- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Sunoco (SUN): Assessing Valuation After Recent Share Pullback

Sunoco (SUN) shares have caught some attention lately, even without a specific event driving the move. The stock is down about 1% over the past week and is trailing further for the month, raising questions about what investors are factoring in right now.

See our latest analysis for Sunoco.

Looking at the bigger picture, Sunoco's share price has cooled a bit lately but comes off the back of steady strength, with the recent dip at $49.97 still well above where long-term total shareholder return sits. Over the past year, total shareholder return was slightly positive at 0.44%, while the last three and five years delivered impressive gains of 56.5% and nearly 195% respectively. This suggests that, despite some recent softening, the long-term trend remains firmly constructive for patient investors.

If you’re weighing your next move, now is the perfect time to broaden your search and see what’s possible with fast growing stocks with high insider ownership

With shares pulling back after a multi-year climb, the question becomes whether Sunoco is now trading below its true value or if recent gains mean any future growth is already reflected in the price. Is a buying opportunity emerging, or is the market looking one step ahead?

Most Popular Narrative: 22.8% Undervalued

With Sunoco’s fair value calculated at $64.71 in the most widely followed narrative, the last close of $49.97 leaves a substantial gap still to be covered. This large disconnect highlights the catalysts supporting the narrative’s bullish target price.

Sunoco's consistent expansion through organic projects and strategic roll-up acquisitions in a highly fragmented fuel distribution market, where over 60% of participants are small, single-store operators, positions the company to capture additional market share and drive sustained revenue and EBITDA growth.

Want to see why this narrative points so much higher? The full story reveals surprising growth assumptions, bold margin forecasts, and a future profit multiple that shifts the usual playbook for this industry. If you’re curious about what moves the needle on Sunoco’s fair value, you’ll need to explore the exact numbers and projections that underpin this case.

Result: Fair Value of $64.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sustained decline in US gasoline demand or delays in integrating acquisitions could undermine the positive outlook for Sunoco's future growth.

Find out about the key risks to this Sunoco narrative.

Another View: Multiples Send Mixed Signals

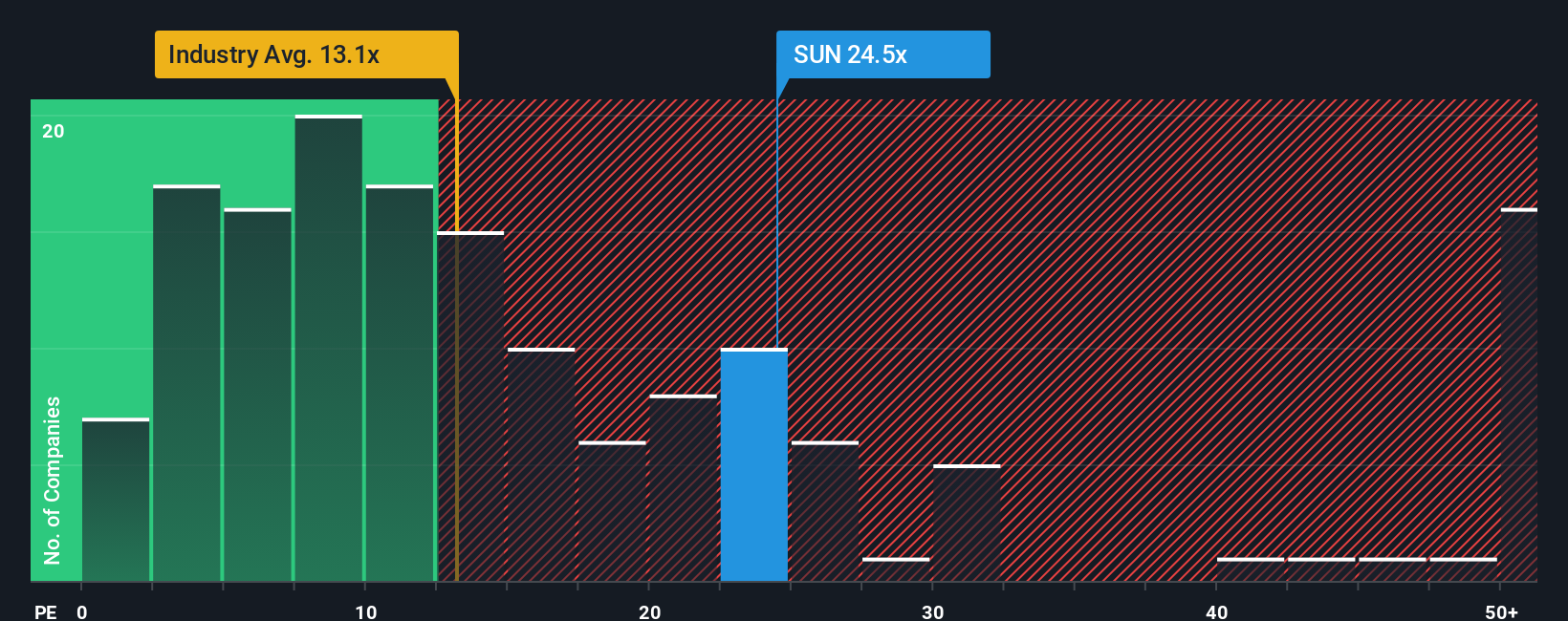

While the narrative fair value suggests Sunoco is undervalued, the current price-to-earnings ratio tells a more cautious story. At 24.5x earnings, Sunoco is much pricier than the US Oil and Gas industry average of 13.2x, and not far off its fair ratio of 26.2x. This narrows the upside and suggests the market may already be pricing in much of Sunoco’s growth potential. Which signal should investors trust when deciding their next move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sunoco Narrative

If you’re not convinced by these perspectives or want to dig into the numbers yourself, crafting your own Sunoco narrative takes just a few minutes. Do it your way.

A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Open up fresh opportunities outside the usual crowd and take control of your financial future with powerful screeners designed to highlight today's standout stocks.

- Capture long-term growth by focusing on reliable income sources. Start with these 19 dividend stocks with yields > 3%, which yields over 3% and is built for stability.

- Capitalize on major breakthroughs in healthcare by scanning these 32 healthcare AI stocks, which pushes the boundaries of medical technology and patient care.

- Accelerate your returns by targeting hidden value with these 892 undervalued stocks based on cash flows, which is currently trading below what its cash flows suggest it's worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion