- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Does Teekay Tankers' (TNK) Regulatory Breathing Room Reveal More About Its Long-Term Earnings Resilience?

Reviewed by Sasha Jovanovic

- Earlier this month, the International Maritime Organization decided to postpone the implementation of a global carbon price on international shipping by one year, affecting regulatory timelines for tanker operators like Teekay Tankers.

- This delay eases short-term compliance and cost burdens for shipping companies, potentially supporting Teekay Tankers’ operating margins and future planning flexibility.

- We’ll now discuss how this postponed regulatory pressure could influence Teekay Tankers’ investment story and future earnings profile.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Teekay Tankers Investment Narrative Recap

To be a shareholder in Teekay Tankers right now, you need to believe that global seaborne oil trade will remain resilient in the face of regulatory and demand shifts, and that the company’s strong balance sheet and vessel portfolio can outperform cyclical tanker market swings. The IMO’s decision to delay implementing a global carbon tax reduces immediate regulatory cost risk and supports the most important short-term catalyst: sustained high vessel utilization and margin stability. For now, the impact of this regulatory delay does not materially alter Teekay Tankers' biggest risk, namely, ongoing tanker market volatility amid uncertain oil demand growth and fleet transition challenges.

One recent development of particular interest is Teekay Tankers’ announcement of a fixed cash dividend of US$0.25 per share for Q2 2025, reinforcing near-term capital returns at a time when positive policy news has buoyed sentiment across shipping stocks. This payout, in the context of a solid cash position and the regulatory reprieve, will likely be closely watched by investors focused on yield and operational flexibility as catalysts for further upside or support during periods of earnings volatility.

However, investors should also be aware that, despite this temporary regulatory relief, the risk of higher fleet renewal costs and revenue pressure if oil demand growth remains subdued is still looming...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers' outlook suggests revenues will fall to $464.3 million and earnings to $238.5 million by 2028. This implies a 22.5% annual revenue decline and a $43.8 million decrease in earnings from $282.3 million today.

Uncover how Teekay Tankers' forecasts yield a $55.83 fair value, in line with its current price.

Exploring Other Perspectives

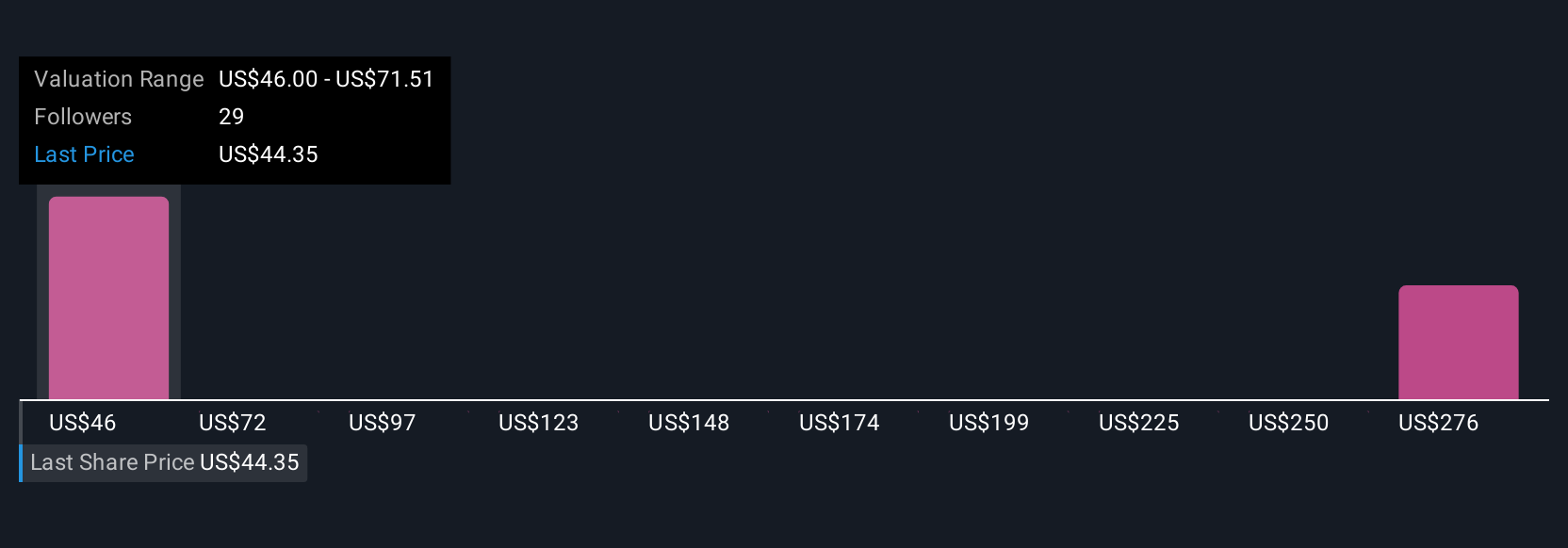

Community members provided 5 independent fair value estimates for Teekay Tankers, ranging from US$46 to US$299.58 per share. Market opinions vary sharply, especially given recent shifts in global regulation and demand that could alter both the company’s revenue outlook and its cost base in the years ahead.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth 19% less than the current price!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives