- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Is There Still Opportunity in Sunoco After Acquisition News and Five-Year 163.7% Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Sunoco is a hidden gem or already fully priced? This article is for anyone curious about what the numbers and the market are really saying.

- Sunoco’s share price has shown some healthy overall growth, up 49.8% across three years and a big 163.7% over the past five, but with just a 1.4% gain year-to-date and recent small swings (up 2.4% in the past week, down 2.8% over the month), many are asking where it might go next.

- Market chatter lately has focused on Sunoco’s acquisition activity and expansion into new fuel markets, fueling speculation that these strategies could drive future gains or add risk. News of recent deals and increased attention on energy infrastructure have only added to the debate about what Sunoco shares are really worth today.

- Based on our checks, Sunoco’s current valuation score is 5 out of 6. This suggests it is undervalued compared to most peers. Next, we will break down those valuation approaches, and then wrap up with a big-picture way to cut through the noise and spot real long-term value.

Approach 1: Sunoco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting those figures back to their present value. This approach gives investors a sense of what the business may be worth today, assuming it performs in line with these forecasts.

For Sunoco, the DCF model uses its current Free Cash Flow of $581.6 million as a starting point. Analyst estimates project growth in these free cash flows, with an expected rise to $1.72 billion by 2029. While analysts provide direct forecasts for the next five years, estimates beyond that are calculated through reasonable extrapolations by Simply Wall St, capturing potential performance over the next decade.

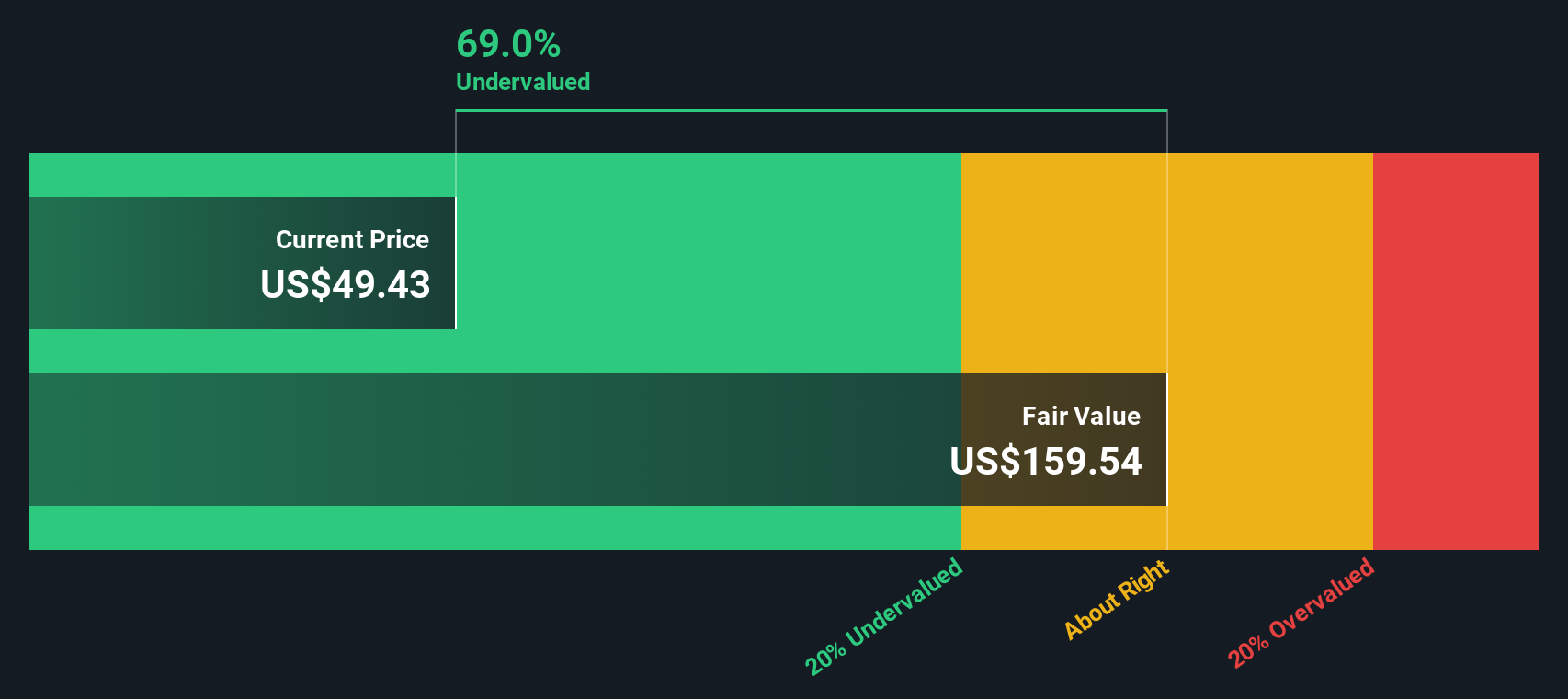

Bringing all these projections together, Sunoco’s intrinsic value is estimated at $229.99 per share. Compared to its current market price, this reflects a notable 77.2% discount. According to the model's assumptions, this points to the stock being substantially undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sunoco is undervalued by 77.2%. Track this in your watchlist or portfolio, or discover 906 more undervalued stocks based on cash flows.

Approach 2: Sunoco Price vs Earnings (PE Multiple)

For profitable companies like Sunoco, the Price-to-Earnings (PE) ratio is a tried-and-true valuation tool because it directly compares a company’s share price with its earnings. This metric helps investors gauge how much the market is willing to pay for each dollar of earnings, making it especially useful for steady, profit-generating businesses.

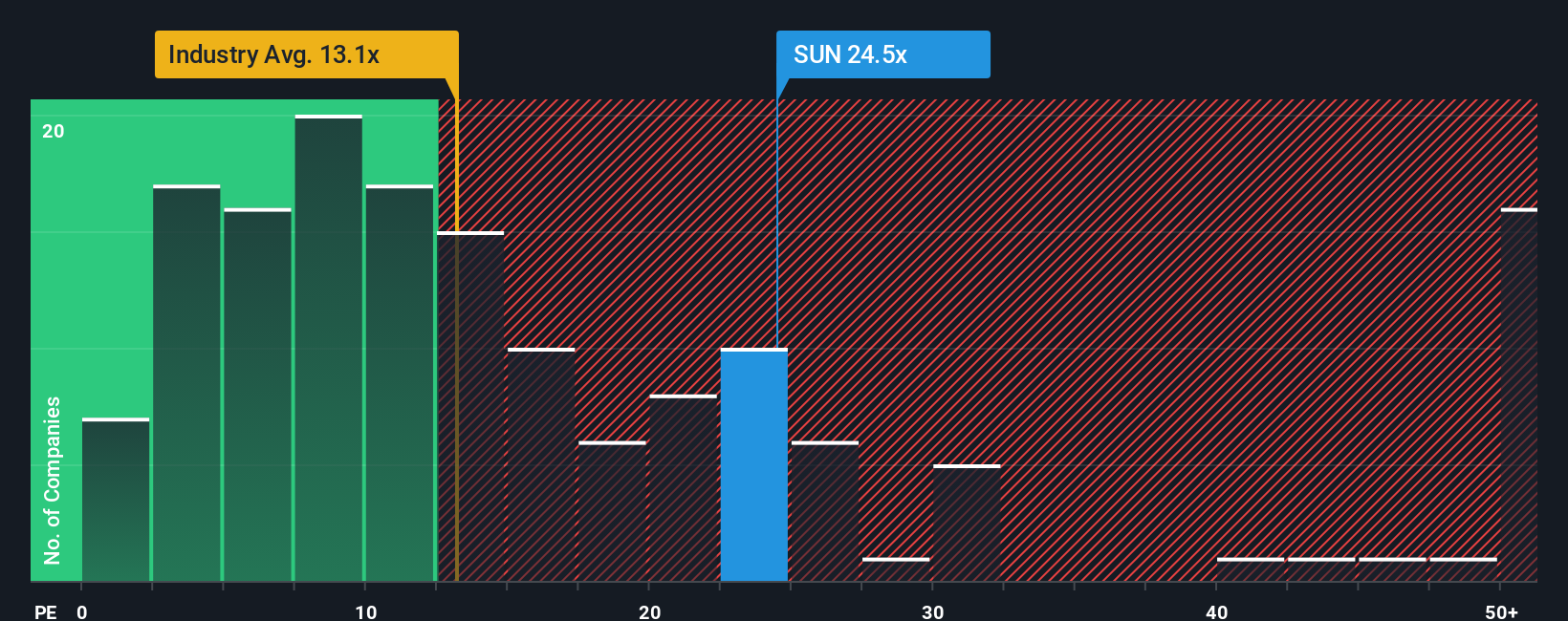

It’s important to understand that a "normal" or fair PE ratio can vary. Companies with higher growth expectations usually deserve a higher PE, since investors anticipate stronger future earnings. In contrast, higher risk or a weaker outlook can justify lower ratios. The broader context, such as industry standards and market trends, also matters.

Sunoco’s current PE ratio stands at 17.8x, which is above the Oil and Gas industry average of 14.2x but below the peer average of 19.9x. On the surface, this could mean the stock is priced below some competitors, yet more expensive than the broader sector.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Sunoco is 27.5x, a tailored benchmark that considers the company’s growth prospects, risk factors, profit margins, industry specifics, and market capitalization. This approach goes far beyond a basic peer or industry average by accounting for deeper drivers of value.

With Sunoco’s actual PE ratio of 17.8x sitting well below its Fair Ratio of 27.5x, the analysis points to the stock being undervalued on this metric. This suggests the market is not fully crediting its underlying strengths and potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sunoco Narrative

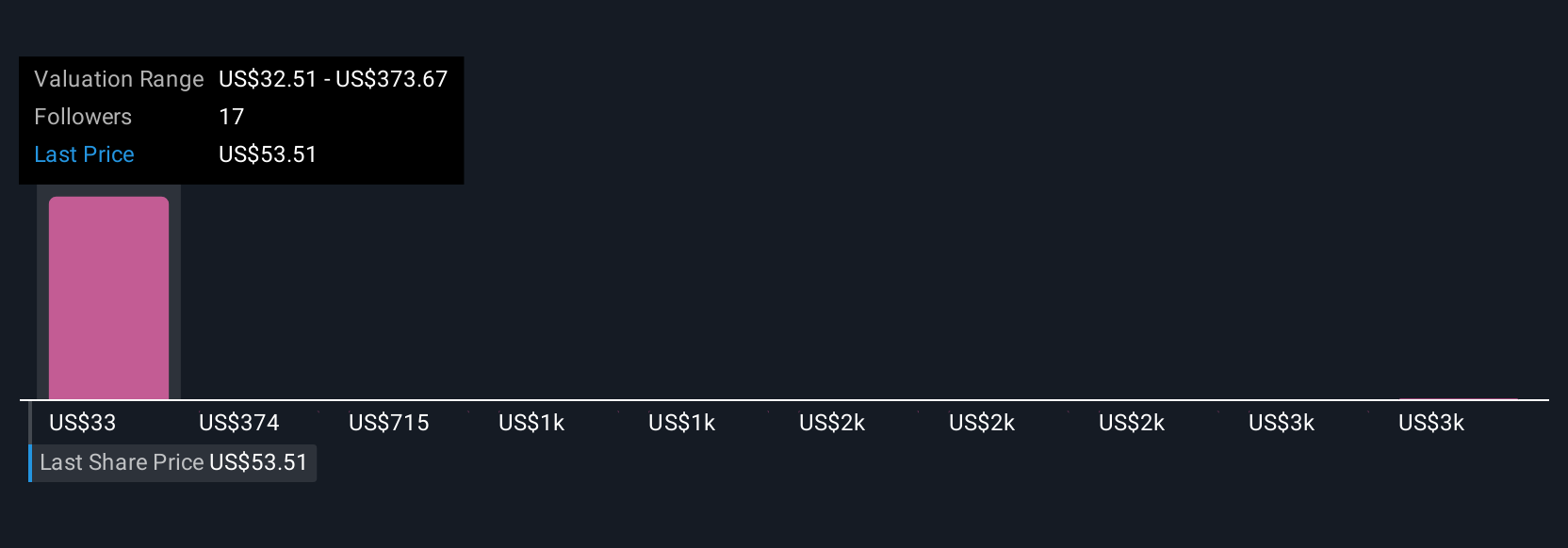

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, connecting what you believe about its business, industry trends, and future prospects directly to your assumptions for things like revenue growth, profit margins, and ultimately, fair value.

Rather than relying only on formulas, Narratives link the facts and developments behind a company to a dynamic financial forecast, helping you see how your expectations or beliefs translate into a price you think is fair. On Simply Wall St’s Community page, millions of investors use Narratives to set out their perspective for any company, compare them with analyst or market views, and see what it means for buying or selling decisions in an accessible, easy-to-use tool.

Narratives update automatically as new information emerges, including company news and fresh earnings data, so your view can evolve as the real story changes. For Sunoco, some investors are optimistic, pointing to expansion and industry tailwinds and setting a higher fair value, while others stress risks from fuel demand and limited diversification, supporting a more cautious estimate. This gives you a clear, story-driven way to weigh up Sunoco’s value and decide if now is the right time for you to act.

Do you think there's more to the story for Sunoco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives