- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Sunoco (SUN): Net Margin Drops to 1.3%, Challenging Bulls on Quality Despite Earnings Growth Forecast

Reviewed by Simply Wall St

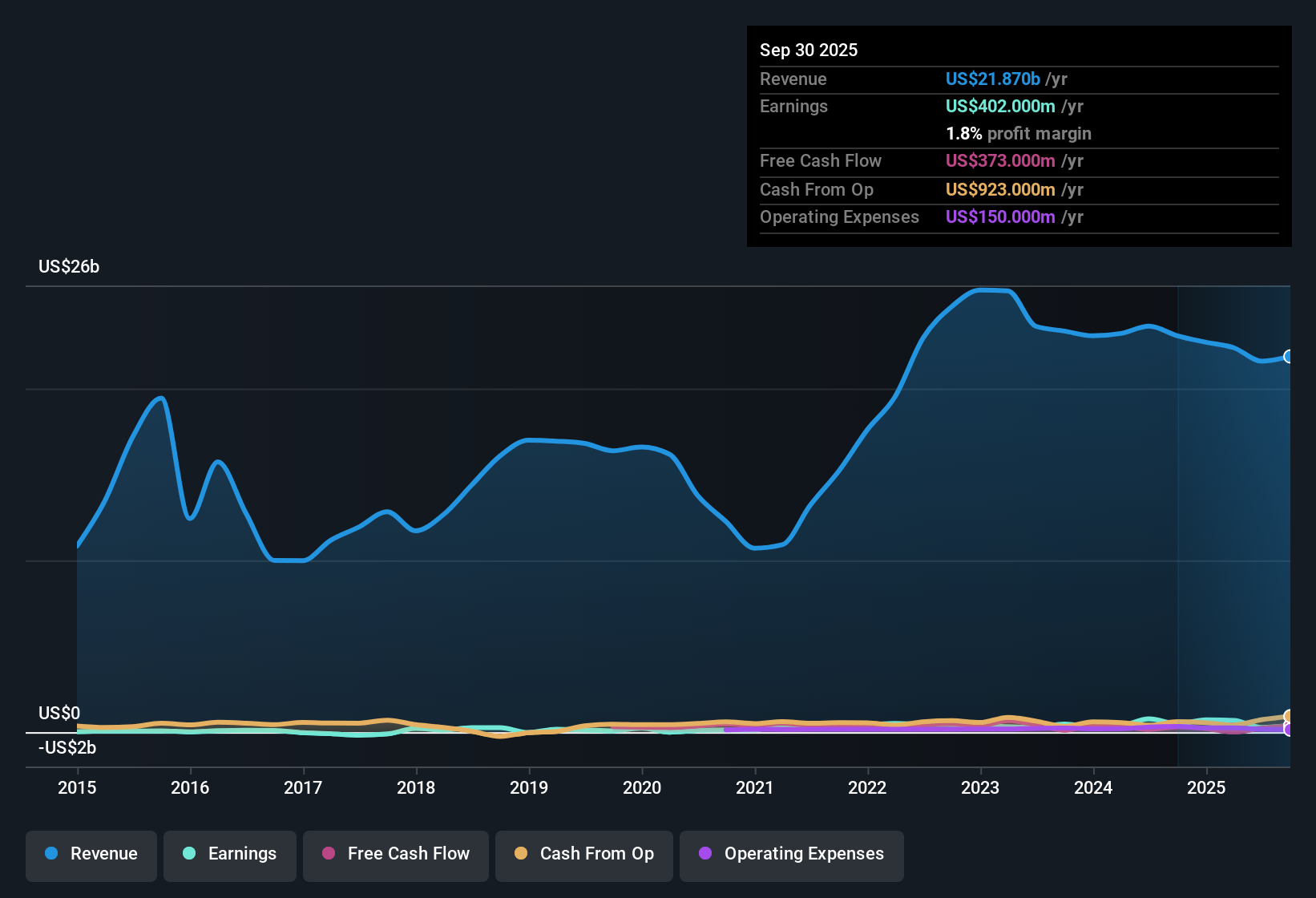

Sunoco (SUN) posted a mixed set of numbers in its latest earnings, with revenue forecast to grow at 4.1% per year, trailing the broader US market's 10.5% per year pace. Earnings are expected to rise at 19.76% per year, pushing ahead of the US average of 16%. Results for the last twelve months were hit by a one-off loss of $126.0 million, and net profit margins dropped to 1.3% from 3.3% a year ago. Investors will focus on whether robust earnings growth forecasts and shares trading below fair value can offset the quality concerns that come with margin compression and the recent significant loss.

See our full analysis for Sunoco.Next up, we’ll see how these numbers stack up against the market narratives that investors and analysts have built around Sunoco, and where views might shift based on the latest results.

See what the community is saying about Sunoco

Margins Projected to Rebound to 5.8%

- Analysts see profit margins rising from the current 1.3% to 5.8% within three years, a dramatic turnaround that directly contrasts with the just-reported margin contraction.

- According to analysts' consensus view, margin improvement is based on successful integration of new acquisitions and continued strength in industry fuel pricing.

- Consensus narrative notes that Sunoco’s acquisition-driven expansion, in a fragmented market where single-store operators dominate, should generate scale, cost synergies, and help margins recover.

- However, the recent one-off $126.0 million loss and cost discipline challenges could create friction with optimistic forecasts if integration hurdles persist.

- The new results confirm how closely margin improvement will depend on management delivering merger benefits in a tough competitive environment. 📊 Read the full Sunoco Consensus Narrative.

Balance Sheet Leverage Near 4.2x

- Sunoco’s leverage, measured around 4.2x following recent deals, stands out as a yellow flag, especially with further acquisition spend in the pipeline.

- Consensus view acknowledges the heavy reliance on new expansions and cost management:

- Consensus narrative highlights that while Sunoco should benefit from ongoing US fuel demand and favorable regulation, its high leverage exposes the company to risk if projected earnings do not materialize or acquisition synergies are delayed.

- With NuStar and other deals rolling up, Sunoco’s financial flexibility could become constrained, which may limit its response to unexpected changes in industry conditions or revenue headwinds.

Trading 21% Below Analyst Target and Significantly Under DCF Fair Value

- At $52.55, Sunoco’s share price trades 21% below the analyst price target of $65.00 and at a substantial discount to its DCF fair value of $246.82, highlighting a significant valuation gap based on current forecasts.

- Consensus sees this undervaluation as a reward for investors who can look past short-term margin and leverage concerns:

- Current price-to-earnings is slightly lower than the peer group, yet higher than the broader industry average, reflecting how the market is weighing growth prospects versus recent volatility.

- Consensus narrative underscores that analyst targets include major improvements in both revenue (expected to rise to $26.7 billion by 2028) and earnings ($1.6 billion forecast), but realizing these targets will require a steady increase in profit margins and effective deal execution.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sunoco on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? Share your own perspective and craft a fresh narrative in just a few minutes. Do it your way

A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Sunoco’s elevated leverage, dependence on successful deal integrations, and recent margin pressures raise questions about its financial resilience if industry conditions turn unfavorable.

If you want steadier footing, check out solid balance sheet and fundamentals stocks screener (1979 results) to discover companies with lower debt and stronger balance sheets designed to weather tough markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion