- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Sunoco (SUN): Evaluating Valuation Following Major Debt Restructuring and Capital Structure Changes

Reviewed by Kshitija Bhandaru

Sunoco (NYSE:SUN) recently rolled out a series of debt-related actions, highlighted by a major exchange offer for outstanding Parkland Corporation notes and amendments to its main credit agreement. These strategic changes could reshape how investors view Sunoco’s financial positioning.

See our latest analysis for Sunoco.

Sunoco’s recent financial maneuvers come on the heels of solid momentum in its stock. The past month alone saw a strong 10% share price return, adding to a 12.8% total shareholder return over the past year. This has reinforced optimism around its longer-term growth prospects. Steady performance like this suggests investors are warming up to the company’s revamped capital structure and improved risk profile.

If you’re interested in exploring what other companies are building momentum, it might be the perfect moment to discover fast growing stocks with high insider ownership.

With shares sitting nearly 19% below the average analyst price target and robust earnings growth in play, the key question remains: Is Sunoco's recent rally the prelude to further upside, or has the market already priced in its future gains?

Most Popular Narrative: 16.5% Undervalued

With Sunoco’s widely followed narrative fair value sitting at $64.71 and the latest close at $54.04, the narrative suggests room for substantial upside. Investors are closely watching whether the company's expansion ambitions can unlock this potential.

Sunoco's consistent expansion through organic projects and strategic roll-up acquisitions in a highly fragmented fuel distribution market, where over 60% of participants are small, single-store operators, positions the company to capture additional market share. This dynamic is driving sustained revenue and EBITDA growth.

Curious what bold bets underpin this attractive upside? Behind the headline figure lie aggressive forecasts for growth, margin expansion and major earnings leaps that could catch even seasoned market watchers off guard. Missing these details means missing the real story behind Sunoco's projected valuation. Dive deeper and see what the consensus expects may be in the company's future.

Result: Fair Value of $64.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on traditional fuels and increasing electric vehicle adoption could challenge Sunoco's prospects. These factors may potentially limit revenue growth and margin expansion in the future.

Find out about the key risks to this Sunoco narrative.

Another View: What Does the Multiple Say?

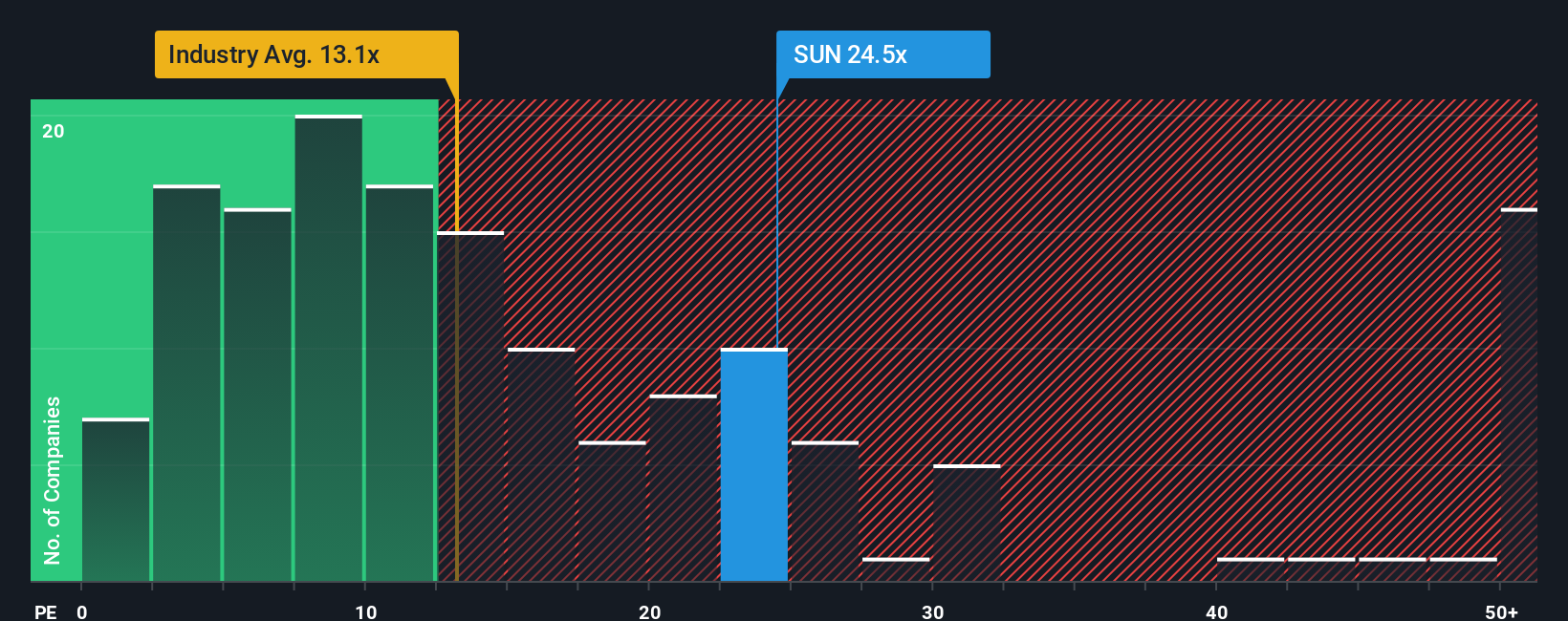

Looking at Sunoco’s valuation through the lens of its price-to-earnings ratio, the story shifts. The company trades at 26.5 times earnings, higher than both its industry average of 12.6x and its own fair ratio of 24.7x. This suggests the stock is priced at a premium compared to its sector and what historical patterns imply it should be. Does this premium reflect justified optimism, or does it increase the risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sunoco Narrative

If you see the numbers differently or want to investigate Sunoco from your own angle, it only takes a few minutes to craft your personal investment thesis. Do it your way.

A great starting point for your Sunoco research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Step confidently into your next opportunity by checking stocks that fit your strategy. You could miss out on the breakthroughs shaping tomorrow’s market leaders.

- Uncover new tech frontiers and accelerate your portfolio by tapping into these 26 quantum computing stocks, a key part of emerging computing power.

- Maximize returns with steady cash flow and growth potential when you start analyzing these 18 dividend stocks with yields > 3%, which features attractive yields above 3%.

- Catch the momentum in artificial intelligence by reviewing these 24 AI penny stocks, which drives innovation across industries and capitalizes on rapid adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion