- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Sunoco (SUN) Valuation Check as It Revs Up Brand Strategy with New INDYCAR Partnership

Reviewed by Simply Wall St

Racing Partnership Puts Brand Strategy in the Spotlight

Sunoco (SUN) is jumping back into the NTT INDYCAR SERIES as a full time primary partner with Chip Ganassi Racing from 2026, a marketing move that directly targets brand visibility and long term demand.

See our latest analysis for Sunoco.

The stock has cooled off a bit in recent weeks, but with the share price at $52.67 and a 90 day share price return of 7.23 percent, that longer three and five year total shareholder return record suggests momentum is still broadly intact.

If this kind of brand driven story appeals to you, it is a good moment to broaden the lens and uncover fast growing stocks with high insider ownership.

Valuation is where the story gets interesting, with Sunoco trading below analyst targets and showing a strong value score. However, do these metrics signal a genuine buying opportunity, or has the market already priced in future growth?

Most Popular Narrative: 18.6% Undervalued

Compared to Sunoco's last close at $52.67, the most widely followed narrative points to a higher fair value anchored in aggressive earnings expansion.

The NuStar and upcoming Parkland and TanQuid acquisitions are expected to deliver substantial double digit accretion and cost synergies, further increasing operating leverage and net margins while materially enhancing Sunoco's international and midstream asset footprint.

Want to see how bold revenue growth, rising margins, and a sharply lower future earnings multiple combine into that upside case? The full narrative unpacks every assumption.

Result: Fair Value of $64.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, long term fuel demand uncertainty and higher leverage from acquisitions could derail the growth story if volumes soften or synergies disappoint.

Find out about the key risks to this Sunoco narrative.

Another Angle on Valuation

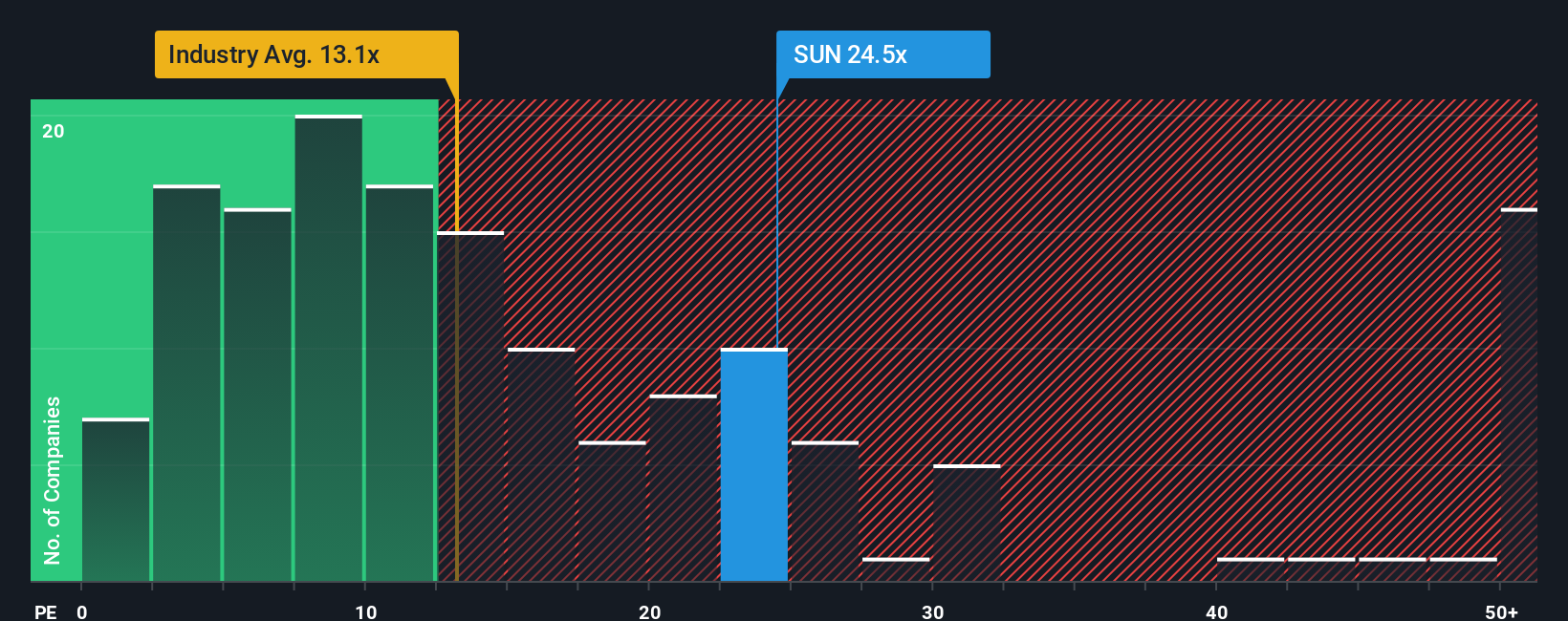

Step away from analyst targets and the story looks less clear. On a price to earnings basis, Sunoco trades at 24.6 times earnings, far richer than the US Oil and Gas average of 12.8 times and its peers at 21 times, yet still below a 29.2 times fair ratio. Is this a calculated premium or creeping valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sunoco Narrative

And if this perspective does not fully resonate with you, or you prefer to dig into the numbers yourself, you can craft a custom view in minutes, Do it your way.

A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you click away, lock in your edge by scanning fresh ideas on Simply Wall St's screener so you are not leaving potential returns on the table.

- Target reliable cash flow by reviewing these 13 dividend stocks with yields > 3% that can keep income coming even when markets turn choppy.

- Ride structural growth trends with these 29 healthcare AI stocks, where innovation and long term demand can work in your favor.

- Capitalize on market mispricing through these 908 undervalued stocks based on cash flows, built to spotlight companies whose cash flows are not yet fully recognized in their share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion