is trending in today’s market, now might be the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

But with the stock now trading at a notable discount compared to analyst targets, the question remains: is Targa Resources undervalued, presenting a potential buying opportunity, or is the market already pricing in its future growth?

Most Popular Narrative: 20.8% Undervalued

Compared to the latest close of $162.65, the most followed narrative suggests Targa Resources has meaningful upside, with a fair value estimate far above its current level. This wide gap prompts a closer look at the driving forces behind the bullish outlook.

Targa's strategic focus on long-term, fee-based contracts with blue-chip producers and end-users has driven resilience in cash flows, even amid commodity price volatility, and sets the stage for more predictable, higher free cash flow available for shareholder returns and potential deleveraging.

Curious what bold projections justify such optimism? The key narrative factors include an ambitious profit margin path and industry-beating growth rates. These elements set a financial target that you might not expect from a company in this space. See the exact forecasts and model assumptions that drive this valuation.

Result: Fair Value of $205.3 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including intensifying competition in core regions and the potential overbuild of export infrastructure. Both factors could pressure future margins and growth.

Find out about the key risks to this Targa Resources narrative.

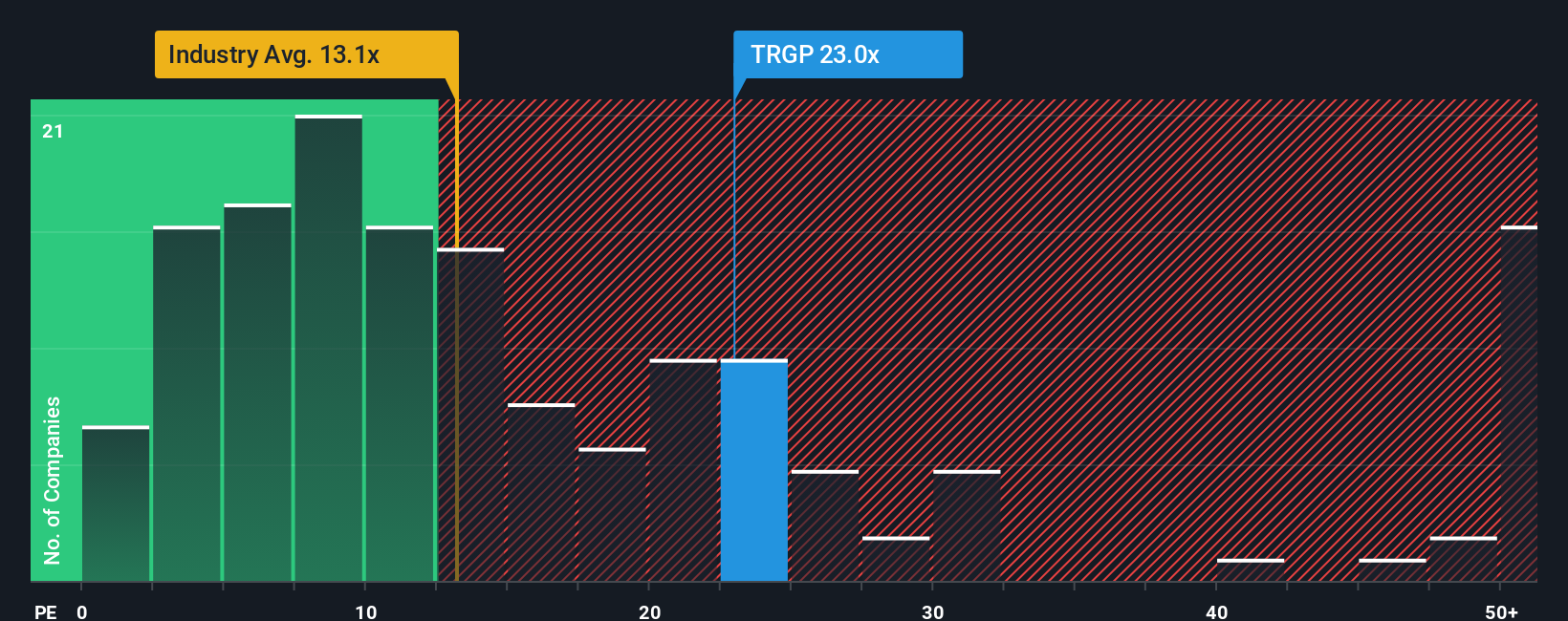

Another View: Price-to-Earnings Paints a Different Picture

While the fair value model points to sizable upside, Targa Resources is trading at a price-to-earnings ratio of 23, noticeably above both its industry peers (13.5) and the market’s fair ratio of 19.3. This suggests the market already credits the company with a premium. Does this signal opportunity or added risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Targa Resources Narrative

If you want to draw your own conclusions or think a different case is more compelling, you can easily build a custom narrative in just minutes. Do it your way

A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next move count by taking advantage of unique investment angles few investors are watching. Uncover stocks you might otherwise miss and stay ahead of the curve. Don’t let opportunity pass you by.

- Uncover high-potential opportunities with these 904 undervalued stocks based on cash flows and spot stocks flying under the radar before others catch on.

- Target future tech breakthroughs with these 26 quantum computing stocks that are reshaping industries and setting new standards in computing.

- Accelerate your passive income goals by checking out these 19 dividend stocks with yields > 3% delivering reliable yields and strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives