- United States

- /

- Oil and Gas

- /

- NYSE:TALO

How Investors Are Reacting To Talos Energy (TALO) Bigger Buyback and Raised Production Guidance Amid Weaker Q3 Results

Reviewed by Sasha Jovanovic

- Talos Energy recently reported a wider quarterly net loss and lower revenue for the third quarter of 2025, while providing higher revised full-year production guidance and announcing the completion of a major share buyback that repurchased over 18.5 million shares for US$195.16 million since 2023.

- Despite weaker financial results, the significant share repurchase and boosted production outlook mark important shifts in both capital allocation and operational expectations for the company.

- We’ll explore how the combination of increased production guidance and completion of a large buyback impacts Talos Energy’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Talos Energy Investment Narrative Recap

To be a Talos Energy shareholder today, you need to believe in its ability to deliver margin-enhancing production growth in the Gulf of Mexico while navigating operational volatility and unprofitable financials. The recent completion of a large share buyback and upgraded full-year production guidance partially offset the significance of this quarter’s wider losses, but they do not fundamentally alter the impact of sector risks or the need to achieve cash flow improvements, a key short-term catalyst for the stock. The main risk remains production and cost volatility due to exposure to offshore operational hazards, which the latest news does not materially change.

Among the recent announcements, the Q3 impairment charges of US$60,209,000 underscore the continued financial pressure from asset write-downs. While these charges draw attention to ongoing cost and balance sheet risks, steady production gains could still support operational catalysts if management sustains improvements in cost efficiency going forward.

In contrast, investors should be aware that even as production climbs, Talos’s exposure to cost inflation and asset impairments...

Read the full narrative on Talos Energy (it's free!)

Talos Energy's narrative projects $1.8 billion revenue and $260.2 million earnings by 2028. This requires a 3.0% yearly revenue decline and a $432.3 million increase in earnings from -$172.1 million currently.

Uncover how Talos Energy's forecasts yield a $12.91 fair value, a 19% upside to its current price.

Exploring Other Perspectives

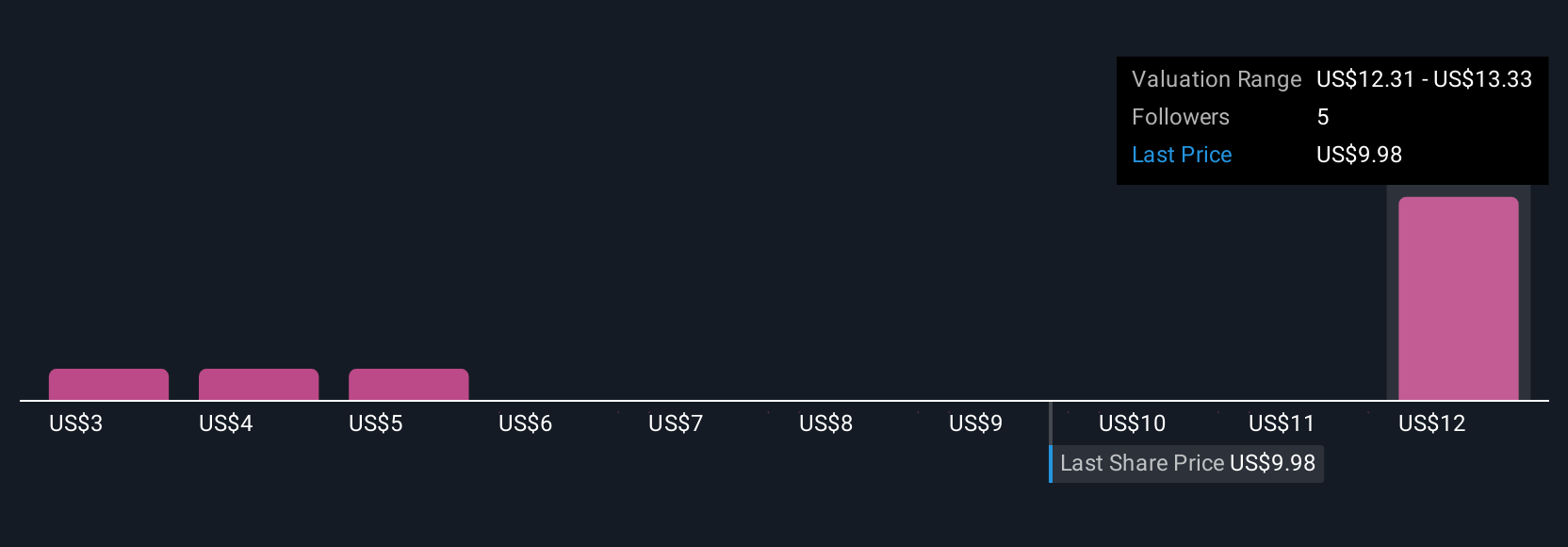

Four fair value estimates from the Simply Wall St Community range from US$3.07 to US$12.91, reflecting a wide span of market opinions. Ongoing cost pressures and notable asset impairments highlight why you will find breadth in these perspectives, explore several to see how different factors shape the outlook.

Explore 4 other fair value estimates on Talos Energy - why the stock might be worth less than half the current price!

Build Your Own Talos Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talos Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Talos Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talos Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talos Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TALO

Talos Energy

Through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives