- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Should You Revisit Targa Resources After Recent 5% Dip and Pipeline Expansion News?

Reviewed by Bailey Pemberton

Wondering whether Targa Resources deserves a spot in your portfolio right now? You are not alone. The stock has been on quite a journey; it has dipped 5.3% in the last week and is down just over 2% in the past month, reflecting some near-term shakiness as the broader energy sector reacts to shifting commodity prices and supply chain updates. But look beyond recent volatility and you will see a company that has consistently delivered for long-term holders: Targa’s share price has skyrocketed by almost 168% over the last three years and an incredible 950% over five years. That sort of performance naturally grabs attention and prompts the big question: is there still upside, or has the stock already run its course?

To answer that, we need to get serious about valuation. Targa Resources currently holds a value score of 3 out of 6 based on six different undervaluation checks. In other words, the stock still checks some key value boxes, suggesting there could be more room to grow if you know where to look. Up next, let’s dig into those valuation techniques. Stick around, because there is an even more insightful way to judge value that we will cover at the end.

Approach 1: Targa Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's worth by forecasting its future cash flows and discounting them back to today’s dollars. For Targa Resources, this involves analyzing the business’s expected ability to generate cash in the years ahead and assessing its present value based on those projections.

Currently, Targa’s Free Cash Flow stands at $1.02 Billion. According to analyst estimates, this figure is projected to grow sharply, with Free Cash Flow expected to reach $2.89 Billion by 2029. While analysts provide estimates for up to five years, forecasts for later years are calculated using trend-based extrapolation to create a more complete growth outlook. This approach, though not perfect, helps establish a ten-year perspective for valuing the business.

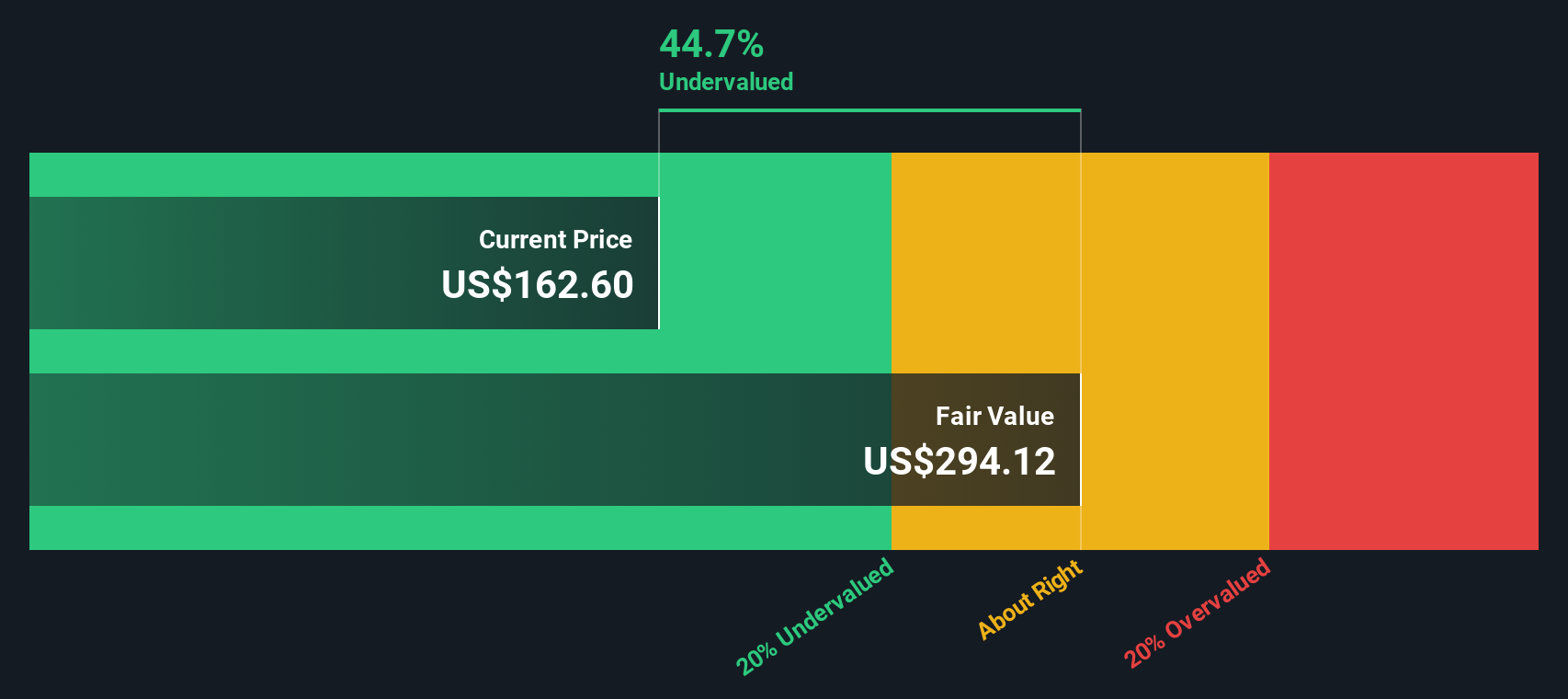

After combining all of these projected cash flows and discounting them appropriately, the DCF model assigns an intrinsic value of $295.84 per share to Targa Resources. With the implied discount at 45.0%, this suggests the stock is significantly undervalued compared to its current market price.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Targa Resources is undervalued by 45.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Targa Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies like Targa Resources because it directly measures how much investors are willing to pay for each dollar of current earnings. For companies with consistent profitability, the PE ratio offers a straightforward way to gauge whether the stock price makes sense given earnings performance.

However, what counts as a “normal” or “fair” PE ratio depends on more than just recent profits. Expectations of future growth, company size, and risk profile can all nudge the fair value higher or lower. Fast-growing companies or those with lower perceived risk might command a higher PE, while those with flat earnings or more uncertainty generally see lower ratios as reasonable.

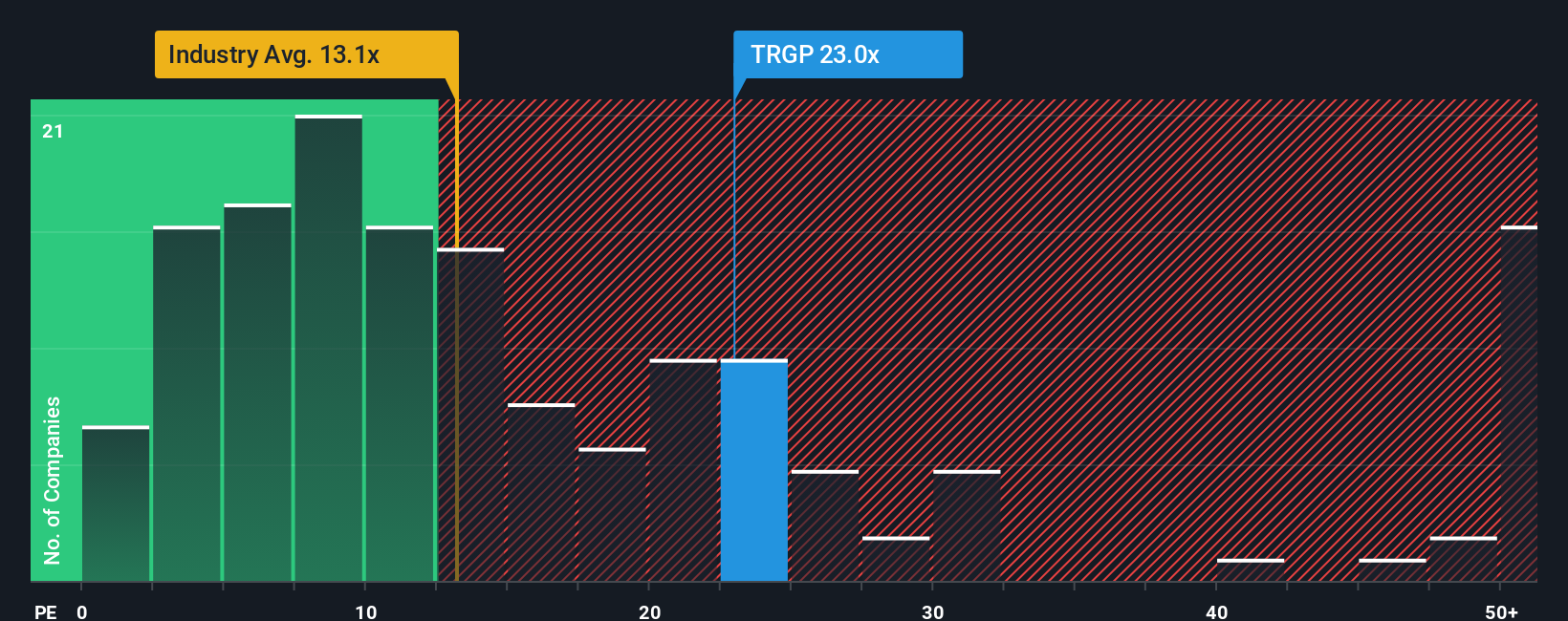

Currently, Targa Resources trades on a PE ratio of 23x. That is higher than the Oil and Gas industry average of 13.1x and above its closest peer group, which averages 15.7x. On the surface, this could suggest Targa is priced for perfection, but it is important to go deeper.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio is tailored to Targa Resources’ specific outlook, benchmarked at 19.3x, and factors in not just industry trends and company size, but also its expected earnings growth, profit margins, and business risks. Because the Fair Ratio provides a more holistic benchmark, it offers a stronger foundation than simply comparing to peer or sector averages.

Comparing Targa’s actual PE of 23x with its Fair Ratio of 19.3x, the gap is meaningful. Based on this framework, Targa Resources appears to be trading at a premium to its intrinsic fair value, suggesting some overvaluation relative to what the company’s fundamentals would justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Targa Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is much more than a number; it is your own story about what lies ahead for a company, blending your unique perspective on key drivers like industry trends, future revenue, margins, and risks, all the way through to your estimate of fair value.

Narratives link a company’s evolving story directly to a financial forecast and then to a clear fair value. They make it easy. Just head to the Community page on Simply Wall St (trusted by millions of investors), where you can see and create Narratives in a few clicks.

This tool helps investors make better decisions by showing how their assumptions affect fair value versus today’s market price, so you can quickly judge if a stock is an opportunity or a risk. Narratives update dynamically as fresh news, earnings, or regulatory changes come in, keeping your view relevant and up-to-date.

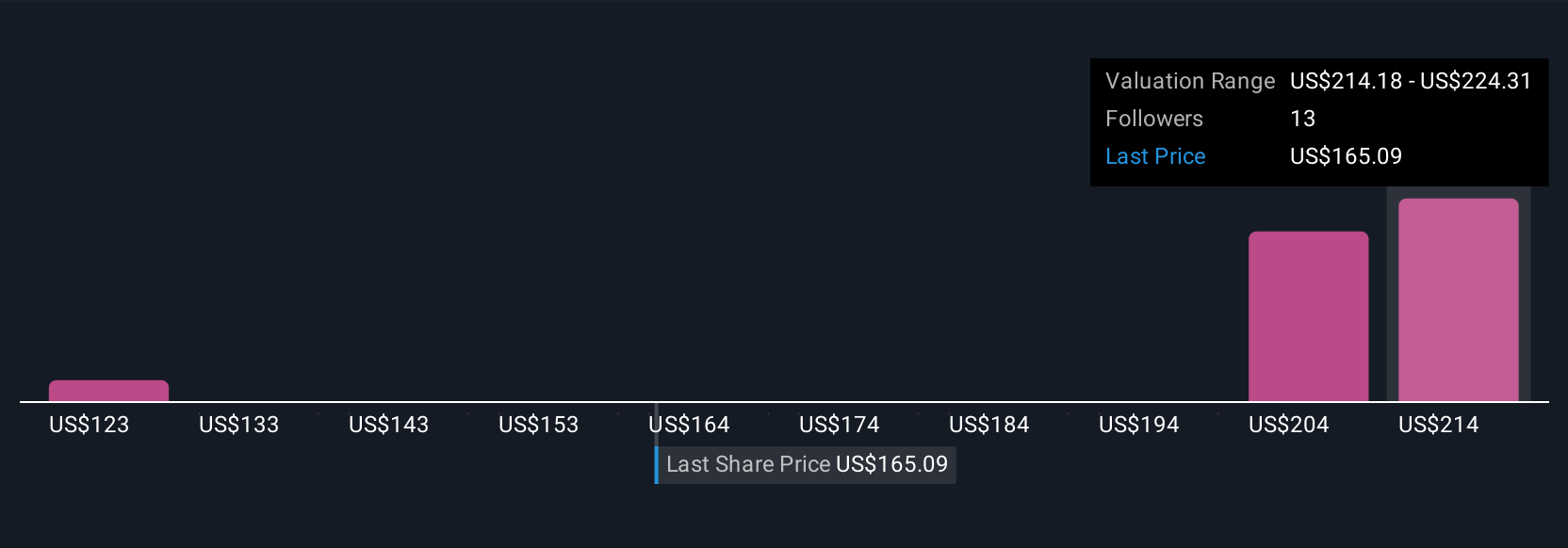

For example, some Targa Resources investors forecast strong export expansion and set bullish targets as high as $240 per share, while others anticipate stiffer competition and regulatory pressure, landing at a more cautious $186. With Narratives, you can instantly see these different viewpoints and decide which story and fair value fits your own investment approach.

Do you think there's more to the story for Targa Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives